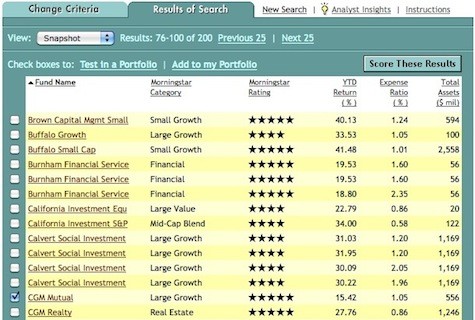

Morningstar Ratings

Post on: 23 Июнь, 2015 No Comment

Quarter-end Ratings

Scroll right to see more. > >

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than performance data quoted. Standardized returns current to the most recent month-end can be obtained by visiting our Month-end Returns Page or by calling toll free 1-800-SATURNA. Saturna Capital, the Funds’ adviser, has absorbed, currently or in the past, certain Fund expenses, without which total returns would have been lower.

The Amana Developing World Fund Investor Shares began operations September 28, 2009.

Morningstar requires a minimum number of funds in a category to issue a Star Rating. As of the most recent quarter-end, there were not enough funds in the Long-Term Bond category with a 10 Year history and Morningstar did not issue a rating for the Sextant Bond Income Fund for that time period.

Source: Morningstar, Inc. Morningstar, Inc. is an independent fund performance monitor. For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% in each category receive 5 stars, the next 22.5% 4 stars, the next 35% 3 stars, the next 22.5% 2 stars and the bottom 10% receive 1 star. The Overall Morningstar Rating for a fund is derived from a weighted average of performance figures associated with its 3, 5, and 10 year (if applicable) Morningstar Rating metrics. Morningstar ratings represented as unshaded stars are based on extended performance. These extended performance ratings are based on the historical adjusted returns prior to the inception date of the institutional shares and reflect the historical performance of the investor shares, adjusted to reflect the fees and expenses of the institutional shares.

A fund’s % Rank in Category is the total-return percentile rank for the specified time period relative to all funds that have the same Morningstar category. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100. The top-performing fund in a category will always receive a rank of 1. Percentile ranks within categories are most useful in those categories that have a large number of funds.

A Few Words About Risk

By diversifying its investments, each Fund seeks to reduce the risk of owning only a few securities. Diversification does not assure a profit or protect against a loss in a declining market.

The Funds (except Sextant Growth and Idaho Tax-Exempt Funds) may invest in non-US companies and in foreign markets. Investing in foreign securities involves risks not typically associated directly with investing in US securities. These risks include fluctuations in exchange rates of foreign currencies; less public information with respect to issuers of securities; less governmental supervision of exchanges, issuers, and brokers; and lack of uniform accounting, auditing, and financial reporting standards. There is also a risk of adverse political, social, or diplomatic developments that affect investment in foreign countries.

The Amana Growth and Sextant Growth Funds typically invest in smaller and less seasoned companies than the Income Fund, which may lead to greater variability in the Growth Funds’ returns. Growth stocks, which can be priced on future expectations rather than current results, may decline substantially when expectations are not met or general market conditions weaken.

The Sextant Core Fund involves the risks of both equity and debt investing, although it seeks to mitigate these risks by maintaining a widely diversified portfolio that includes domestic stocks, foreign stocks, short and long-term bonds, and money market instruments.

Investment in the Sextant Global High Income Fund entails the risks of both equity and debt securities, although it seeks to mitigate these risks through a widely diversified portfolio that includes foreign and domestic stocks and bonds. Issuers of high-yield securities are generally not as strong financially as those issuing higher quality securities. Investments in high-yield securities can be speculative in nature. High-yield bonds may have low or no ratings, and may be considered junk bonds.

The risks inherent in the Sextant Short-Term Bond. Sextant Bond Income. and Idaho Tax-Exempt Funds depend primarily on the terms and quality of the obligations in their portfolios, as well as on bond market conditions. When interest rates rise, bond prices fall. When interest rates fall, bond prices go up. Bonds with longer maturities (such as those held by the Bond Income Fund ) usually are more sensitive to interest rate changes than bonds with shorter maturities (such as those held by the Short-Term Bond Fund ). The Funds entail credit risk, which is the possibility that a bond will not be able to pay interest or principal when due. If the credit quality of a bond is perceived to decline, investors will demand a higher yield, which means a lower price on that bond to compensate for the higher level of risk.

The Idaho Tax-Exempt Fund’s investments are susceptible to factors adversely affecting Idaho, such as political, economic, and financial trends unique to this relatively small state. Investing only in Idaho bonds means that the Fund’s investments are more concentrated than other mutual funds, and relatively few bond price changes may lead to underperformance compared to investments selected in greater number and/or from a wider universe.

Islamic principles restrict the Amana Funds ‘ ability to invest in certain stocks and market sectors, such as financial companies and fixed-income securities. This limits opportunities and may increase risk.