Market Timing

Post on: 21 Август, 2015 No Comment

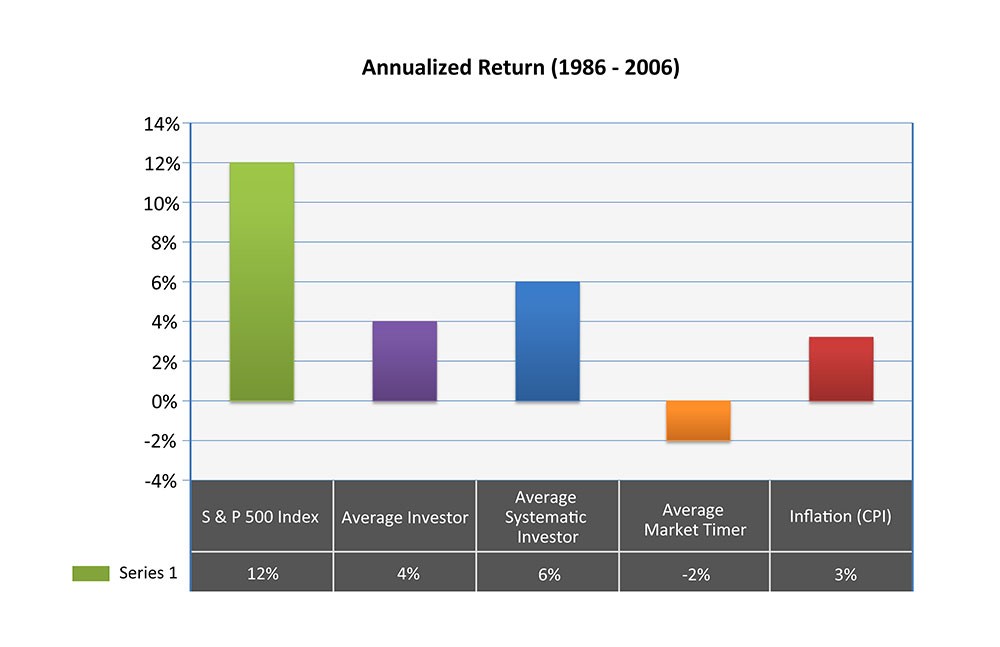

Market Timing is the science of analyzing macro level economic indicators along with other big-picture data to predict the beginning and end of recessions, the future direction of Treasury bonds, gold, crude, currencies, certain commodities, and the stock market. Market Timers are usually very experienced market analysts and/or economists that each have their own favorite indicators and/or proprietary indicators that they’ve invented themselves. The market timing community has been followed for dozens of years by publications such as Timers Digest and TimerTrac . The folks at Monthly Cash Thru Options spent a lot of time watching several of these experienced prognosticators and then came up with our own mix of macro-level economic and investor sentiment indicators to help us better time our entry and exits of credit spreads and to help us decide if/when we should be sitting on the sidelines to reduce our downside exposure.

The Monthly Cash Thru Options team starts off by watching the DOW, S&P 500 and NASDAQ 100 daily and weekly price charts, closely scrutinizing support & resistance levels, along with handful of other technical indicators. For example, below is the price chart of the S&P 500 Index (SPX) in 2007 and 2008. Note the vertical line near January 1, 2008. This is the point that the 100 day simple moving average (SMA) (thick blue line) crossed below the 200 day SMA (thick black line). Moreover, the 50 day SMA (thin black line) crossed below both the 100 day and 200 day lines. When these bearish crossovers happen, it’s a warning sign that the US economy is becoming unhealthy and that we need to tread carefully when opening our bull put credit spreads, and at a minimum we need to get off of margin. We also watch the volatility closely and monitor how it increases over time. In this case the volatility of the SPY increased by 90% in early 2007, increased an additional 70% from its January high in Aug 2007, and then jumped an additional 20% from its Aug high in early 2008. We also watch the volume, especially on the DOWN days, and in this case it gradually increased throughout 2007 and 2008 gradually pushing up the 200 day SMA. This increase in volatility and volume is a warning sign that needs to be watched closely. Finally, the Relative Strength indicator is showing negative divergence where the indicator was getting weaker while the SPY continued to climb.

