Managed Funds

Post on: 19 Июль, 2015 No Comment

Mutual Funds and Managed Accounts

There are several types of mutual funds and managed accounts that we typically recommend or use. They are used to enter various market niches and build a portfolio for a client. We do not earn any fees or commissions when we recommend these products. We seek out the highest quality and lowest cost managers. The following attempts to define the various products. There are additional links at the bottom of this page for more information. Also, there is a separate section on ETF’s and unmanaged indexes which should also be studied. The basic concepts of both managed and un-managed indexes should be understood.

Managed Open End Funds

- Open end funds are listed in the mutual fund section of the newspaper.

- Vanguard, Fidelity, T.Rowe Price are examples of open end funds.

- The share price is calculated at the end of the day.

- The fund issues new shares when a client purchases the fund and buys back shares when the fund shares are redeemed. This means that investors do not affect the price of the share (or Net Asset Value NAV).

- The fund shares trade at the end of the day: If you buy or sell at 10:00 am you get the 4:00 price at the closed of that day.

- Although by reading the prospectus and annual reports you have a pretty good idea about what the fund does and what it owns, most funds do not disclose and are not required to disclose to you exactly what they own on any given day.

- Funds can have sales charges associated with them and are usually designated as A,B or C shares.

- Funds can be “no load” and have no sales fees associated with them – see below.

Managed Closed End Funds:

- Closed end funds trade like stocks on various exchanges.

- There are two values to be concerned about:

- The actual value of the fund or Net Asset Value N.A.V.

- The trading price of the fund as determined by the market.

Wrap Accounts — Managed and Self Directed

The wrap account is not really a mutual fund. It is simply a brokerage account where securities could be bought and sold under one flat fee wrapper. There are two main types of wrap accounts.

Self Directed Wrap Programs: Unlimited trading for a flat fee or percentage. For example a million dollars at .5% per year would be $5,000 per year. Typically there is access to a broker for some advice but the client makes the trades on the account picking when and what to buy and sell. Keep in mind that a typical trade through a discount brokerage firm would be about $10.00. So, $5,000 would be about 500 trades. An individual would have to make 500 trades to break even and factor in the value of the advice that he or she is getting from that firm.

Managed wrap accounts. These are much more like traditional mutual funds. They are managed in aggregate by a portfolio manager — much like a traditional mutual fund. Unlike a mutual fund, the individual investor owns the individual stocks in the portfolio. So, if a manager buys 10 thousand shares of IBM for “everyone” then one individual investors may personally own 89 shares. Since the investor actually owns the 89 shares, he or she will realize the tax consequence on the sale of those shares. The advantage of the managed account over the fund is that it offers more tax control over the individual sales of the securities held. They are, however, more expensive than traditional funds and these costs have to be weighed. As advisors, we have access to over 700 managed accounts through our discount broker. We are not actively using them; however, we will use them if there is a benefit to the client.

Caution on managed wrap accounts: If an account is a pension or an IRA, there is no tax benefit to taking possession of the individual securities in the wrap program. Also, if an investor with a few hundred thousand dollars puts all of his money into one or even two wrap programs under the IRA, it is very much like owning one or two mutual funds. This is because the prospectus of the wrap account, like a mutual fund, has specific parameters that it works within. These parameters define how the money is managed and the manager is limited to working within these parameters. It is the opinion of this advisor that greater diversification, greater liquidity, and a lower overall cost structure could be achieved by owning various funds or indexes that represent more markets and various management styles. If an account is large enough, however, it is possible that instead of using managed funds, employing multiple wrap accounts may have the benefit of lower costs and more control. Finally, most of the managers that run these separately managed accounts,(sometimes called SMA’s), also run mutual funds with similar characteristics so it is difficult to determine if the performance of these programs is superior to the mutual fund counterpart.

