Municipal Bonds 2014 Market Outlook

Post on: 16 Март, 2015 No Comment

Risks Remain, But Munis are on Track for Outperformance in 2014

You can opt-out at any time.

Please refer to our privacy policy for contact information.

The bond market performed poorly in 2013. but there were still plenty of places investors could have made money: high yield bonds. senior loans. and short-term bonds. to name three. The outlook again points to a year of continued volatility and muted gains in 2014, but this time municipal bonds may well be the asset class that stands out from the pack.

Municipal bonds’ 2013 underperformance stemmed from three major factors: the sharp rise in U.S. Treasury yields, concerns about the health of state and local governments following Detroit’s bankruptcy filing and headlines about Puerto Rico’s increasingly tenuous finances, and massive outflows from municipal bond funds. All three trends look set to stabilize or improve in 2014, which should allow municipal bonds’ attractive yields to underpin stronger performance.

The 2014 Outlook for Treasuries and its Impact on Municipal Bonds

The first factor weighing munis’ performance in 2013 – rising Treasury yields – is the most important component of the 2014 outlook. If Treasury yields move substantially higher, municipal bonds will feel the pain no matter how attractive their fundamentals and valuations.

This was the crux of the negative outlook set forth by Morgan Stanley’s head of municipal bond strategy, Michael Zezas, who released a report in December calling for losses of 1.7% to 4.1% in municipal bonds in 2014. He stated, “A painful 2013 yielded better valuations, but more must be endured before our outlook brightens,” and added that municipals are “disposed to negative returns and volatile liquidity as the economy improves and rates rise.”

True enough, but – as laid out in detail in my 2014 Bond Market Outlook – the potential for the Federal Reserve to taper its quantitative easing (QE) program is well-known, and Treasury yields have already rocketed higher in expectation that QE will be withdrawn. This leaves only one avenue for a negative surprise: much stronger-than-expected economic growth. which in turn would force the Fed to taper much more quickly than expected. Absent this, Treasuries could experience better-than-expected performance in 2014, which would be a boon for munis. Zezas writes that the ideal scenario for the municipal bond market would be if the United States “is unable to break out of its current slow growth channel, but continues to avoid recession,” – an outcome he thinks could lead to returns of 3.5% to 6% for municipal bonds in 2014.

Improving Conditions for State and Municipal Finances

Detroit’s financial troubles had a major impact on market psychology in 2013, as the news crossed over into the mainstream press and raised concerns about municipals’ credit quality among individual investors. However, assuming that Detroit’s issues are a system-wide problem and a sign of further bankruptcies to come is a questionable leap of logic. Bloomberg reports that U.S. cities, as a group, are on track for their first revenue increase in seven years during 2013. In addition, state tax revenues have risen in 13 consecutive quarters. These positive trends contributed to a default rate in 2013 that was half of its level in 2012 and the slowest pace in four years.

Not least, two December developments point to an improved picture for munis. First, Detroit’s bankruptcy proposal, which reduces pensions and benefits, was approved in Federal Court – setting a precedent for cities to avoid default in the future. Second, Illinois’ state legislature enacted pension reform to help shore up the state’s longer-term finances. These decisions indicate that lawmakers are increasingly willing to take steps to shore up credit quality, even if it comes at the expense of workers. In the long-term, this is an extremely positive development for municipal bond investors.

Investor Demand Stands to Improve

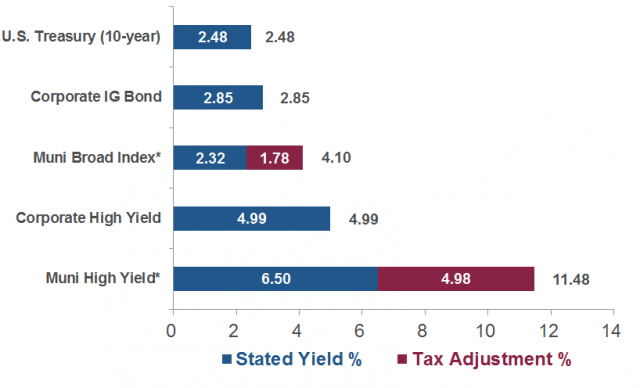

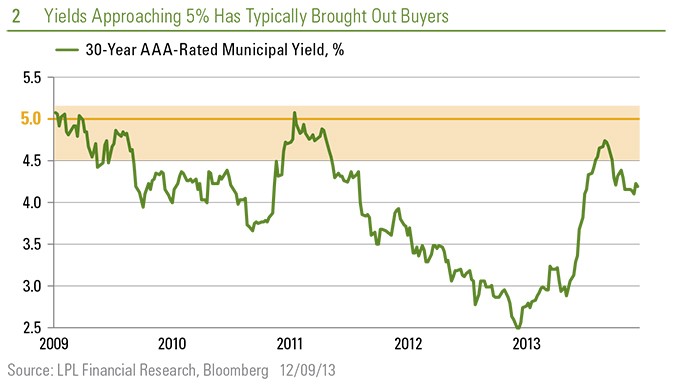

The outflows that plagued the municipal bond market in 2013, while likely to continue in the early months of 2014, should cease to be a major driver of performance in relatively short order. Municipals actually stand to benefit from two relatively fresh sources of demand stemming from their attractive yields. Munis close 2013 with yields at levels 95% or more than those on Treasuries of comparable maturities, which is well above the historical average. This indicates that municipal bonds are very attractively priced relative to history.

Once investors become more comfortable with the outlook for municipal finances and interest rates, these attractive yields should fuel demand from two important sources. First is “cross-over” investors, or funds that typically invest in taxable bonds but who may move into munis to take advantage of yields that are now attractive even without the tax advantage. Second, the yields on munis have become high enough that even investors in lower tax brackets can come out ahead by investing in municipal bonds.

The table below shows two exchange-traded funds – one investment-grade, one high yield – along with the taxable yield that investors would need in order to make a taxable bond fund more attractive, based on yields as of December 9, 2013. Notably, an MUB investor would be able to earn a yield higher to those on investment-grade corporate bonds in all but the 15% bracket, while HYD out-yields high-yield corporate bonds across the board.

Federal Tax Bracket

MUB After-Tax Yield