Market Risk Premium

Post on: 20 Апрель, 2015 No Comment

Part 14

In our last tutorial. we have understood how to find beta for private company.In this article we will see market risk premium(MRP) in detail.

Market Risk Premium Definition

The Market Risk Premium (MRP) is a measure of the return that equity investors demand over a risk-free rate in order to compensate them for the volatility/risk of an investment which matches the volatility of the entire equity market. Such MRPs vary by country.

Market Risk Premium Formula

Market Risk Premium = Stock Market Return – Risk Free Rate

Two methods of calculating MRP are possible: historical or projected. has reference to both methodologies.

Historical

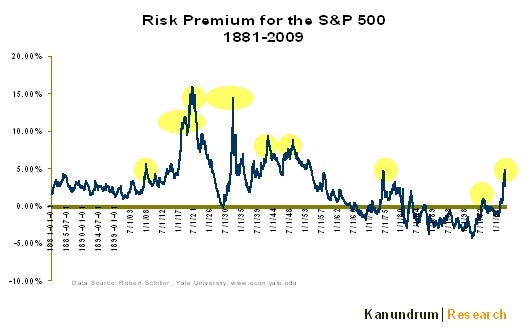

Utilising historical equity results to arrive at a risk premium assumes that past market returns are the best indication of the premium investors will demand over the risk-free rate for prospective investments. By calculating an arithmetic or geometric average of past risk premia, this method is often considered objective because of its easily observable results. However, choosing the correct historical time horizon is quite subjective as it is difficult to know what past period gives the best estimate of future premia. For instance, data is available since at least 1970s, but is today’s market are very different. In seeking the premium over the risk-free rate for a long-term investment, most often a long-term (eg 10-year gilt) instrument is used as a proxy for the risk-free rate.

Treasury Bill or Treasury Bond?

Treasury Bill (short term bonds)

- Short term rates change significantly over time. The long term average of the 3-months Treasury Bill would better approximately the real risk-free rate.

- In a DCF, you forecast five to ten years into the future. Long bonds represent a better match with the maturity of the cash flows in your DCF.

- A long bond’s yield includes long term forecast of inflation. A historical average of 3-months Treasury yields does not include an inflation forecast.

- It is inconsistent to use the Treasury bill to help calculate the Equity Risk Premium if you use the Treasury bond as the risk free rate in CAPM.

What is practically used?

Most analyst use ten year government bond.

Arithmetic average or Geometric average?

Arithmetic Average

- When you discount cash flows in your DCF, you use an arithmetic calculations

Geometric Average

- As from the above table, arithmetic average can be biased if you change the measurement period.

- The geometric average is a better predictor of the average premium over the long term.

What is practically used?

Arithmetic mean is used.

What is done by Analysts?

- Most analyst use the arithmetic mean of the difference between the Treasury Bond Rate and the return on the Stock Market to estimate the equity risk premium for the CAPM equation.

Forecast

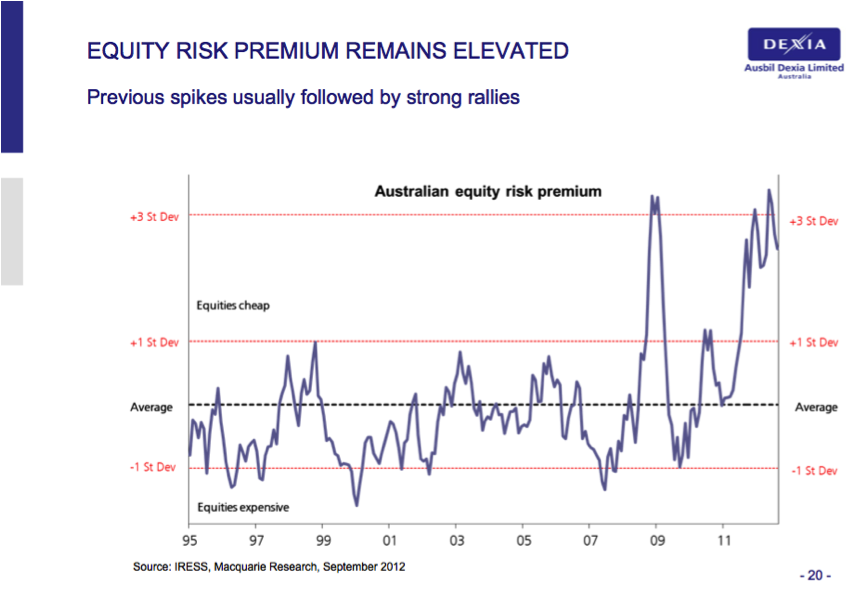

Rather than assume that yesterday’s equity markets will resemble those of tomorrow, forecast market premia can be calculated in an effort to account for structural changes in equity markets. The goal of calculating such a premium is to modify or replace historical data to factor in present knowledge and future expectations.

Step 1: Estimate the expected return on the market using the analysts forecasts of the market’s free cash flow to equity holders

Step 2 Rearrange the equation to solve for cost of equity

Step 3: Current risk-free rates are normally assumed to be an indication of future risk free rates, as treasury yield curve factors in such expectations

Preferred method

Analyst’s has regard to both methods, but has a bias towards the forecast method of estimating the market risk premium (in line with market practice). s Equity Research department should be able to provide you with estimates of the appropriate forecast market risk premium in the appropriate country. Forecast premia allow a better match between a future market view and the forward-looking nature of relevant investment decisions analysed in a DCF. Moreover, forward estimates better take into account changes between historical and future markets. For instance, today’s equity markets are characterised by better information, faster and broad dissemination of relevant facts, larger and more sophisticated investors, and are bigger and more liquid than in the past. Furthermore, in today’s low inflation environment, it is widely perceived that the risks associated with holding equity have ceteris paribus lessened. Thus, historical premia are less useful as indicators of future performance than future premia projections.

Step 11 – Calculate Cost of Equity & WACC

Step 1: Identify the listed comparables and their Beta. Also, find the Unlevered Beta for comparables

What Next

In this article we have understood market risk premium (MRP),we will see enterprise value calculation. Till then, Happy Learning!