Modified Sharpe ratio – Calculate your performance

Post on: 16 Март, 2015 No Comment

In the tradimo trading challenge, the modified sharpe ratio is the key concept on which the performance of the participating traders is measured.

In a nutshell, the concept is that a trader who takes less risk will be placed higher in the competition than a trader that has taken more risk. but achieved the same results.

This prevents one of the typical problems with trading competitions: some people try to take large risks and then hope for luck to do well in the competition’s ranking.

This way, the competition is more realistic. Banks and institutions also do not want their traders to take excessive risk – after all, the first place is to manage a $100,000 account.

Measuring risk has multiple facets

Measuring risk goes beyond looking at whether you risk no more than 2% of your account on any one trade. It also incorporates:

- How volatile are the assets you trade?

- The likely maximum that you can lose in a given time period

Approaching risk the way banks and financial institutions do

There are many different approaches through which you can measure this success rate of a trading strategy and one of them is the so-called Sharpe ratio. In finance, this ratio is used to evaluate the outcome of an investment strategy related to its risk exposure.

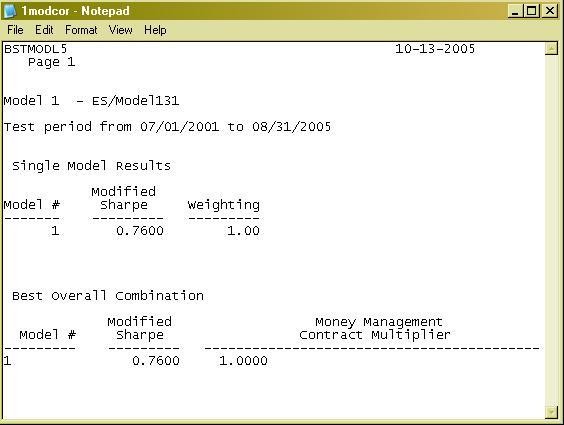

For the trading challenge, a modified version of the Sharpe ratio is used.

Advantages of the modified Sharpe ratio

- You can participate with any account size above €1,000 without a disadvantage.

- The best trader – not the most risk-taker – is rewarded.

- Deposits during the competition are possible.

Calculating the modified Sharpe ratio

In the Trading Challenge we adopt a modified version of the Sharpe ratio :

- Modified Sharpe ratio = Rt / Σt

- Where Rt is the rate of return of the portfolio up to time t;

- Σt is the risk of the portfolio up to time t – as measured by Value-at-Risk (VaR).

Do I have to understand the modified Sharpe ratio to participate in the competition?

In practice, no. It’s much more important that you follow your strategy that should incorporate a good risk and money management. If you have a great strategy and execute it well, you can get very good results in this competition.

You can compare it to the way the ELO in chess or the world ranking in tennis are calculated: it’s not easy to understand in detail, but it doesn’t play a big role: we know that it’s a fair measure of performance.

Example for calculating the modified Sharpe ratio

The most important thing to know about the modified Sharpe ratio is that the higher it is, the better the traders’ risk-adjusted performance is.

Consider a trading strategy where we trade the EUR/USD:

On June 3, 2013 (day 1), we deposit 1000 EUR on our account and, at 14:00, we open a long position (buy order) in size of 1 lot for the opening price 1.3000 (1 lot being 100 000 units).

At the end of the day, the price has increased to 1.3020.

On June 4, 2013 (day 2), the value increases further and we close at 13:00 for a closing price of 1.3040. We made a profit of 307.21 EUR.

On June 5, 2013 (day 3), we open a short position of size of 2 lots at 8:00 for the value of 1.3030. At the end of the day, the price is 1.3035. Our equity decreases in the amount of 76.72 EUR.

The table below summarises our three-day trading: