Market Profile

Post on: 5 Июнь, 2015 No Comment

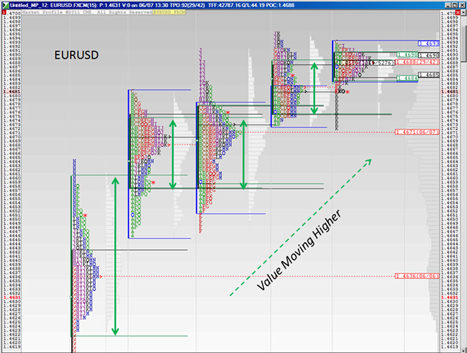

Market Profile/Meta-Profile for Day-Trading: A Brief Introduction

September 23, 2004

Your job as a trend trader is to locate the start of a directional move (trend) and to stay with it until you detect the congestion (non-directional balancing) that signals end of trend. If you are a congestion trader you want to sell tops of balances and buy balance bottoms.

Facts to keep in mind:

The CBOT Market Profile (tm CBOT)

A Market Profile is a graphic displaying price and volume on the vertical axis, with cleared price activity on the horizontal broken down by trading period. Market Profile is a subset of the Liquidity Data Bank (LDB) report. LDB reports are released only by the Chicago Board of Trade (CBOT). The horizontal activity is identified by letters for each time period (for half-hour periods the letters are A = 08:00 to 08:30, B = 08:30 to 09:00 and so on). These letters are called TPOs (Time-Price-Opportunity). Value is defined as those prices included within the central 70 percent of the cleared volume. beginning at the peak volume of the day. Market Profiles are available only from exchanges that report volume at price (Liquidity Data Bank). Currently, the CBOT is the only exchange that reports out the LDB. Since Market Profiles come from cleared volume data they are not available in real time even for the CBOT.

The CISCO Meta-Profile(tm CISCO)

A Meta-Profile replaces the volume of the Market Profile with tick data, generating TPOs (That-Price-Occured or Ticked). These TPOs are used as a surrogate for the volume of the CBOT Market Profile. Value is defined as those prices included within the central 70 percent of the TPOs. Meta-Profiles are generated in real time and are limited only to markets that produce tick data. Meta-Profile methodology was created by CISCO in 1987, it was published in 1987 and it has been in continuous use on the CISCO Bulletin Board and website since then. In balanced markets values from Meta-Profiles and Market Profiles agree quite well. In directional markets they diverge, a finding potentially quite useful to traders and market analysts. It should be noted that many subscribers to Market Profile services are actually receiving the Meta-Profile.

Market Profile or Meta-Profile is the basic building block in Auction Market Analysis

Market Profile/Meta-Profile Value Area is the market’s best estimate of value for a day

The shape of the profile distribution is the picture of demand

Rejected prices identify a lack of value

Market Profile/Meta-Profile is a day oriented information set

Market Profile/Meta-Profile gives detailed information on a market’s potential for continuation

1. Extremes show rejected prices. In an uptrending market, a sound rejection of the top price

is an argument against trend continution.

2. In an up market, an upper range extension* that holds argues for continuation of trend

3. In an up market, more TPO’s below the POC* argues for upside continuation

4. Trading above the previous day value area* shows upside strength

* Items defined in the following discussion

Market Profile/Meta-Profile give same value in balanced markets but may differ in directional markets

Initial balance is calculated by CMaPS. Pit trading has a defined start and IB is the first hour.

It is harder to define a starting time for the electronic markets. With CMaPS you have a choice:

IB is the first two periods based on the start time you select.

Availability: Normal market hours.

Market Structure: The Market Profile/Meta-Profile Display

Market Profiles and Meta-Profiles are graphics of developing market activity. They plot price on the vertical axis and time on the horizontal. The two profiles look much the same but they differ in important respects. At the end of a day in a balanced market they both result in a visual picture of demand in balanced markets (bell curve). In the following we will primarily use Meta-Profile displays since they cover all markets in a consistent manner. When a Market Profile is used, it will be so indicated. A (Meta) Profile for soybeans, July 98 contract, March 2, 1998 illustrates the form.

The Market Profile/Meta-Profile day is split into half-hour time periods, A is 0800 to 0830, B is 0830 to 0900, etc. Soybeans open at 0930 (D). In the profile above, the opening half hour ranged from 666 1/2 to 669. The next period, E, covered 669 1/2 to 668; and so on for the rest of the day.

