Morningstar on How to Build a Core ETF Portfolio

Post on: 16 Март, 2015 No Comment

Asset Class ETFs News:

Focus on what matters. Thats Morningstars message on how to build the critical core component of your investment portfolio.

Asset allocation and a long term buy-and-hold strategy arent as exciting as trading. Yet Morningstar explains how a strategic asset allocation strategy can do the bulk of the work within a long term investment strategy, using exchange traded funds.

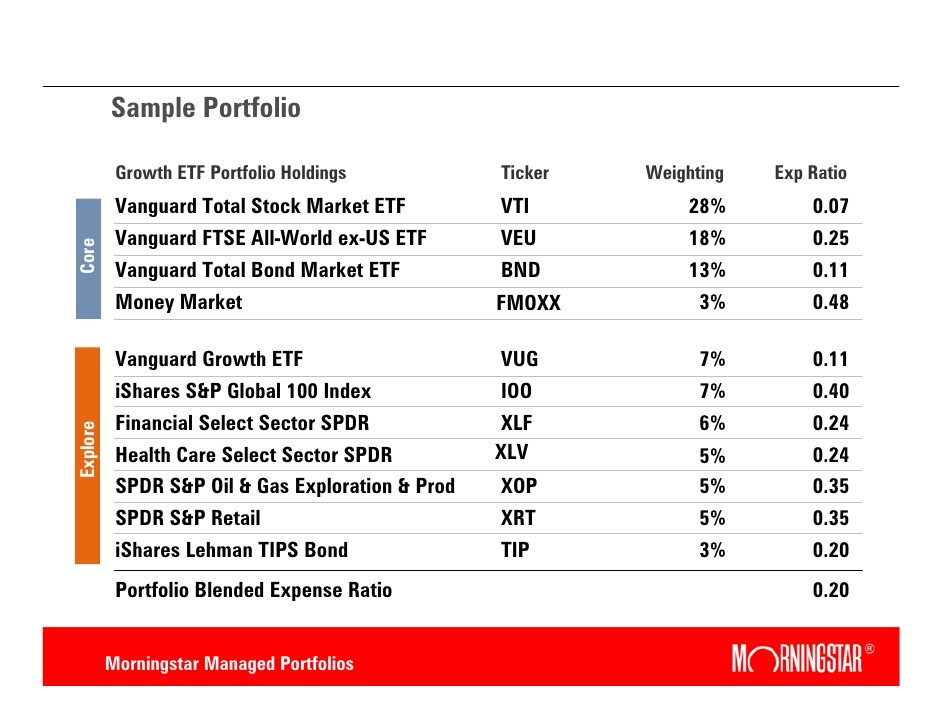

A popular and effective way of segmenting your investments is the core and satellite approach. Here, you might categorize 80% of your overall portfolio as the core and the remaining 20% as the satellite. The satellite portion of the portfolio is where to express your tactical views on the market, John Gabriel for Morningstar wrote.

The core of a portfolio should be invested into a long term asset allocation strategy, with re-balancing needed maybe once per year. A very general allocation is about 60% of holdings put into stocks, and 40% invested in bonds. Investors will vary and personalize this depending on investment horizon, goals and risk tolerance.

A good base holding is an ETF such as Vanguard Total World Stock Index ETF (NYSEArca: VT) which is representative of about 85% of the globes total world stock market capitalization. The largest risk to a fund such as this is the currency risk, due to it being denominated in U.S. dollars. A good rule of thumb when considering core holdings is that the ETF is passive, low-cost, and gives diversified equity exposure. [ETF Chart of the Day: VTI ]

For the emerging market equity portion of a portfolio, the iShares MSCI Emerging Markets Index (NYSEArca: EEM ) is a low-cost, diversified fund that focuses on overseas economies. Another area that should be considered for proper equity allocation are the developed markets outside of North America. An index such as the MSCI EAFE Index represents developed markets in Europe, Australasia and the Far East, explains Gabriel. [ETF Spotlight: Vanguard Total Stock Market]

Next is the bond portion of a portfolio. Bond ETFs bring transparency and liquidity to the bond market by bringing them to the exchanges. ETFs also help make bonds more accessible for the masses. There are often high minimum investments and wide spreads associated with buying individual bonds. [Where is Our Friend, the Trend? ]

A portfolio consisting of the four mentioned market segments can sustain a buy-and-hold ETF investor for some time. The maintenance needed would simply be to rebalance at least once per year. Morningstar suggests a good way to control turnover is to establish a rule that you will only rebalance the portfolio when a position has moved 15% away from the target weight. This can also help control transaction costs, which can add up if there are too many ETF trades taking place. [ETF Chart of the Day: Emerging Markets ]

Tisha Guerrero contributed to this article.

Story updated to correct ticker for Vanguard Total World Stock Index ETF.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.