Market Timing v and Hold at Critical Market Periods

Post on: 19 Апрель, 2015 No Comment

In the previous blog we looked at how the addition of an optimized market timing scheme to the asset allocation model provided by Modern Portfolio Theory [MPT] not only increases portfolio returns, sometimes substantially, but also at lower, and sometimes greatly lower, risk.

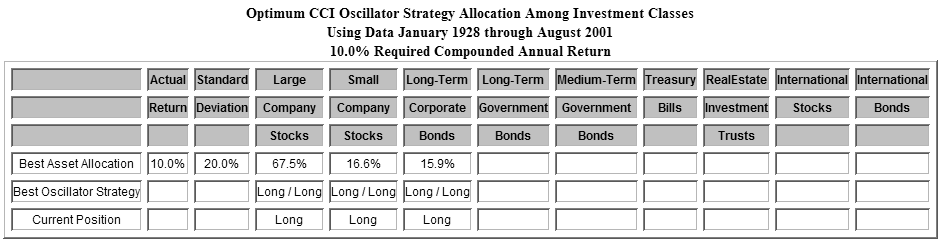

Today well be expanding on yesterdays topic of comparing two portfolios both with assets allocated according to the tenets of MPT. The first portfolio is allocated according to the traditional buy-and-hold strategy, and the second uses a market timing oscillator, the CCI, that is specifically optimized for each of the nine asset classes under consideration. [See the previous blog for the list of those asset classes.] We looked at the performance of each fund starting with equal dollar amounts in January of 1990 with the requirement that the funds attempt to generate at least a 10% average annual compounded return. The analysis was run through April, 2009.*

The difference in results was staggering. The buy-and-hold portfolio, which is the one that is used in typical MPT calculations, only was able to attain an average compounded return of 4.2% compared with the market timing portfolio that achieved a comparable return of 9.8%. Moreover, the risk as given by the standard deviation was 15.8% for the first portfolio compared with only 6.9% for the market timing onea huge difference!

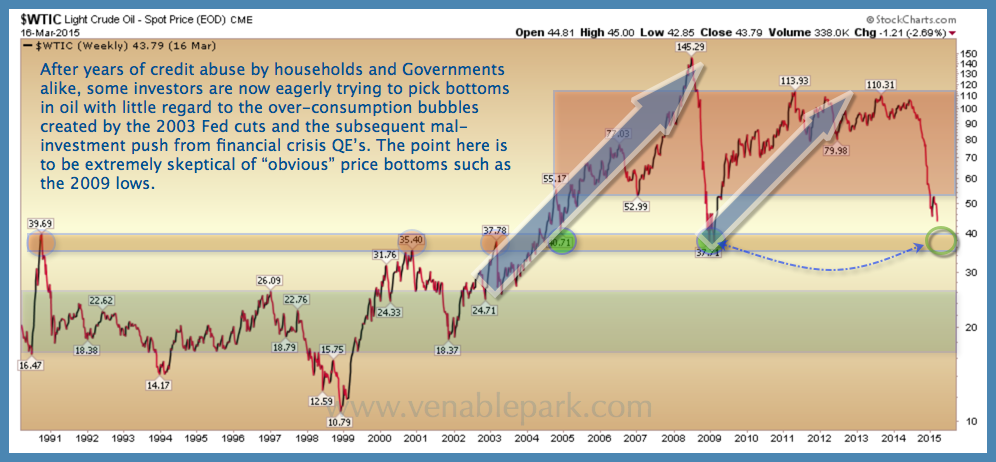

Where the market timing portfolio really outperformed the other was during the dot-com bubble in 2000 and in the recent mortgage meltdown in late 2007. How did it accomplish this?

Lets examine what the SMC Analyzer would have recommended just before and during each of these major market downturns.

Just before the dot-com bubble burst

The first period well be examining is the bull market preceding the internet bubble burst. The tables below show how the SMC Analyzer would have allocated assets for a buy-and-hold portfolio which is one that is long during all market conditions; and a market timing portfolio which is long when the CCI oscillator is positive for that asset class and in T-bills when the oscillator is negative.

Click to enlarge

Here, still, the risk is much less for the market timing model (the second table): 10.1% compared with 18.2%. And the table shows you one reason why: the percentage of funds allocated to stocks is much less in the market timing model as compared with the buy-and-hold one.

Lets see move ahead a bit in time to the middle of the dot-com decline to August, 2001 and see if theres been any change to these allocations.

Mid-dot-com decline

The following tables show that the buy-and-hold portfolio has become riskier, mainly because in order to meet the 10% return, MPT must allocate more funds to those asset classes that offer higher returns. In contrast, the Long / T-bill timing portfolio is long in REITs and Medium-term government bonds, and in T-bills for the other asset classes (given in the third row). Moving into these conservative investments during this market downturn not only prevented loss in the portfolio but actually increased returns, although not by much.

Pre- and Mid-Mortgage Meltdown

Lets take a brief look at how these portfolios would have been allocated before and during the recent downturn.

Pre-meltdown (June, 2007):

Mid-meltdown (September, 2008):

Click to enlarge

Again, had you applied market timing to your portfolio, you would have been spared the nasty loss in stocks as you would have been 25% in Medium-term government bonds and the rest in T-bills.

What is the Analyzer recommending now?

*Transactions costs, margin rates, trading fees, and taxes are not considered in these analyses as these factors differ with individual circumstances. The SMC Analyzer software, however, does have the capability to take all of these factors into its calculations.