Maximize Investments DollarCost Averaging with Automatic Investment Plans

Post on: 16 Июль, 2015 No Comment

Share the joy

Warren Buffett describes the day he picked up The Intelligent Investor by Benjamin Graham as one of the luckiest days of my life. Though it was written decades ago, the investment principles that Graham offers in the text still hold up in todays economy.

For more, watch: Warren Buffett discussing The Intelligent Investor (YOUTUBE VIDEO)

Key Point- DOLLAR COST AVERAGING : One of the main arguments Graham makes in The Intelligent Investor concerns Dollar-Cost Averaging; which is a method of investing a set amount of money in a Stock/Fund at a regular interval.

How this relates to your bottom line. Instead of pretending that you can predict the markets next move; you can automatically hedge against heavy losses, and take advantage of price advantages whenever your Fund dips or gains in price. Take this example from Jason Zweig s Commentary on Chapter 5 in The Intelligent Investor :

If you had invested $12,000 in the S&P 500s Stock Index at the beginning of September 1929, 10 years later you would have had only $7,223 left. But if you had started with a paltry $100 and simply invested another $100 every single month, then by August 1939, your money would have grown to $15,571!

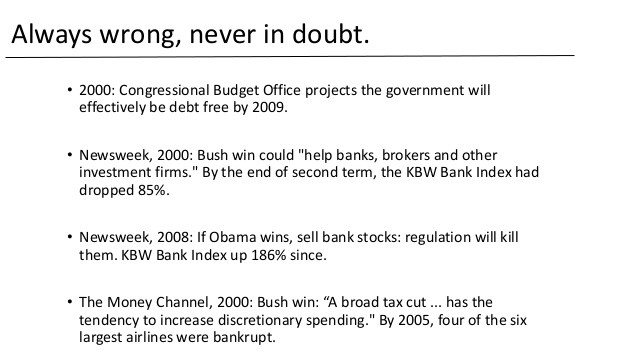

As the chart below shows, the Extremely Patient investor (Far Left) earns far more than the Hyperactive Investor (2nd from Right). The moral? The more you try to guess what the market is going to do, the more you will most likely be wrong.

Insert: Graph from The Intelligent Investor Revised Edition, page 151:

From Jason Zweigs Commentary on Chapter 6 — The Intelligent Investor Revised Edition.

Take Advantage- AUTOMATIC INVESTMENT PLANS: One of the best ways to use Dollar-Cost Averaging to your advantage is to set up an Automatic Investment Plan. Consult with your Broker or Financial Planner about setting aside a certain amount of money to invest in a Fund every month.

Who Benefits: Automatic Investment Plans are particularly well suited for Beginning Investors . With a relatively low amount of money- say $100/month- you can start building a portfolio with exposure to any market; domestic, emerging, bonds, etc. Coupled with a Buy and Hold strategy for shares in companies that you believe will grow in the long run- say Facebook (FB), or Google (GOOG)- you will be setting yourself up for a well-diversified portfolio.

Take time to research the funds you want to invest in: NOT ALL FUNDS are available with Automatic Investment Plans.

Meaning. The choice of Funds you can invest in will vary greatly, depending on who your broker is- Schwab, Merrill, or Fidelity for example.

Invest and Forget: Setting up an Automatic Investment Plan may not be as fun as trying to anticipate the stock markets next big breakout, but it does accomplish two very important things: 1) Limiting HUMAN ERROR and 2) Limiting HUMAN EMOTION in your investment decisions.

If you subscribe to daily market News Sources like Investors Business Daily (IBD), or the Wall Street Journal (WSJ), it can be tough to withhold from investing in Hot Stocks or Top Performers that are producing big returns. But even these publications recommend Dollar Cost Averaging; whether they know it or not!

After subscribing to IBD, I was sent a complimentary copy of their Book How To Make Money In Stocks . Though there is only 1 mention of Dollar Cost Averaging in the text -as compared to 11 mentions in The Intelligent Investor- they do make this rather elucidating point:

Had investors bough at the exact top of 1929, they would have broken even in just 14 years, based on the performance of the S&P 500 and the DJIA. Had these investors bought at the top of the market in 1973, they would have broken even in just 11 years. If, in addition, they had dollar cost averaged throughout these bad periods (meaning they had purchased additional shares as the price went down, lowering their overall cost per share), they would have broken even in half the time. How to Make Money in Stocks, page 396.

Bottom Line. 1) The only smart time to buy a stock is when it is undervalued; aka it has suffered a significant loss in perceived value or price. 2) Most people buy stocks when they are hot; aka overvalued. 3) If you can eliminate human judgement from this equation- aka buying in equal values when it is overvalued, and undervalued- you will be able to defeat the markets volatility, and come out on top.

For more on Dollar Cost Averaging, check out these good articles:

When Not to use Dollar Cost Averaging. Dollar-Cost Averaging is a smart way to start your investing career. If you have a very large sum of money to invest with- say a few million dollars- Dollar-Cost Averaging may not be advisable. For more, see this related article: