Managing Interest Rate Risk In An IncomeOriented Investment Portfolio (Part 2)

Post on: 24 Апрель, 2015 No Comment

Income-oriented investors face many challenges in our current environment of generational-low interest rates. Some have taken either credit risk, liquidity risk or maturity risk in order to help offset the reduction in yields, and many have substituted bond-like equities for portions of their fixed-income portfolios. The stock markets around the world are in the rally mode, perhaps signaling economic improvement in the future at the same time as Fed Chairman Ben Bernanke is pouring gasoline on the fire potentially with QE3.

Interest rates won’t always be this low, and the recent actions to jump-start our sluggish economy may work, or, more likely, create fears of inflation should they appear to be working. As interest rates normalize, many income-oriented securities face potential price declines, some more than others. In this first part of this series. I discussed how rising interest rates could impact various parts of the bond market. In Part 2, I consider income-producing equities.

Like bonds, stocks can be impacted very differently by changes in interest rates. Before I dive into various types of stocks, I want to generalize. The more like a bond the stock is, the more likely it is to perform poorly if rates rise. Stocks don’t have maturities (typically, as a few, like royalty trusts, for instance, do), so they can be considered more like very long maturity bonds than shorter ones. In part 1, the basic message was to shorten maturities, which isn’t really an option with stocks. There is, however, a safety valve for many stocks: the dividend can rise. So, the basic strategy to protect from the potential loss of principal is to focus on dividends that can rise.

Let’s take a quick look at the math. Assume a stock trades at $10 and has a $0.40 dividend or 4% yield. If Treasury rates were to rise by 1%, it’s not likely that the yield on many dividend-paying stocks would rise the same amount (because of the growth), but we will assume so in this example. If the stock were able to only maintain the dividend, then it would need to yield 5% (a price of $8). This would cause the stock to decline by 20%, which would actually be worse than the decline in the 30-year Treasury, which would decline approximately 18%.

Now, if the dividend were to grow by 10% to $0.44, the price decline would be substantially less, as the price at a 5% yield would be $8.80 (a 12% decline). Investors appreciate this feature, so the yield would likely not rise by the full 1%. Now, do keep in mind that this was just an example, but hopefully it illustrates how rising dividends offer protection against rising yields. The key, then, when looking at and within various sectors of the stock market, is to identify the potential for dividend growth. Secondarily, a really high dividend yield can cushion some of the price erosion as well. If a stock yields 9% and increases to 10%, the price decline would be 11% rather than 20% in the case of a stock going from 4% to 5%.

Clearly, one area of the stock market that has attracted fixed-income investors has been the dividend-growth stocks. In general, these stocks are likely to provide better performance than long-maturity bonds in the type of environment I envision ( a slightly better economy with slightly higher interest rates). A better economy should lead to higher earnings, perhaps supporting improved dividend growth. While these are among the lowest-yielding dividend stocks, strong balance sheets and low payout ratios combined with underlying growth can team up to offset the headwinds of rising interest rates.

Utilities, such as those in the Utilities Select SPDR ETF (NYSEARCA:XLU ), are perhaps the most bond-like, with a limited ability to grow the dividend due to substantial debt on the balance sheets and regulated rates. If you are going to invest in the sector but are concerned about the potential negative impact of rising rates, it might be worth considering lower-yielding stocks with higher growth rates. In general, though, the valuations are somewhat high in the sector, and it could be difficult to avoid capital losses.

REITs (NYSEARCA:IYR ) are an extremely diverse sector, with different types of assets that could provide a wide range of potential growth rates. If we experience inflation, the underlying assets would typically increase in value, especially where rents are able to rise. When investing in specific REITs, this is one factor you can investigate further by reading SEC filings. One issue that concerns me about the sector is that much of the growth in recent years for many REITs has been a function of their ability to borrow at low rates. As rates rise, borrowing costs could increase. Additionally, while short-rates are less likely to increase than longer rates, many REITs (and other companies) have substantial exposure to short-term borrowing rates (either directly or through interest rate swaps).