Note that any occurrence of trading in a period creates a TPO at that price. (A TPO is a Time Price Opportunity, or, for Meta-Profiles, That Price Occurred). So the profile is a frequency distribution. The prices 668 1/2, 668 1/4 traded in six of the day’s 8 half-hour periods. These were the most frequently traded prices (most in demand). Least traded, least in demand, were the prices at the highs and lows.

And the half-hour tick bars from the CBOT from which the Meta-Profile is made:

For illustration, the Market Profile below can be contrasted with the Meta-Profile we just studied.

Describing the Profile

In the Meta-Profile above, the (profile analysis) elements are: An examination of the G period shows the high is followed by a pullback.

This could have been commercial capping. But the market recovered an hour or so later and showed strength in K period (13 — 13:30). So the pullback in H period was probably just normal market action (rejection of a tail). At the start of H period the pullback is apparent.

The two TPO tail in G period (11124 and 11123) indicates the market rejected that high.

So the capping reported on the Visual Graphic must have come in L period. Simple understanding of the Market Profile clarifies that problem.

Now the trader knows the capping came at the end of the day and can react accordingly (i.e. examine the overnight market if there is one or wait until the next day open to see if it was really capping (price moving down) or non-speculative buying by the commercials late in the day).

Three Intra-Day Profile Applications

The day trader now has three new, powerful tools for market analysis on the internet.

Meta-Profiles (CMaPS) track a market’s development throughout the day.

Half-Hour Tick Bars pinpoint the location and intensity of the most recent activity.

The Congestion Report contains important exit-decision data; that point in the day where a market’s movement has stalled.

These three applications, taken together, are all a profile trader needs to day-trade. In many cases they permit day-trading without the normal expense of a live quote machine. All three are included in the CISCO Day Trader Package.

History of the Meta-Profile ™

The Market Profile concept first appeared in the CBOT Market Profile Manual (1985) and in 1986 in the book ‘Markets and Market Logic’, by J. Peter Steidlmayer and Kevin Koy. Steidlmayer was a successful floor member at the Chicago Board of Trade (CBOT); Koy was a trader and a journalist. Their book created a completely new way of reading markets. For the first time, the public trader could measure value and the intentions of the participants (exchange members and the public). These concepts provide the day-trader with an unparalleled depth of market understanding.

Market Profile/Meta-Profile Methodology: Sources

Early on, formal training on the profile was available from Steidlmayer’s Market Logic School and through a series of lectures by James Dalton (principal author of ‘Mind Over Markets, Dalton, Jones & Dalton, Probus 1991′). The Steidlmayer/Koy book is out of print but the MOM book is still available at Amazon.Com.

The Meta-Profile arose because of the limitations of the Market Profile. It was end of day only (from the LDB report) and covered only markets cleared by CBOT. The Tick-TPO method of CISCO was real time and applied to all futures markets that produced tick data. The Meta-Profile methodology was published 1) Determining the TPO Value Area, D.L. Jones, Market Logic School, Al. Ltr. V1-#3, Apr 13, 1987 and 2) Estimating the Market Profile Value Area for Intraday Trading, D.L. Jones, S&C, Sep 1987. The S&C article is available from Stocks & Commodities Magazine.

Sources

faculty.wiu.edu/TP-Drinka/tutorial.htm. The Chicago Board of Trade book store stocks the text ‘CBOT Market Profile’ (parts 1-6). Steidlmayer’s revised ‘Steidlmayer on Markets’, is available from Wiley. CISCO offers a 5 month training course on value based trading in which Market Profile/Mets-Profile plays a leading role. Short Course SC2 Details

CISCO carries a number of studies and research reports on Market Profile and value based data subjects, including a copy of our book, ‘Value Based Power Trading’. A good starting place is our homepage in the section ‘Background Reading’. There you will find information on value based data, trading methodology and Auction Market Theory, the theoretical justification for Market Profile and value based market analysis. The profile alone is found at: Market Profiles Background

Click to buy the book Mind over Markets by Jim Dalton

How the Trader Applies the Market Profile/Meta-Profile

In the Dalton, Jones, Dalton book (MOM), they make the strong point that Market Profile ™ trading relies on these factors:

Market Structure is found from the Profile graphic. Trading logic develops from learning who is doing what in the market, i.e. by understanding the market forces (the Congestion Report illustrates one such force). Time validates price (price over time = value), and time regulates opportunity.

