Monthly Dividend Stocks What They Are and How to Use Them in Your Portfolio

Post on: 8 Июнь, 2015 No Comment

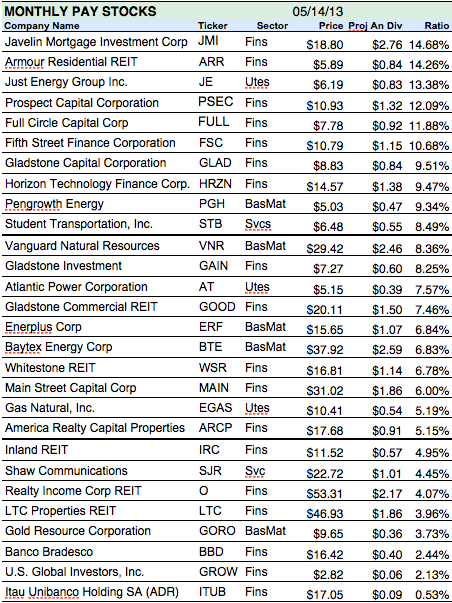

First of all, yes, they do exist! There are stocks that pay dividends on a monthly basis. If you’re only familiar with those that pay quarterly, semi-annual, or yearly dividends, this article will be a real eye-opener. Second, I’ll show you where to look and how to fit them into your portfolio. Third, I’ll show you some of these stocks that beat the yield on US Treasuries hands-down.

Where’s the Yield?

Today, the 10-year US Treasury bond, which is considered to be safe and reliable by most investors, yields barely over 2%. The S&P 500, on the other hand, yields 2.2% — so there’s really not much difference between the yields of stocks and bonds. The question that now arises is, “where can you get higher yields on your investing dollars?”. I’d like to give a possible solution to that question by introducing you to monthly dividend stocks.

What Are Monthly Dividend Stocks?

As the name suggests, these are stocks that pay off dividends every month. They trade like any normal stock on stock exchanges and can be bought or sold through your regular broker. Most of these stocks are either:

1. From the oil and gas industry.

2. Are business development companies.

3. Linked to real estate investment trusts, or REITs.

What sets monthly dividend stocks apart from other stocks is that most of them invest in income-producing asset portfolios. Their monthly dividend payments are generated from diverse streams of income; ranging from corporate profits, to rental income, or through the interest payments on the underlying bonds that they invest in.

Monthly dividend payments can help supplement income during retirement, and they can also help offset high-risk investments. The best thing about them is that you can get yields of at least 8% on many of these stocks, almost more than four times better than that of the 10-year U.S. Treasury Bond.

Where Can You Search for Monthly Dividend Stocks?

Start with a Google search. So many results will come up, ranging from subscription-based websites to your regular online articles. I won’t suggest you pay for a subscription because you can always use Yahoo Finance’s stock screener. Just plug-in the criteria that you are looking for in the given fields and make sure to select a minimum of 8% yield on the dividend field. That will then give you a good number of stocks to research on.

How Should They Fit in Your Portfolio?

Treat monthly dividend stocks just like any other stock. You will need a bit of diversification because these stocks earn from their specific sectors like energy, real estate, or mortgage securities. Make sure that you are not too concentrated on a specific sector and if possible, buy other stocks in the same sector so you won’t be exposed to too much individual stock risk. A good rule of thumb would be to keep individual exposures to 1-3% and sector holdings to 10-15% unless you have done deep research and analysis.

A Few Examples

Realty Income Corp. (O ). This is a 42-year old, publicly traded real estate company. It pays monthly dividends through revenue received from 2,600 commercial properties that they own and operate in 49 states. They operate under long-term leases, primarily with businesses, national and regional retail chains, and restaurants. Realty Income yields 5.4% and has been paying monthly dividends since 1969. Its dividend yield is not among the highest in the REIT universe, and most analysts would say that its price is trading at a premium to net asset value. But this serves as a good example because its management has made it successfully through multiple economic cycles. Plus, they always make sure that the occupancy rate is always in the high 90’s.

Main Street Capital (MAIN ). Main Street Capital is a principal investment firm that provides long-term debt and equity capital to lower middle market companies. Main Streets investments are primarily made to support management buyouts, recapitalizations, growth financings and acquisitions of companies that operate in diverse industry sectors and generally have annual revenues ranging from $10 million to $100 million. Main Street seeks to partner with entrepreneurs, business owners and management teams and generally provides one-stop financing alternatives to its portfolio companies. MAIN has never cut the dividend during its existence, and in fact has increased it after the switch to monthly payouts in 2008. It currently pays 9.3% on its monthly dividend.

These are just a few examples for you to base your research on. You can always check their peers in the same sector and evaluate for yourself which stock has better fundamentals. There is an ongoing global search for good yields right now so these monthly dividend stocks may be a good start. Always remember to stay diversified, look behind the yield at the payout ratio, and be careful of specific sector risks like falling rental rates and European bank exposures among others. Good luck and happy earning!