Market Volatility and the Effects of a Stronger

Post on: 11 Август, 2015 No Comment

by Jon Snare, CFA®, CFP®

Regional Investment Manager

In this Quick Market Update:

- This week’s volatility was exacerbated by weakness in international economies and a strengthening U.S. dollar.

- Over the past five months, the U.S. dollar has appreciated 9 percent against the euro, and 6.1 percent against the yen and 4.7 percent against the pound.

- The stronger U.S. dollar is due to a combination of factors: relative interest rates, balance of trade, and perceived safe-haven status.

- A strengthening U.S. dollar presents potential opportunities and potential risks for investors.

U.S. markets are little changed today following a week of sizable swings. Wednesday’s release of the Federal Reserve’s minutes had investors predicting that the Fed would keep interest rates lower for longer than had previously been anticipated given the weakness abroad and recent dollar strength. The Dow Jones Industrial Index rallied 275 points and the dollar dropped on this interpretation. However, by Thursday, traders had come to a different conclusion and the timeline for an interest-rate policy shift by the Fed was adjusted back toward mid-2015. The Dow Jones Industrial Index fell 335 points and the U.S. dollar appreciated as this adjustment was factored together with additional weak news from abroad. In this Quick Market Update, we look at the potential opportunities and risks presented by a stronger U.S. dollar.

Dollar gains

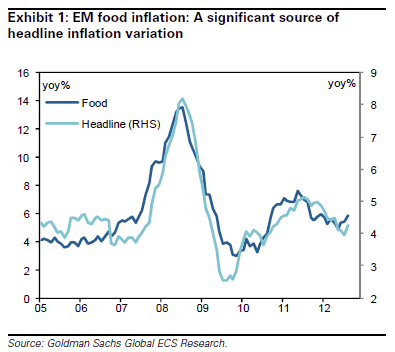

Differing economic conditions around the globe are not only causing disparities in the returns of various markets, but are also causing shifts in currency valuations. The U.S. dollar has gained relative to the major developed currencies such as the euro, the yen and the British pound.

On May 7, 2014 the U.S. dollar traded at $1.39 vs. the euro. On October 9, 2014, the U.S. dollar closed at $1.27 per euro 1. In nearly five months, the U.S. dollar appreciated nearly 9 percent against the euro. The U.S. dollar has also appreciated approximately 6.1 percent against the Japanese yen and 4.7 percent against the British pound over the same time period. For the world’s major currencies, these are fairly large moves over a relatively short period of time.

Chart 1: U.S. dollar has strengthened vs. the euro

Source: Factset, 10/10/14

What has caused the U.S. dollar’s appreciation?

In a market in which currencies are free to float, supply and demand for a specific currency drives changes in relative values, much like any commodity or asset. Some countries, such as China, fix the value of their currency and do not allow it to float freely in the foreign exchange market. Many countries peg, or in other words, manage the value of their currency against the U.S. dollar. But most major developed market countries allow their currencies to float freely against foreign currencies. So, what causes a specific currency to appreciate or depreciate in value against foreign currencies? There are a variety of reasons for the change in value, but the most common are:

Relatively higher interest rates: While interest rates in the U.S. have been very low since the 2008-2009 financial crisis, interest rates in most other developed economies are now even lower. Thus, many investors find the U.S. bond market more attractive than those of other developed countries. The combination of comparatively higher interest rates and the expectation for rates in the U.S. to increase even further have helped to fuel the U.S. dollar’s rise in value.

Balance of trade: When one country carries a trade surplus with another country, its currency tends to appreciate in value. Although the U.S. economy continues to run an overall trade deficit, the gap has been shrinking in recent months. One of the primary reasons for the diminishing trade deficit is the renaissance and growth of the U.S. energy industry. This shift in oil production is helping to improve the U.S. trade deficit.

Perceived safe haven: Some of the changes in the value of currencies can be attributed to psychological factors rather than pure economic ones. Since World War II, the U.S. dollar has been the world’s reserve currency and has been perceived as a safe-haven currency for many investors during times of international crisis. When we observe economic uncertainty and political instability outside of the U.S. the U.S. dollar tends to rally. However, when such events appear to threaten the U.S. directly, the U.S. dollar’s value can depreciate in response.

Opportunities and risks of a stronger U.S. dollar

U.S. dollar appreciation or depreciation can create both opportunities and risks for investors. A strong U.S. dollar can help benefit some parts of the economy while it detracts from others—there are winners and losers. Here are some potential opportunities and risks from an appreciating U.S. dollar:

Opportunities

- U.S. consumers – A strengthening U.S. dollar typically causes the prices of imported consumer goods to decrease. In general, a stronger U.S. dollar increases the purchasing power of U.S. consumers. Additionally, virtually all commodities are priced in U.S. dollar terms, so a strong U.S. dollar may cause many commodity prices to drop; also a positive for U.S. consumers.

- U.S. equity markets – While not a direct relationship, the U.S. stock market likely has benefited from a strong U.S. dollar and an improving U.S. economy. Foreign investors’ returns on their capital in the U.S. have been relatively good, thus attracting more capital to the U.S. and some of this capital is being invested in the U.S. stock market.