We also watch for crossovers on the 17 and 43 week exponential moving averages (EMA). Analysts in the Standard & Poor’s Equity Research Department did a lot of back testing and found that these EMA’s did a good job of keeping investors in or out of the market during bull and bear markets. Below is a weekly chart of the S&P 500 index and we can see when the 17 week EMA (thin blue line) crosses below the 43 week EMA (thin black line), it’s a good time to move to bearish trades; and for us credit spread writers, it’s a good time to be extremely careful when opening bull put spreads.

In addition to monitoring the big picture of the price charts of the major indexes as discussed above, we also monitor macro-level economic and investor sentiment indicators, as listed below. For more information on each of these indicators, please visit the Learning Center .

Investor’s Intelligence Bull/Bear Ratio Sentiment Indicator — A well respected gauge of overall investor sentiment. For more information please go to Investors Intelligence Bull/Bear Ration Sentiment Indicator.

ISE Call/Put Ratio Sentiment Index (ISEE) — A more refined put/call ratio because it only uses opening long customer transactions to calculate bullish/bearish market sentiment.

McClellan Oscillator & Summation Index — One of the more accurate and modernized market breadth indicators available and is based on the smoothed difference between the number of advancing and declining issues on a broad-based index, such as the NYSE Composite, the S&P 500 Index, or the NASDAQ Composite.

Aruoba-Diebold-Scotti Business Conditions Index (ADS) — One of several macro-level indicators tracking the overall health of the US economy. This index is a diffusion of 6 economic components: Weekly initial jobless claims; monthly payroll employment; industrial production; personal income less transfer payments; manufacturing and trade sales; and quarterly real GDP. The ADS index’s claim to fame is that it’s updated in almost real-time with high-frequency input data.

Economic Cycle Research Institute (ECRI) Weekly Leading Index (WLI) — ECRI is one of the most respected independent economic research houses, and they have one of the best track records in predicting when recessions start and end.

US Treasury Yield Curve — The relation between the interest rate and the time to maturity of the debt. When the Yield Curve inverts, it’s been a good predictor since 1970 that the US economy will worsen in about 1 year.

Dow Jones Media Economic Sentiment Indicator (ESI) — The ESI is calculated through a monthly assessment of the tone of content in 15 metropolitan dailies . (an example of tone would be scanning for the word recession) The ESI is a simple barometer based on a scale of zero to 100—the higher the number, the more upbeat the news and, by extension, the stronger the economy. For more information please go to Dow Jones Media Economic Sentiment Indicator .

TrimTabs Demand Index (TTDI) — The TTDI is a diffusion of 18 stock market liquidity and macro-economic indicators giving the TTDI some uncanny, predictive abilities. Liquidity analysis is based on supply and demand of stocks, bonds and commodities and is different from the usual technical and fundamental analysis that is used by the majority of stock market analysts.

The Conference Board Leading Economic Indicator (LEI) — The Conference Board is a highly respected independent economic research house that publishes the Leading Economic Indicator, or LEI.

Interest Rate Spread Between Similar-Maturity Corporate Bonds and Treasuries to Monitor Health of the US Credit Markets — This is one effective way to monitor the overall health of the US credit markets, and it gave an early warning in July 2008 that the US economy was deteriorating, 2 months before the October 2008 stock market crash.

Money flow IN/OUT of long-term, domestic equity mutual funds — This funds flow indicator tells us how much money is flowing IN or OUT of long-term, domestic equity (stock) mutual funds. When money is flowing into US equity mutual funds, it will help push-up stocks and help the major indexes stay above certain support levels. If money is flowing out, mutual fund managers will need to liquidate stocks to satisfy requested distributions and their selling activity will usually push the markets down. For more please go to equity mutual fund money flow indicator .

Revolving Consumer Credit — This number comprises total available credit via credit cards and personal bank loans. Similar to how easy credit in the mortgage industry can create a strong housing market (and bubbles), ample consumer credit can help an economy grow because consumer spending makes up 70% of the US gross domestic product (GDP).

In summary, by monitoring the big picture from the price charts and implied volatility of the major indexes, along with the macro-level economic and investor sentiment indicators listed above, we are able to make better decisions when to get off of margin, reduce our bull put exposure, or to completely avoid opening any new bull put spreads during uncertain times, substantially reducing our downside risk.