Like REITs, MLPs could have varied responses to rising rates, as the growth rates differ greatly. Again, one can mitigate the risk by investing in MLPs with higher distribution growth. Like the REITs, though, higher cost of borrowing could constrain that growth. While the connection between the price of oil and the performance of MLPs isn’t necessarily tight from an economic perspective, the two tend to be highly correlated. If we are moving to a reflationary or potentially inflationary environment, this correlation could prove beneficial to investors in MLPs.

One area of the market that could fare well are the Business Development Companies (NYSEARCA:BDCS ). For those not familiar, these are companies with regulatory restrictions limiting debt levels that provide primarily debt financing to smaller companies. If you are interested, I shared my positive views on the sector in late 2011. Many have performed quite well subsequently, and I would be very cautious paying a premium of more than 10% to NAV. While I haven’t evaluated all of the BDCs for their interest-rate exposure, I do recall that Fifth Street Finance (NASDAQ:FSC ) is purposefully converting its investments (loans) from fixed to floating, funded by low-cost fixed-rate long-term debt.

So, certain sectors in general are likely to fare better than others, based primarily on their ability to raise dividends to offset likely required higher dividend yields. Even within the various sectors, growth differences can vary greatly. Like high-yield bonds, very high dividend yields can provide some cushion from price declines. If the economy is improving, the improved earnings can increase the likelihood of a dividend increase. A final consideration is that growth drivers may be changing. In recent years, the ability to lower borrowing costs has dropped to the bottom-line for many companies. Similarly, some commodities have been under pressure lately, restraining dividend growth for many companies. Future growth could look very different from past growth — make sure you understand how sensitive cash flows of the companies are to interest rates and commodity costs. A great type of stock for this environment would be debt-free or, perhaps even better, sitting on a wad of cash that it just raised by issuing very inexpensive debt (to the borrower) and whose cash flows can benefit from inflation.

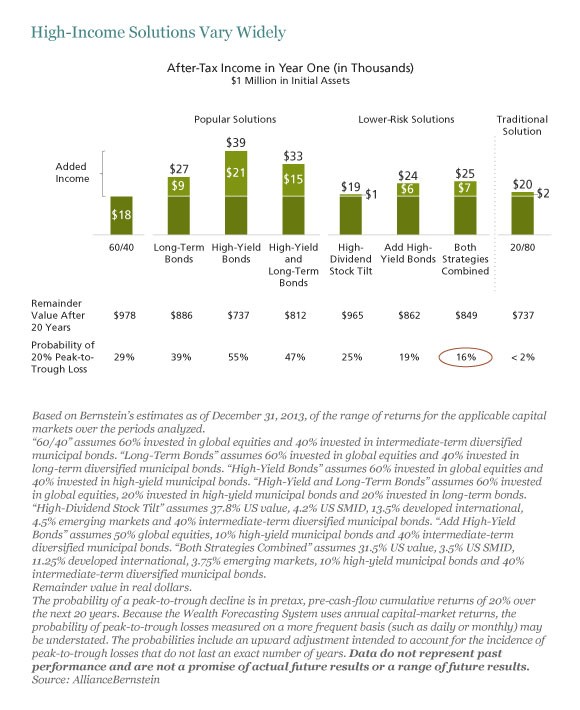

The strategies that I shared for minimizing interest rate risk generally have a cost: reduced income. Less risk usually does entail less reward. Many investors have been reaching for yield in equities, so perhaps this isn’t such a bad idea in any event. The real trade is likely reducing long-dated fixed-income exposure and increasing equity exposure (like dividend growth stocks) as well as taking credit-risk or less interest rate risk with shorter maturities, with the goal of setting up the portfolio for higher future income from dividend growth on the equity side. This is a barbell approach that works because equity valuations are extremely attractive relative to Treasuries.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.