Many ETF Expense Ratios Moving Targets

Post on: 16 Март, 2015 No Comment

Expense ratios are the first thing most investors will look at when evaluating an ETF, and that’s information that is easy to find on an issuer’s website. What may surprise investors, however, is that the expense ratio may not be entirely accurate.

The reality is that for many of the 1,400-plus U.S.-listed ETFs on the market today, the expense ratio is not a set-in-stone fee, but rather a moving target that goes up and down as a result of changes in a fund’s total assets. That means that the fee for an ETF can change every day.

This isn’t news to industry veterans. These type of expense ratio calculations are widely used among the major U.S. fund providers, but it’s an issue that came front and center recently when iShares-the largest ETF provider in the world-updated prospectuses on 43 of its ETFs late last year.

The fresh round of paperwork was procedural. Regulators require ETF providers to update prospectuses on funds once a year, but iShares surprised an industry that has grown accustomed to declining ETF fees by listing higher expense ratios on 40 of those 43 funds on Dec. 31.

While several news services and publications-including IndexUniverse-reported on the fee changes, which affected big popular funds including the $50 billion iShares MSCI Emerging Market Index Fund (NYSEArca:EEM), iShares was quick to challenge the notion that it was increasing fees, arguing that the new expense ratio figures were already stale, a symptom of backward-looking regulatory filings.

As they stood, the Dec. 31-dated prospectuses listed expense ratios that reflected a 12-month rolling average of fees accrued during the fiscal year ended Aug. 31, 2012.

Since then, many of those ETFs-including EEM-have seen solid asset growth, which meant expense ratios were in fact going down, not up.

Legally, iShares had to report in its new prospectus that the fee on EEM had climbed to 0.69 percent from 0.67 percent in the prior filing, but grappled with the fact that the actual fee that an investor would pay for EEM on Jan. 1 was actually lower than the price in the prospectus:0.66 percent.

A New Way Of Stating Expense Ratios

What followed is perhaps one of the most interesting new developments in the evolution of ETFs and fees. iShares decided to try something new on its website and start listing not one, but two expense ratios for 105 of its 280 ETFs.

As an advocate for greater transparency of ETFs, we felt that it was useful to provide investors with more current information on expense ratios, said Robert Nestor, managing director and head of iShares Global Product Marketing.

The iShares Web page for EEM, therefore, now posts two expense ratios:0.69 percent as the stated expense ratio as of Aug. 31, 2012, and 0.66 percent as the expense ratio as of Dec. 31, 2012.

Which should you believe?

The truth is neither 0.69 percent nor 0.66 percent.

The 0.69 percent in expenses is from the prospectus, which calculates the average annual expenses for the 12-month period ending Aug. 31, 2012. The 0.66 percent in expenses is derived solely from asset levels on the final day of the quarter, and this one-day calculation will be updated at the end of each quarter going forward.

But what’s the expense ratio today?

iShares, like many ETF providers, sets its investment advisory fee-by far the largest contributor to the total expense ratio-based on a sliding scale of assets:The more assets, the lower the fee. That’s a good thing, because the firm is sharing economies of scale. But as an investor, with the asset-dependent fees, you have no way of knowing what you’re paying. And the reality of fund accounting is that BlackRock is waiving fees-voluntarily, per the prospectus-that exceed a certain threshold. That waiver, in the case of EEM, expires in 2014, and history would suggest that once a cap is in place, it tends to stay in place.

It’s worth noting, of course, that iShares is not alone in any of this:Fees at many issuers are asset-dependent, and the expense-cap game is commonplace.

Vanguard, for instance, runs its funds at cost and regularly adjusts fees both up and down to account for asset growth or shrinkage.

Between A Rock And A Hard Place

On the surface, the reason for the iShares change in expense-ratio reporting was to increase clarity for investors-something many were quick to congratulate iShares for.

I think that’s great that they put a more nuanced expense ratio up on their website, said Dave Nadig, director of research at IndexUniverse. My initial take is we should applaud them for it; it’s transparency.

iShares was caught between a rock and a hard place.

On one side, it faced a regulatory requirement that says an issuer has to publish the same expense ratio for an ETF in its marketing materials as it has in its most up-to-date prospectus.

To remain compliant, iShares would have to report that the published expense ratios on 40 of its funds were higher than in the previous prospectus-a PR disaster, no doubt, at a time of downward pressure on expense ratios.

On the flip side, the firm grappled with the reality that these higher price tags were in fact no longer accurate. Because issuers have up to 120 days to update prospectuses after the end of the fiscal year-and we are told most issuers wait until the very last day to do so-many of the iShares funds in question had gathered enough assets to see those ratios drop in the last three months of 2012. Got it?