Logic creates the framework for trading, the strategy; time generates the signal; and structure provides the confirmation.

1) Market Structure: The Profile Display

We repeat the Profile graphic from above:

The Profile day is split into half-hour time periods, A is 0800 to 0830, B is 0830 to 0900, etc. Soybeans open at 0930 (D). In the profile above, the opening half hour ranged from 666 1/2 to 669. The next period, E, covered 669 1/2 to 668; and so on for the rest of the day.

Note that any occurrence of trading in a period creates a TPO at that price. (A TPO is a Time Price Opportunity, or, for the Meta-Profile, That Price Occurred.) So the profile is a frequency distribution. The prices 668 1/2, 668 1/4 traded in six of the day’s 8 half-hour periods. These were the most frequently traded prices (most in demand). Least traded, least in demand, were the prices at the highs and lows.

Another way to evaluate demand uses ticks as a substitute for volume. In the display below, the numbers in the columns are tick counts for the TPO’s of the profile above.

TRADING DATE: 02 MAR 98 CONTRACT: JUL 98 SOYBEANS (CBOT) (S N) Tick counts show that the downward drive in K period was fueled by relatively heavy trading. It was apparently not merely liquidation by floor members who were caught long late in the day.

Most importantly, tick information is available during the trading day and a day trader can act on it. Additionally, one could use the information to trade on in the late afternoon, Project A, market.

2) Trading Logic: The Congestion Report

Dalton, Jones and Dalton poses two questions:

Which Way is the Market Trying to Go?

Answers to A. and B. require knowledge of the functions and behavior of the various classes of trader: commercial interests, members, hedge funds, public and all others.

**Note: At this time, 2010, most trading is automated. Pits are relatively unimportant.

Exchange members generally are satisfied with a balanced market, one with no directional impetus. Floor members go home ‘flat’, so they have little effect on the longer term direction of the market. The public traders do buy or sell and hold. creating demand. So the public seeks to unbalance the market.

To answer the question ‘Which way is the market trying to go?’ we must look to the public trading. If the sellers control, the market is trying to go down. If buyers control, it is trying to go up. What tools are available prior to the market open? We know the previous day’s behavior. We know the overnight behavior. And we know the opening call. So who is controlling, buyers or sellers or the floor? If either buyers or sellers or floor members control exclusively, it is a one-timeframe market. More often the market is a tug-of-war between the members who want balance and the public who want a trend.

What has the market been doing? Who is in control? If both the floor and the public are active and no net movement is occurring, it is a ‘two-time-frame’ market. The short time framers (members) and the long time-framers, the public are at loggerheads. The developing Meta-Profile is the public trader’s pipeline to the floor. Understanding the message from the pipeline is the public’s key to trading decisions.

The Congestion Report, illustrated below, is an example of the market telling us which way it is trying to go. In this case, it was trying to go up early in the day and did so successfully. Then, around E period (10:20 to 10:50) The up move stalled, congestion set in, and then there was no attempted direction. The market started the day attempting to go up, a one-time-frame market, controlled by public buyers. When it started to stall, control became shared between the public and the floor. Later, the trend collapsed and the floor members prevailed. However, there remained enough public buying to keep price from rotating downward.

Another approach, Value Analytics, (Lesson 5 of Short Course) measures the market’s momentum via a number of reference points. These momentum measures are applied to Market Tipping Point analyses in the Day Trading Engine (Lesson 4).

3) Time: TPO’s at price in the Profile; Counts in tick bars

Time spent at a price measures market acceptance. If the time is long, the market is highly accepting. In the soybean Mar 2, Profile above, six of the eight periods of the day traded at 6684, 6682 and 6680. These were the most popular prices of the day. These prices were accepted almost all day. They are in the middle of the value area. Price moved as high as 6710 in F period, but returned to the middle. It is the clustering of price around value that creates the bell shaped curve so characteristic of the Profile.

If the time spent at a price is short, the market is rejecting that price. Look at the same profile again. The top three prices, the upper tail, occurred all within a single period. Price was bid up, sellers came in and quickly sold. The tail is composed of prices that were rejected.

Now examine the lower tail of the soybean profile. Can we say the same for it as for the upper tail? Not necessarily. K is the last period of the day. Maybe the drive down is not over. First, look to the close: if price came back to close above 6660 the down move would have been negated and the prices rejected. The actual close was 6626, near the low of the day. Later, after the close, price continued down. The tail was not rejected. Rather it was a spike down, and that became apparent during the work-out the next day.

