More volatility in Treasurys seen ahead

Post on: 23 Июнь, 2015 No Comment

Share

Tools

Last months unprecedented 15 percent intra-day spike in Treasury prices has led to considerable soul-searching among market participants and regulators. And the Financial Times the other day laid out a list of possible causes. But there isnt a single explanation, according to Anthony Perrotta, head of fixed-income research at the Westborough, Mass.-based financial market consultancy TABB Group.

Perrotta pointed out in an interview with FierceCFO that there were a host of factors that came together to explain the 33-basis point decline in yields on 10-year Treasurys, which the FT notes was the biggest intra-day move ever seen by several orders of magnitude.

There was a host of macroeconomic events that together caused a massive flight to quality move into Treasurys, Perrotta explains, ranging from weak economic data in the U.S. Europe and Asia and a wave of Pimco fund redemptions to geopolitical concerns in the Middle East.

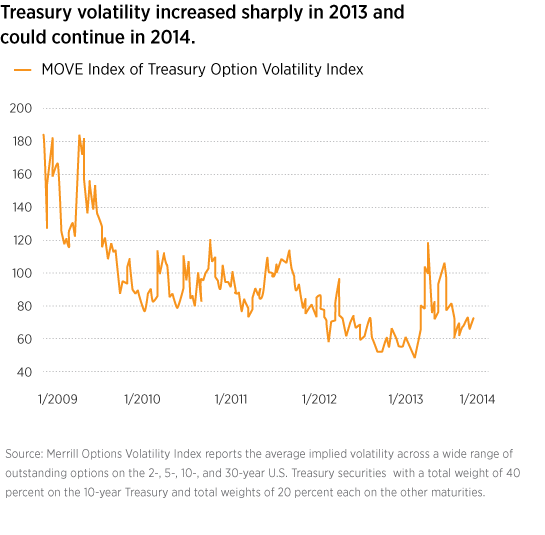

Meanwhile, the analyst notes, electronic networks have enabled participants to trade more quickly. Add to all that a decline in liquidity because banks are holding fewer bonds as a result of the so-called Volcker rule, which has removed them from proprietary trading, and Perrotta says its no wonder the market moved so violently. In fact, he predicts well see more such bond market volatility ahead unless theres a change in market structure.

But Perrotta says observers are mistaken to think the root cause is a reliance on technology. Thats completely unrelated, he said. He noted that electronic trading has merely given some participants quicker access to liquidity, and that it isnt being replaced at the same rate by market makers.

Electronic trading didnt lead to the move in yields, but exacerbated volatility because of the lack of liquidity provisioning behind it, he explained.

Yet in the case of banks that once played that role, Perrotta says thats by design. By getting financial institutions out of trading for their own accounts, he says, the Volcker Rule has put banks in a more stable and secure environment. He observed that banks are often considered vulnerable to moves like the one last month, but they werent because theyre holding 40 percent fewer bonds than they once did, thanks to the Volcker Rule.

Were starting to see the fruits of that labor, he observed.

But because the line between market making and proprietary trading is so fine, Perrotta says the rules impact on banks bond inventories has definitely impacted liquidity provisioning.

From that perspective, Perrotta described last months spike in Treasury volatility as a watershed event, but just a precursor to many more in the future. He also noted that the Federal Reserve has effectively reduced the float of Treasurys by $2 trillion, or 17 percent, through its Quantitative Easing program.

To address illiquidity going forward, Perrotta says the bond market, with or without prodding from regulators, must become more like that for equities, where other intermediaries besides banks play the role of market makers.

The market structure in place no longer can support the size of the markets, he observed, referring to the bond market. The bigger they get and the more unstructured, the lack of a formal structure will expose the market to more volatility.

For more:

- r ead the FT article on the bond market spike

- r ead a TabbFORUM piece on declining liquidity in the bond market

Related Articles: