MarketAxess launches European BidAsk Spread Index

Post on: 23 Июль, 2015 No Comment

First Published 6th February 2014

MarketAxess launches new index for European corporate bond market liquidity.

London — MarketAxess has launched a new liquidity index for the European corporate bond market. The European Bid-Ask Spread Index (BASI) is the first detailed analysis of European bond prices over time and serves as a broad indicator of market liquidity and implied transaction costs.

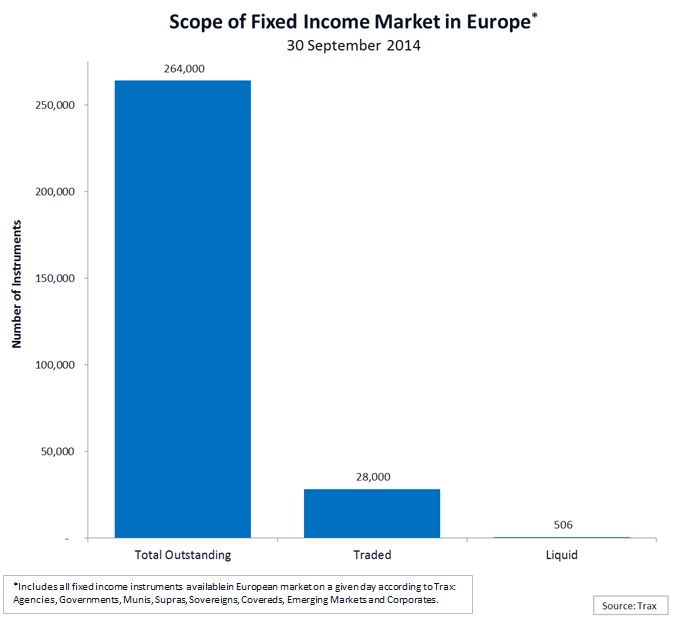

Incoming regulatory changes such as Basel III are imposing additional capital requirements on broker-dealers and limiting their ability to make markets in risk-weighted assets such as corporate bonds. In light of these shifts in market structure, many investors have expressed a need for greater insight into the euro and sterling corporate bond markets. The European BASI was created to provide a clearer view into these markets, by analysing bond market flows. The index comprises data from euro- and sterling-denominated high-grade and high yield corporate bonds and can be calculated on a daily, weekly, monthly or quarterly basis.

The European BASI follows the launch of the U.S. BASI in June 2013, which utilises FINRA TRACE data, as well as MarketAxess trade data, to track the spread differential between buy and sell trades of the most actively traded U.S. corporate bonds. The European version of the BASI was developed using publically available data from the Xtrakter end-of-day pricing tool, XM2M.

The Bid-Ask Spread Index was originally created as a quantifiable benchmark to measure liquidity over time. There are more challenges with applying the same methodology in Europe due to a lack of publically available data. Our new European index utilizes data available from Xtrakter to track credit market cycles and help inform market participants’ research and analysis, said Alex Sedgwick, Head of MarketAxess Research. The European BASI has been calculated for both euro and sterling corporate bonds, in high-grade and high yield. By comparing the two currencies we can see, for example, that the euro BASI is much tighter than the sterling BASI, reflecting a larger market in Eurobonds and comparatively better liquidity.

Following the success of BASI in the U.S. we are thrilled to launch a pioneering new liquidity barometer for Europe. In difficult market conditions we’ve already had good feedback from clients and we feel that the European BASI will provide a clearer image of corporate bond market liquidity, helping investors identify market trends and reduce their execution costs, said Robert Urtheil, Head of Europe and Asia, MarketAxess, and CEO, Xtrakter.

Trax announces rebranding, appoints NYSE Euronext’s Chris Smith as head of Post Trade Services, Kevin Swann of Thomson Reuters named head of Data. continued

MarketAxess hires Gareth Coltman as European Product Manager. continued

Xtrakter appoints Kevin Swann as Head of Data. continued

- Perseus goes live with wireless connections in London metro

First high-speed wireless network connects financial markets from Slough to Basildon, claims 40% reduction in latency. continued

- LME Clear to provide trade reporting service

LME Clear selects DTCC as strategic partner for new LMEwire reporting service. continued

- RavenPack News Analytics digests larger chunk of big data

RavenPack News Analytics enhancement includes content curation, adds 7 years of historical data. continued

Related Items

- Market Axess launches Axess All

- MarketAxess and BlackRock expand strategic trading alliance into Europe

- TABB Group appoints new head of fixed income research