Metric Assets

Post on: 4 Июнь, 2015 No Comment

Contents

Assets

As investors use the term, assets are usually purchased, or equivalently a deposit is made, in hopes of getting a future return. or interest from it. Assets are held to have some recurring, or capital appreciation. Assets are expected to give income. without any work on the asset per se. [1] Seen from a cash flow perspective, an asset is something that puts money in your pocket, and a liability is something that takes money out of your pocket. [1] [2] The word investment originates in the Latin vestis, meaning garment, or vest, and refers to the act of putting assets into others pockets. [3]

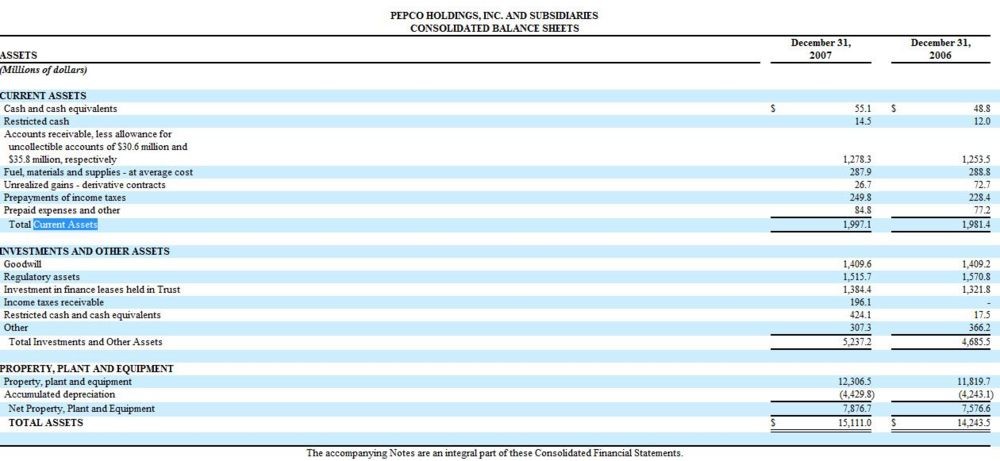

In the accounting use of the term, an asset is any property that theoretically can be converted to ready money. Financial assets can include cash. stocks. and bonds ; fixed assets such as buildings, machinery and equipment, or even intangible assets such as goodwill or a company’s reputation among customers. The opposite of an asset is a liability — something of negative value, usually a debt owed by a company. Publicly-traded companies are required to list a summary of their assets and liabilities every quarter.

Types of Assets

From an accounting perspective, assets are divided into two broad categories:

Current assets

Current assets are assets, which the company expects to sell, use-up, or otherwise convert to cash in the next year. Current assets include:

- Cash

- Inventory. Includes inventory of raw materials and finished goods

- Short-term investments that can be converted to cash quickly, such as T-bills held by the company

- Receivables (money owed to a company, usually as payment or goods or services)

- Office Supplies

Net current assets or Working capital . calculated by subtracting current liabilities from current assets, is a measure of the assets the company has at its disposal in the short term to fund operations — other kinds of assets such as equipment, real estate and goodwill are less easily converted to cash.

By the principle of prudence. current assets are reported in the balance sheet at their least favorable valuation. Short-term investments, for example, will be recorded at the value that the firm paid for it or the market value, whichever is lower. It is only after selling the position that the company recognizes any gains. Similarly, inventory of raw materials is valued at the lower of cost of purchase and market price; and inventory of finished goods are recorded at the lower of cost of production and selling price.

Long-term assets

Long-term assets are assets that cannot be converted to cash easily and hence are not used to fund everyday operations. Examples include: company cars, computers, and investment in another company. Long-term assets are of three types:

Fixed assets, also known as property, plant & equipment (PP&E). are used to produce the goods or services of the company and cannot easily be converted to cash. Fixed assets include equipment such as production machinery, computers, and motor vehicles, as well as land and buildings. These assets are referred to as fixed since they remain unchanged in the course of production — unlike cash, which is used to buy raw materials, which in turn is used to produce finished products. Normally, fixed assets are subject to depreciation and/or amortization.

Often, fixed assets are tailored to be production specific and have little resale value. Oil rigs, for example, are built on site and are not reused after the oil well is depleted. They can be sold as scrap metal, but it is highly unlikely that a company can resell these rigs for the value of new rigs. However, companies record the value of these assets on their balance sheets at the purchase price (including the cost of installation) rather than at resale value. Similarly, computers decrease in value quickly and can only be resold at a fraction of their original purchase price.

On the other hand, land and buildings can increase or decrease in value depending on local real-estate conditions, but, in most cases, the principle of prudence only allows devaluation to be recognized in the balance sheet.

Fixed assets are treated as investments (instead of expenses) by companies and are depreciated over the course of their useful life.

Long-term investments are to be held for many years and are not intended to be disposed of in the near future. [4] These are made by a company in order to secure an additional income stream or a strategic goal. Such investments can range from anything from buying a minority stake at another company to long-run hedges against oil prices. Berkshire Hathaway ‘s investment in Coca-Cola and Southwest Airlines ‘ hedge against high oil prices are good examples of long-term investments.

In this case too, the company needs to exercise prudence in reporting the value of the investment. They are reported at the lower of purchase price or market value. Any gains from these investments are only recorded after the sale of the position. These gains are subject to capital gains taxes rather than income taxes.

Intangible assets are assets, which cannot be physically seen. Capitalized research expenses, goodwill. trademarks, copyrights, patents, brand recognition are all intangibles. Even though intangibles are not present physically, they are often more valuable than fixed assets. For example, Coca-cola and Apple would not be as valuable without their brands.

However, not all intangible assets appear on the balance sheet. In fact, in most cases, GAAP does not allow internally generated intangibles to show up on the balance sheet. On the other hand, if a company pays more than the fair value to acquire another company, the difference would show up as goodwill in the acquirer’s balance sheet. Also, research-based companies, such as drug-manufacturers. are allowed capitalize their development expenses — since, in theory, research can provides value long after it has been completed.

Generally, intangibles are amortized on a straight-line basis over their useful life (e.g. franchising agreement would be amortized over the life of the franchising contract). Amortization provides the companies with tax benefits since it is considered to be an expense (and thus reduces taxable income). However FASB rule 142 mandates US companies to keep intangibles with indefinite life on their balance sheet. [2] For example: Goodwill is kept on the balance sheet at its historical value, and is revised annually for impairment.