Municipal Bond Basics Hennion Walsh

Post on: 22 Июль, 2015 No Comment

Municipal Bond Basics

Municipal Bonds are issued by state and local governments to raise money for major capital projects such as the building of infrastructure like bridges, roads, hospitals, schools, sewer systems, stadiums, airports, power plants, and prisons, or to provide for other needs of local government.

Virtually all states and local governments issue municipal bonds from time to time. The $2.7 trillion* municipal bond market consists of over 50,000 issuers across the country.

Like any borrower, local governments pay interest on municipal bonds to investors that own or hold them. Interest on municipal bonds is typically paid every 6 months. Interest earned from municipal bonds is exempt from federal income taxes, and, depending on the residence of the bond holder, may also be free of state and local taxes.

As a general rule, interest income is exempt from state and local taxes if the investor lives in the same state as the bond issuer. For example, a New Jersey resident owning a New Jersey State municipal bond would not have to pay federal or state taxes on the interest received from this bond.

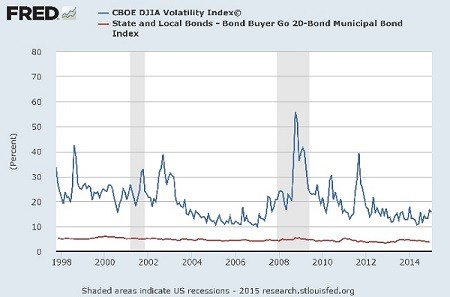

Investors have historically viewed municipal bonds as safe investments because their default rate has historically been less than 1%**. The reason for this low historical rate of default is that many municipal bonds are backed by the unlimited taxing power of the local government issuing them. Such bonds are referred to as “General Obligation Bonds” (or “GOs”), and are backed by the full faith, credit and taxing power (i.e. income, property, sales, and vehicle taxes, tolls, special levies, etc.) of an issuer*** to pay back the principal and interest owed to bondholders. General Obligation Bonds thus offer a measure of safety to bondholders because unlike corporations, local governments rarely cease to exist and dissolve altogether. As long as they exist, municipalities should be able to generate tax revenue sufficient to meet their obligations to bondholders.

Another type of municipal bonds, the “Revenue bonds”, are backed not by taxes, but by revenue (i.e. toll revenue or electric power revenue). The safety of a bond will vary based on the revenue streams backing it, which is why we recommend working closely with a municipal bond expert.

* Lazard Insights, December 15, 2009

** Fitch Special Report “Default Rates and Recovery Rates on US Municipal Bonds”, January 9, 2007

*** Municipal Securities Rule Making Board Website

All investments involve risk, including loss of principal. Past performance does not guarantee future returns. Income from certain Municipal Bonds may be subject to the Federal Alternative Minimum Tax.