Michael Millette Goldman Sachs intervie bonds ILS

Post on: 7 Май, 2015 No Comment

Posted on Oct 12th, 2014 by Editor Comments Off | 1499 Views

A conversation with Goldman’s Global Head of Structured Finance

Michael Millette was one of the founders of the Goldman Sachs insurance linked securities business. Since joining the firm in 1994, he has worked on many of the market’s most significant transactions.

He is now the global head of the Structured Finance business in the Finance Group which includes Goldman’s ILS business. This gives him a unique understanding of the latest developments in the ILS market within the context of the broader financial system.

In November he will be moderating a panel at the Convergence 2014 event in Bermuda – ‘Relative value – How do opportunities in reinsurance funds compare to other asset classes?’. In the first of a two part interview with InsuranceLinked, he shared his views on this topic.

When reinsurance funds are raising money, what other asset classes are they competing against?

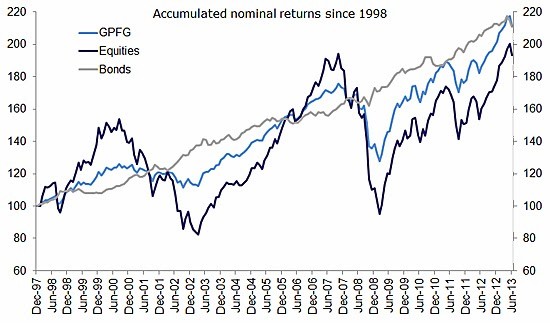

This is one of a number of alternative assets that pension funds, endowments and sovereign wealth funds purchase, in part for improved risk return characteristics and in part for diversification from the main run of their portfolio.

Historically, hedge funds of all types (including long short, macro, cap structure arbitrage and event driven) have been used as alternative asset classes. And in effect, the reinsurance funds are an alternative within that alternative. Because many hedge funds showed correlation with markets during the crisis, reinsurance funds gained popularity.

Other alternatives to regulator conventional hedge funds and private equity funds include infrastructure funds, drug royalty funds energy-related funds, commodity funds, and even more specialised categories where there may only be a couple of funds operating.

How does the twelve month outlook for ILS fund returns compare to those asset classes?

In a word, well. Reinsurance funds are continuing to produce premium returns per unit of expected loss and they continue to produce diversification versus other types of funds. That’s why, despite the run that we’ve seen in pricing, investors continue to be very engaged by these funds.

How does the twelve month outlook for fund returns compare to reinsurance equity?

Reinsurance equity has also generated gains over the past couple of years. During the crisis, most reinsurers traded at a discount to book and virtually all reinsurers over the past year have reached or exceeded book value.

However, the outlook for reinsurance companies has been coloured by the perception that market pricing is lower and market opportunities are being contested by alternative sources of capital. Funds also are impacted by lower prices, but not so much by the notion that they face competition from alternative providers. The funds are the alternative providers.

Apart from improved reinsurance pricing, what could draw more capital into insurance linked funds?

Investors in the funds have been very happy with the return and diversification they’ve received. Now they would like to see some deepening and broadening.

By deepening, investors are very interested to see arrangements by which funds are able to access risk closer to the source in the reinsurance system. We’ve seen some arrangements where funds have entered directly into transactions with primary insurers.

As far as broadening, we have talked with investors who are very interested to invest in a broader array of risks than natural cat. That includes non-elemental catastrophe, life, health, weather and other types of risks.

What are some of the limiting factors to the broadening of risks?

First not every investor wants to broaden. The properties of natural cat that many investors appreciate are not only diversification and return but also what they perceive as high quality risk measurement. The quality and thoughtfulness of the modelling is important.

They are not as confident in modelling across the broader insurance landscape. That’s a consequence of familiarity and also a sense that some of these insurance risks are less stationary — they are more susceptible to change over time.

Another issue is the relative pricing. Historically catastrophe risk has been priced at a very steep premium to the expected loss. That’s less true of other sub-sectors.

Are investors wary of multi year (long tail) risks?

It’s hard to say that too forcibly when we just witnessed a capital raise for Watford Re in excess of $1 billion based entirely on casualty. So clearly there’s some appetite. But longer tail risk presents a few challenges. It’s hard to leave capital on account idle for a long period of time in order to collateralise a tail.

Casualty risk is also much harder to understand over time. Most investors feel that natural catastrophes reflect fundamental long-term trends on earth that may drift but have some stability. Casualty rests on notions of fault and compensation that have a social dimension and that evolve.

The notion of pollution liability, which has caused enormous volumes of claims in casualty, is a good example. The socially acceptable threshold has moved sharply over the past 70 years.

Are there any structural innovations that could increase the appeal of insurance linked funds?

A broader array of insurance risks would make this sector more robust, more useful to investors. I’m not just talking about adjacent lines of business. For example, an interesting series of transactions by Aetna involving indemnity health has broadened and diversified the space.

A greater market share for the capital markets could increase the appeal of the sector.

We also have a theory — and we’ve discussed this with issuers — that longer bonds would increase interest in the sector. The bonds that are out there generally range from one to four years (a few five years here and there). We think if there were some ten-year bonds it would create trading benchmarks for movement in reinsurance rates and they would drive more interest as well.

What factors could decrease the relative attractiveness of the asset class?

The factors that cause attractiveness are diversification, price per unit of risk and (in third place) measurability of risk. So if any of those factors deteriorated that would be a problem, for example if a series of events occurred that generated doubts about the quality of modelling that would undermine confidence in the asset segment.

That hasn’t been the case. In its 18 years, the sector has produced catastrophe losses very closely in line with the expected losses that investors were given in risk disclosures (which are adjusted for climate change). But if that changed, investors could either decide that the models were not good or alternatively, the models were good, but the world has changed more than expected. Either of those factors would decrease the attractiveness of the sector.

Another factor that would decrease the attractiveness of the sector would be the occurance of more correlation. That could come either because a catastrophe event caused losses that also translated into capital market losses, or it could occur because the broader ownership of catastrophe risk causes it to be more susceptible to mark to market losses, because investors are selling off holdings across sectors. I doubt either of those factors is very likely, but either of them could influence the sector.

There’s been a hypothesis that rising interest rates could reduce the attractiveness of the sector. We are not convinced that would be the case. If and when rates do go up, these bonds are likely to continue to trade near par because they are all floaters. It is possible that investors could actually move towards the sector in the short run. If we saw this sector remain at this price per unit of risk level and saw rallies in other sectors that could cause a little bit less enthusiasm.

The appeal of the sector is very stable given the way people are using it. The bulk of the investment dollars in the sector come from very large institutions that are investing low single digit percentages of their portfolio in this sector specifically to diversify other asset classes.

Do you think that we will we see more retail investors attracted to the sector?

We have never, and to my knowledge no other dealer has ever sold catastrophe bonds directly to retail investors. We’ve been quite conservative in thinking about suitability. But we do see individual investors being interested in the same qualities in the cat market as institutional investors.

That’s manifested through the success that Stone Ridge has had raising funds from financial advisors; that certain funds in Europe have had raising funds through banks; that the Blue Capital vehicles have had raising public equity; and that some of the hedge fund reinsurers have had raising money from high net worth investors. So we’re seeing individual investor interest and the way they are generally expressing that interest is through diversified funds and vehicles.

Posted: Monday, October 13th, 2014