- Hedged international bond funds – One of our key investment themes for 2014 involves diversifying fixed-income investments. In view of the strengthening dollar, we suggest that investors in international bond markets might want to consider a 50 percent target allocation to U.S. dollar-denominated bonds—an asset class which represents a significant portion of available emerging markets’ bonds – and hedged international bond funds, widely available for investing in international developed-market bonds. 2

- International multi-national firms – Non-domestic companies whose products are exported to the U.S. as well as to countries tied to the U.S. dollar (i.e. the Middle East) may see the volume of their exports increase, because their product prices become less expensive in U.S. dollar terms.

Risks

- U.S. multi-national corporations – Many major U.S. corporations generate a large percentage of their revenue outside the U.S. When the U.S. dollar appreciates, the revenue these firms generate in foreign markets loses value when the foreign earnings are repatriated and converted to U.S. dollars. As third-quarter earnings season progresses, we expect some U.S. companies to attribute earnings disappointments to currency swings.

- Exporters – A stronger U.S. dollar usually will increase the cost of exports from the U.S. to other countries. This, in turn, makes U.S. exporters less competitive from a price standpoint.

- Commodity producers – Just as a strong U.S. dollar provides benefits for consumers by helping to drive down commodity prices, it has the opposite effect on commodity producers. As prices drop, so does revenue for commodity producers, including U.S. commodities producers. The U.S. is one of the world’s largest exporters of agricultural products, and agricultural companies that export become less competitive against international producers when the U.S. dollar strengthens.

- Unhedged international bond funds – As we discussed above, should the U.S. dollar continue to appreciate in value, international bond investors who do not hedge their currency exposure could see weak returns. That’s because unhedged bond funds tend to underperform their hedged counterparts in a strengthening U.S. dollar environment.

Keep a long-term perspective

While we have been expecting a pull-back in U.S. equity markets for some time, the current volatility has been largely related to Fed policy interpretation and weakness in foreign markets. Equity and currency markets alike react to both interest rate policy and global economic conditions. We continue to see a positive economic backdrop in the U.S. while there is much support for improvement in many international economies. This likely means the U.S. dollar will continue to strengthen modestly from current levels.

This environment presents a variety of global opportunities as well as certain risks for U.S. investors. Over the long term, significant U.S. dollar strength is not necessarily a negative for global opportunities. For example, in 1999, near the top of the U.S. dollar’s most recent cyclical peak, the benefit of a strong U.S. dollar to global exporters was so great that emerging markets (represented by the MSCI Emerging Markets Index) actually outperformed the S&P 500 Index. We believe that global investors should maintain a well-diversified portfolio to exploit the international opportunities that a strong U.S. dollar may present. We encourage you to talk with your investment professional to determine whether your portfolio is positioned for a strengthening U.S. dollar environment.

All data for this Quick Market Update was sourced from Bloomberg Finance, LLP, unless otherwise noted.

Disclosures

Wells Fargo Wealth Management provides products and services through Wells Fargo Bank, N.A. and its various affiliates and subsidiaries.

The information and opinions in this report were prepared by the investment management division within Wells Fargo Wealth Management. Information and opinions have been obtained or derived from sources we consider reliable, but we cannot guarantee their accuracy or completeness. Opinions represent Wells Fargo Wealth Management’s opinion as of the date of this report and are for general information purposes only. Wells Fargo Wealth Management does not undertake to advise you of any change in its opinions or the information contained in this report. Wells Fargo & Company affiliates may issue reports or have opinions that are inconsistent with, and reach different conclusions from, this report.

Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses.

Past performance does not indicate future results. The value or income associated with a security may fluctuate. There is always the potential for loss as well as gain. Investments discussed in this presentation are not insured by the Federal Deposit Insurance Corporation and may be unsuitable for some investors depending on their specific investment objectives and financial position.

This report is not an offer to buy or sell, or a solicitation of an offer to buy or sell the securities or strategies mentioned. The investments discussed or recommended in the presentation may be unsuitable for some investors depending on their specific investment objectives and financial position.

Investing in foreign securities presents certain risks that may not be present in domestic securities. For example, investments in foreign and emerging markets present special risks, including currency fluctuation, the potential for diplomatic and potential instability, regulatory and liquidity risks, foreign taxation and differences in auditing and other financial standards.

Bond funds are subject to the same credit and interest rate risks as regular bonds. Bond prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of the fund’s investments. Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than original cost upon redemption or maturity.

Exchange rate risk between the U.S. dollar and foreign currencies may cause the value of the fund’s investments to decline.

Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Wells Fargo and Company and its affiliates do not provide legal advice. Please consult your legal advisors to determine how this information may apply to your own situation. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared.

INVESTMENT PRODUCTS. NOT FDIC INSURED. NO BANK GUARANTEE. MAY LOSE VALUE.

© 2014 Wells Fargo Bank, N.A. All rights reserved.

1 All currency and commodity prices from FactSet, as of October 9, 2014

2 Please see our Monthly Asset Allocation Strategy Report or speak with your investment professional about our strategic asset allocation guidance.