The Benefits of Managed Portfolios

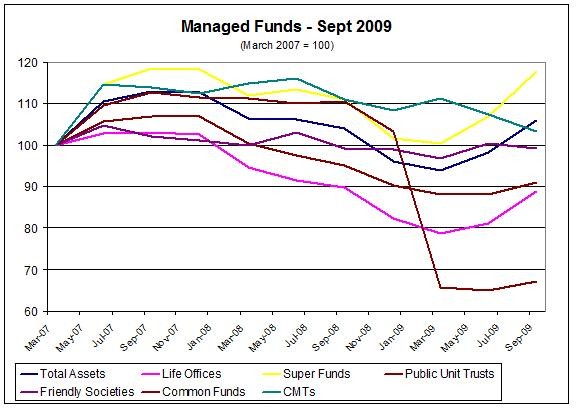

Years ago, investors that knew little about the stock market put money into a mutual fund for long term growth. Over the past 15 years, the mutual fund marketplace has changed dramatically. Mutual funds are used by both individuals and institutional investors to tap into a portfolio managers expertise in a particular market.

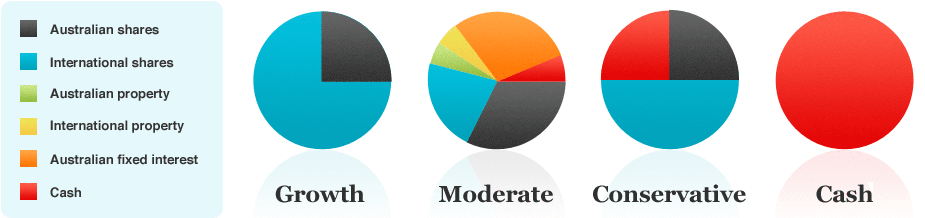

The fund simply allows us as an advisor to enter a unique marketplace instantly. We seek out the best managers to manage that segment of a client’s overall portfolio. We build a total portfolio by gaining exposure to various markets and asset classes. We look for relationships between those asset classes to create a lower risk portfolio that will generate solid returns over time.

Many people feel that they can drop money into a mutual fund and the fund will take care of their money for them. This is usually false. A mutual fund and/or a comparable wrap program, is not an overall money management program. It uses a very specific, well defined system of managing money and does not deviate from that system even if the current market environment will cause that market system to perform very poorly. The investor must understand the system that the fund is using and understand fully under what market conditions that portfolio will perform.

Think of a mutual fund as a machine that manages money in a very specific way. That machine will work best under certain market conditions. A great deal of the funds performance depends on the kind of market environment that exists while that machine is running. If a fund is not doing well, it may not be because the fund is bad, it may be because the market environment for that fund is bad. It is not the portfolio managers job to change the way he or she manages money simply because the market is changing. Their job is to do the best they can and buy securities in accordance to the parameters outlined in their prospectus and not deviate from those guidelines. The following are only a few specialized markets that can easily be entered using funds.

- Junk Bonds. Low quality bonds trade in a different marketplace and behave differently than traditional bonds.

- International: This would include owning broad markets such as Europe or specific countries like Japan, Australia or China etc.

- Small Cap Stocks. There are many levels of these stocks and they require a great deal of research and expertise.

- Market Sectors. Health, Energy, Airlines, Finance. etc: These are industries that offer great opportunities under the right conditions. A specialist that understands these industries can be a great asset.

There are many markets, management styles and philosophies. Rather than trying to be experts in specific stocks of one or a few of these sectors, we utilize the expertise of proven professionals and have the best money managers working for one client. As an advisor, our job is to concentrate on building a very solid and well diversified portfolio across markets, sectors and investments styles and structuring the risk of an overall portfolio by using various classes and sectors of the market.

We use managed funds and ETFs for our client portfolios. Of the 15,000 managed funds available, there are only a few that we actually use and we use the following guidelines:

- Eliminate A, B and C share funds. These are sales charge funds and are simply too expensive and illiquid.

- Evaluate the overall management fees of the funds and see if it is offering value for the fees charged: Fees eat into return so we look for low fee structures and true no loads.

- Evaluate performance. We compare performance with respect to their peers and their benchmark indexes. If we could do better just buying the index with very low expenses, we will do so. (See ETFs)

- Evaluate Management Styles: Compare those styles to other similar funds and their benchmark indexes or corresponding ETF.