Meaning Derivatives Market

Post on: 16 Март, 2015 No Comment

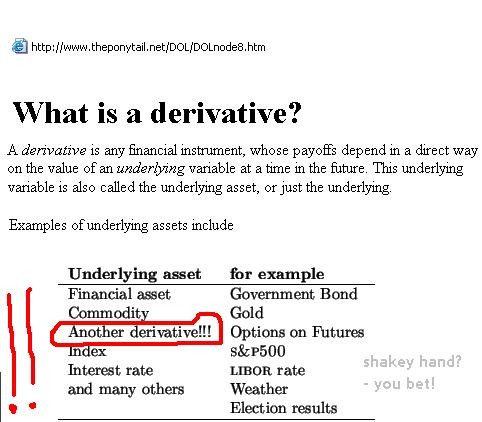

The Derivatives Market is meant as the market where exchange of derivatives takes place. Derivatives are one type of securities whose price is derived from the underlying assets. And value of these derivatives is determined by the fluctuations in the underlying assets. These underlying assets are most commonly stocks, bonds, currencies, interest rates, commodities and market indices. As Derivatives are merely contracts between two or more parties, anything like weather data or amount of rain can be used as underlying assets.The Derivatives can be classified as Future Contracts, Forward Contracts, Options, Swaps and Credit Derivatives.

The Types of Derivative Market

The Derivative Market can be classified as Exchange Traded Derivatives Market and Over the Counter Derivative Market.

Exchange Traded Derivatives are those derivatives which are traded through specialized derivative exchanges whereas Over the Counter Derivatives are those which are privately traded between two parties and involves no exchange or intermediary. Swaps, Options and Forward Contracts are traded in Over the Counter Derivatives Market or OTC market.

The main participants of OTC market are the Investment Banks, Commercial Banks, Govt. Sponsored Enterprises and Hedge Funds. The investment banks markets the derivatives through traders to the clients like hedge funds and the rest.

In the Exchange Traded Derivatives Market or Future Market, exchange acts as the main party and by trading of derivatives actually risk is traded between two parties. One party who purchases future contract is said to go “long” and the person who sells the future contract is said to go “short”. The holder of the “long” position owns the future contract and earns profit from it if the price of the underlying security goes up in the future. On the contrary, holder of the “short” position is in a profitable position if the price of the underlying security goes down, as he has already sold the future contract. So, when a new future contract is introduced, the total position in the contract is zero as no one is holding that for short or long.

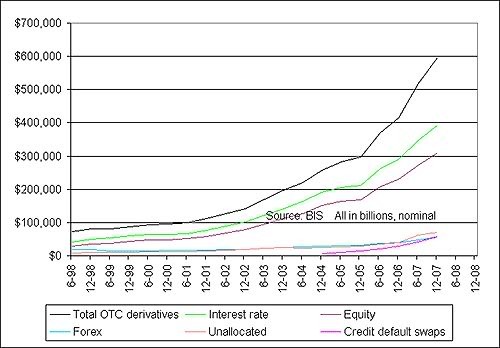

The trading of foreign exchange traded derivatives or the future contracts has emerged as very important financial activity all over the world just like trading of equity-linked contracts or commodity contracts. The derivatives whose underlying assets are credit, energy or metal, have shown a steady growth rate over the years around the world. Interest rate is the parameter which influences the global trading of derivatives, the most.

Derivative Market and Financial Risk

Derivatives play a vital role in risk management of both financial and non-financial institutions. But, in the present world, it has become a rising concern that derivative market operations may destabilize the efficiency of financial markets. In today’s’ world the companies the financial and non-financial firms are using forward contracts, future contracts, options, swaps and other various combinations of derivatives to manage risk and to increase returns. It is true that growth of derivatives market reveal the increasing market demand for risk managing instruments in the economy. But, the major concern is that, the main components of Over the Counter (OTC) derivatives are interest rates and currency swaps. So, the economy will suffer surely if the derivative instruments are misused and if a major fault takes place in derivatives market.