The result was this unprecedented approach-the listing of two expense ratios-as iShares looked to sweep up a public relations challenge it didn’t fully anticipate.

In defense of iShares, it all comes back to the fact that the prospectus is a snapshot in time, and the firm is trying to minimize the impact of a potentially misleading fund cost figure in an annual document.

They’re not real-time documents, said Kathleen Moriarty, a partner at Katten Muchin Rosenman LLP in New York, said about fund prospectuses.

It might be reflective of the price on the day you buy it, and it might not, Moriarty said, who helped write the prospectus on the first U.S.-listed exchange-traded fund, the SPDR S&P 500 ETF (NYSEArca:SPY).

It’s not clear whether iShares sought or obtained approval from regulators to add a second snapshot of fund expense ratios on its 105 ETFs that are structured with expense ratios that change as a function of fund assets.

An official at the Financial Industry Regulatory Authority declined to talk about company-specific regulatory matters, and it wasn’t immediately clear from iShares officials whether there were conversations between its compliance department and FINRA.

What is clear is that by including the 0.69 percent figure on the website, iShares has remained in compliance by explicitly acknowledging the legally binding characteristics of a fund’s prospectus.

To Each His Own

While iShares isn’t alone in its math, that doesn’t mean other companies will follow iShares’ lead just yet in breaking out multiple, time-period-dependent, expense ratios.

As an example, Vanguard just cut the expense ratio on its Vanguard FTSE Emerging Markets ETF (NYSEArca:VWO) by 10 percent to 0.18 percent based on a 23 percent increase in assets in the 12 months ended Oct. 31, 2012.

The fund’s assets have climbed another 7 percent since then, so that means the fee is indeed lower than 18 basis points, but Vanguard has no plans to break out that more-current fee.

While the continued asset growth of VWO will likely result in additional savings, Vanguard will continue to report the fiscal year expense ratio figure, as is industry standard, so that investors may make apples-to-apples comparisons with peer ETFs, Vanguard Head of Public Relations John Woerth said.

For the record, all of Vanguard’s funds have expense ratios that rise and fall in line with changes in assets-and expenses-and iShares, as noted, does so on 105 of its 280 funds.

For its part, State Street Global Advisors, the No. 2 U.S. ETF company by assets, only uses this fee structure on its sector funds. On the rest, it employs a so-called unitary fee structure under which the expense ratio is set by the fund board and doesn’t change until the board decides to.

Blame The Fee Wars

You might ask, as you take in the differences in price that iShares is parsing with its new double-expense ratio disclosure, What is a basis point or 2 worth at the end of the day?

From an investor perspective, 1 basis point is $1 in annual fees for each $10,000 invested.

While regulators are quick to point out that small numbers can lead to big differences in returns over time, many others in the money management industry aren’t impressed by such small distinctions.

To me it just seems like a tempest in a teapot, Moriarty said, adding she doubts regulators would pay too much attention to how a company reports its fees if the differences from what’s in the prospectus are so small.

Rick Ferri, president of Michigan-based registered investment advisor Portfolio Solutions, goes one step deeper in his analysis, linking the undue focus on iShares’ initiative to a fee war that has been sweeping through the ETF industry for the past few years.

This wouldn’t even be a story if it weren’t for all the focus on fees in the past year,’ Ferri told IndexUniverse.

But investors and industry sources may agree to disagree.

Even small differences in fees can translate into large differences in returns over time, the Securities and Exchange Commission warned on public documents on 40-Act fund fee regulations.

And from iShares’ perspective, 1 basis point in fees on a $50 billion ETF like EEM is worth $5 million in annual revenue.

And that certainly sounds important-whether that’s added to or subtracted from the world’s biggest ETF company’s top-line revenue.

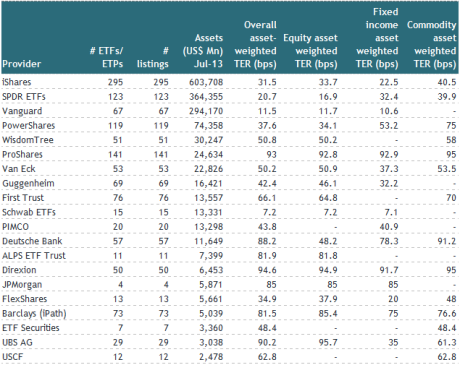

Don’t forget to check IndexUniverse.com’s ETF Data section.