Merrill Edge Pricing Commissions Fees for Online Trading

Post on: 30 Май, 2015 No Comment

Additional services

Count on more value and extra benefits when you invest with Merrill Edge. See for yourself how easy it is to take advantage of our latest offers.

Special pricing

$ 0 online trades 1 up to 30 per month

Qualify for thirty $0 online equity and ETF trades 1 per month when you have $25,000 in cash in your Bank of America banking or Merrill Edge self-directed investing accounts, or if you maintain Platinum Privileges status. 3 How to qualify | See pricing details for other transaction and management fees

Current offers

2 Comparison table data based on pricing as of 1/31/2015 and excludes special promotional offerings.

a E*TRADE’s standard online price for equity, ETF or option trade is $9.99, $7.99 for customers who trade at least 150 times per quarter, $6.99 for customers who trade 1,500+ times per quarter

b For TD Ameritrade ETFs: the ETF must be on list of 100+ commission-free ETFs and must be held for a minimum of 30 days in order to not incur a fee. Also, the user must be enrolled to qualify.

c Price per non-Schwab ETF

d Price per non-iShare ETF

3 $0 trades are only available with an individual or joint Merrill Edge self-directed brokerage account. When placing a trade, Merrill Lynch, Pierce, Fenner & Smith Incorporated (MLPF&S) determines whether you meet the balance or relationship requirements to qualify that trade for the $0 waiver. To determine the number of qualifying trades, MLPF&S adds the qualifying trades in your individual accounts and joint accounts. Commission fees apply when qualification requirements are not met, or when you exceed the number of qualifying trades a month. Brokerage fees associated with, but not limited to, margin transactions, option trading, special stock registration/gifting, account transfer and processing, research request and termination apply.

a) Commissions are waived for 30 online equity trades each month including stock and exchange traded funds (ETFs) on behalf of MLPF&S, for customers who meet any one of the following criteria:

i) Combined total of $25,000 or more in your deposit accounts at Bank of America, N.A. MLPF&S adds the average collected balances in your deposit accounts as of the prior month to the balances in your bank CD and IRAs as of the prior business day. Bank deposit accounts with the same Social Security number (SSN) as the SSN(s) on the self-directed brokerage account are systematically included in the balance determination. Standard deposit account fees apply.

ii) Or combined balance of $25,000 or more in cash balances in one or more of the following sweep options in your Merrill Edge self-directed account(s) as of the prior business day:

- Bank Deposit Accounts sweep option with your Cash Management Account (CMA)

- Retirement Assets Savings Program II sweep with your IRA

iii) Or Client of U.S. Trust

iv) Or Client of Platinum Privileges

v) Or Client of Preferred Rewards Platinum

b) Commissions are waived for 100 online equity trades each month including stock and ETFs on behalf of MLPF&S, for customers who meet any one of the following criteria:

i) A Client of Preferred Rewards Platinum Honors

ii) Or Client of Banking Rewards Wealth Management U.S. Trust

This offer does not apply to Business/Corporate Accounts, Investment Club Accounts, Partnership Accounts and certain fiduciary accounts held at MLPF&S. Other fees and restrictions may apply. Relationship requirements and pricing are subject to change and/or termination without advance notice. To learn more about the ways to qualify for $0 trades, call 1.888.MER.EDGE (1.888.637.3343).

If you are already enrolled in the Platinum Privileges program you can maintain your status by keeping an active Bank of America personal checking account and at least $50,000 as a combined balance in your Bank of America deposit accounts and/or your Merrill Edge brokerage accounts. Platinum Privileges is no longer open for new enrollments. Platinum Privileges is not available to U.S. Trust and Merrill Lynch Wealth Management clients. Please speak with your U.S. Trust advisor or Merrill Lynch financial advisor for information about the enhanced banking benefits available to you through your wealth management relationship.