More Profile Understanding: Transition to Congestion

With time and experience, a public trader will learn to discriminate between real demand and, say, a short covering rally. Such a rally often follows sustained selling. But it lacks new buyers and thus will be unlikely to follow-through. The same is true for long liquidation breaks. Both types of market are characterized by rapid movement immediately followed by substantial congestion. The congestion picture is that of a ‘p’ for a short covering rally (see example below) or a ‘b’ for long liquidation. A tip-off for the start of congestion is five or more TPO’s on a line. Here there are nine TPO’s at 12031.

CISCO Congestion Report

Yet More Market Understanding: Market Condition

Market condition is the framework that the day market trades within. The condition can be balancing (bracketing), testing the balance for breakout to trend, trending and testing for the trend end (and back to balance). If you know the condition, you are in a far, far better position to make trading decisions.

As an illustration, take the congesting T-bond market of May 20 (above). First look to the market condition of the previous day, May 19. That is shown in the Overlay Demand Curve ™ below. There, we have combined five days of profiles to obtain the composite curve defined by the X’s. The market is in balance, with an upper limit of 12020 and lower limit 11930.

Combination of Latest Day Profile (May 20) with Previous Overlay

Valid Only During Trading Hours

As price rose above 12020 during the opening period, it broke out of the bracket, signalling the potential start of a trend. That makes the ensuing trading activity very interesting. Is it a real trend start or just a false breakout? If it is a trend, we would want to stay with it because of the potential for large gain. Alternatively, our experience is that the T-bonds have been poor breakout traders over the past several months. So we want to be doubly alert to a failed breakout. The form of the distribution is very clearly up trend—as evidenced by the breakout and then the run up (single prints at 12024 & 12025). The pause is also a normal part of a trend, although it has more substance, more TPO’s than normal. The large amount of trading in the pause could be congestion. In this case, the CISCO algorithm for congestion shows it to be ‘p’ type congestion, halting the up move.

Congestion is the key to the trend-end phase. If not congesting, the behavior is a pause and the trend is probably intact; if congesting, the trend is likely over. The CISCO Congestion Report, in this case, signals congestion, and hence, end of the (brief) trend.

The Congestion Report of a ‘p’ congestion by 12:22 PM would have certainly encouraged the day-trader to exit. Where the day-trader would have entered is not shown. Normally, entry would have come via a profile or other strategy, whatever the day-trader normally used. For instance, the exit from a long could have triggered a new short (a stop and reverse order) because the market is expected to fall away from the congestion.

The swing/trend trade is treated as a complete trade. Both the entry and exit are identified; the entry as a breakout from a bracket and the exit from the failure of the trend to continue.

Although the trend lasted less than a day, the trade is still profitable (long at 12021, exit at 12100, for 11 ticks, $343, less slip and commission).

Recap

Recall that Profile trading relies on three factors, 1) Market Structure, 2) Trading Logic, and 3) Time.

The market structure and its development intra-day is well covered by the Meta-Profile function. Building the profile is a continuous process.

Trading Logic results from experience and training in market understanding. One must learn to interpret Profiles i.e. to divine who is doing what and where it is being done. Who is dominating: floor or public, buyers or sellers? The Congestion Report adds a significant piece of information about stalled markets.

Combining the Overlay Demand Curve with the latest profile provides an in-depth view of the evolving market. This joins longer term market condition with current structure, oftentimes a potent mixture. Lastly, tick counts act as a surrogate for volume analysis of demand.

Time regulates the markets. It validates price, leading to value. An overlooked element of time is it’s necessity in market evolution. Price alone is very volatile, moving up and down, sometimes very quickly. The trader who realizes that time must pass before decisions can become clear is a trader who will likely avoid the trap of excessive trading. It is this feature of markets, time validation, that obviates the need for up- to-the-second quotes.

Disclaimer

This brief introduction is intended to familiarize the trader with CISCO’s three profile related intra-day market information tools. Some knowledge of Profiles is assumed. The trader who is unfamiliar with profile techniques is advised to investigate the information sources contained in the paragraph above entitled ‘Market Profile/Meta-Profile Methodology’.

References

Mind Over Markets, Dalton, Jones, Dalton, Probus, 1991