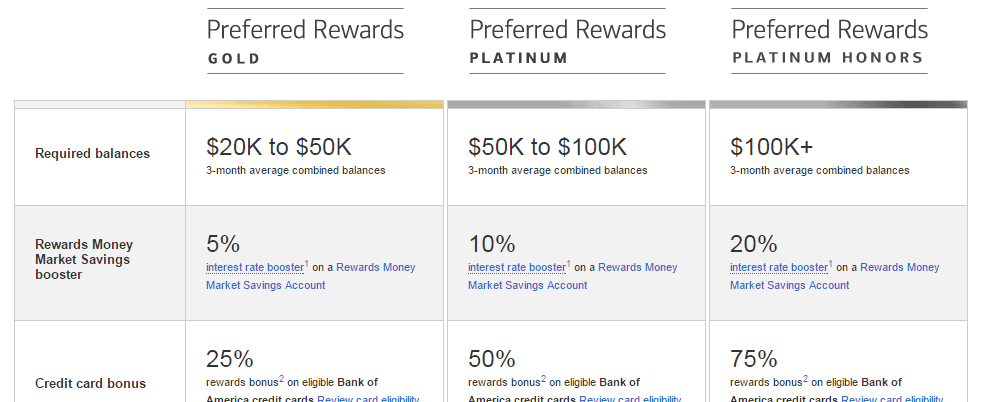

You are eligible to enroll in the Preferred Rewards program if you have an active, eligible Bank of America personal checking account and maintain a three month average combined balance in your qualifying Bank of America deposit accounts and/or your qualifying Merrill Edge and Merrill Lynch investment accounts of at least $20,000 for the Gold tier, $50,000 for the Platinum tier, or $100,000 for the Platinum Honors tier. SafeBalance Banking accounts do not count towards the account or balance requirements, and do not receive the fee waivers and other benefits of the program. Certain benefits are also available without enrolling in Preferred Rewards if you satisfy balance and other requirements. For details on Employee qualification requirements, please visit the Employee Banking & Investments website. The Preferred Rewards Gold tier does not include the $0 online equity and ETF trades via Merrill Edge . a benefit that is currently available at the Platinum and Platinum Honors tiers of Preferred Rewards. Platinum Privileges clients who enroll in Preferred Rewards and qualify for the Gold tier could potentially lose this benefit. Merrill Lynch Wealth Management clients with greater than $250,000 in assets with Bank of America and Merrill Lynch are eligible for additional banking benefits. Please speak with your Merrill Lynch financial advisor for details.

Equity securities sold through Merrill Edge self-directed investing are subject to stock market fluctuations that occur in response to economic and business developments.

Options Trades: Options involve risk and are not suitable for all investors. Certain requirements must be met to trade options. Before engaging in the purchase or sale of options, investors should understand the nature of and extent of their rights and obligations and be aware of the risks involved in investing with options. Prior to buying or selling an option, clients must receive the options disclosure document Characteristics and Risks of Standardized Options. Call the Investment Center at 1.877.653.4732 for a copy. A separate client agreement is needed. Orders which involve multiple option transactions will be charged a separate commission on each leg of the option order.

Mutual Funds: While no-load funds do not assess sales charges, fund shares are subject to management fees and certain other expenses. Redemption fees may also apply. Merrill Lynch receives remuneration from participating fund companies. In addition to receiving dealer concessions and asset-based sales charges and/or services fees in connection with clients’ purchasing and holding mutual fund shares, Merrill Lynch and its affiliates provide other services for which they may receive additional compensation from funds or their affiliates. This compensation is generally disclosed in a fund’s prospectus which is available from an Investment Center representative and in the Guide to Mutual Fund Investing, which is available here. For specific mutual fund family compensation information, please contact the Investment Center.

Fund shares may be redeemed directly with the Fund without payment of the Merrill Lynch Short-Term Redemption fee. Additional transfer fees may apply.

Many Load Funds offer various sales charge discounts or waivers depending on the terms of the prospectus and/or statement of additional information. You should consult a fund’s prospectus and/or statement of additional information to determine whether you may qualify for a discount or waiver. Notify an Investment Center representative if you believe you qualify for any of these discounts or waivers. Call the Investment Center at 1.877.653.4732 for assistance.

Fixed Income: Fixed income orders contain order information on Agency Discounts/Notes/Bonds, Certificates of Deposit, Corporate Bonds, Municipal Bonds and Treasury Bond investment vehicles.

Exchange Traded Funds are subject to risks similar to those of stocks. Investment returns may fluctuate and are subject to market volatility, so that an investor’s shares, when redeemed or sold, may be worth more or less than their original cost.

A Brokered Certificate of Deposit is different than a bank Certificate of Deposit. It is sold for a bank by a broker while a Certificate of Deposit can be purchased directly from a bank. Brokered CDs may offer higher rates of return, but their value may fluctuate with changing interest rates. Banking products are provided by Bank of America, N.A. and affiliated banks. Members FDIC and wholly owned subsidiaries of Bank of America Corporation.

The offering of cash rewards, free trades, waiver of fees (including account fees), and/or any other thing of value may not be used as an inducement to sell any kind of insurance, including life insurance or annuities.