Lumpsum investing vcost averaging

Post on: 16 Июль, 2015 No Comment

Vanguard analysis finds that lump-sum investing outperforms dollar-cost averaging two-thirds of the time

Share This Story

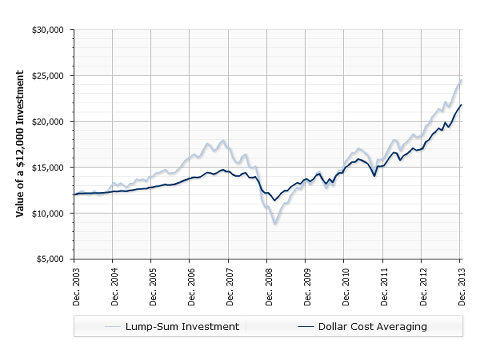

Lump-sum investing outperforms dollar-cost averaging two-thirds of the time, according to Vanguard, even when results are adjusted for the higher volatility of a stock/bond portfolio versus cash investments.

In its report, Dollar-cost averaging just means taking risk later, it explores the use of both investment approaches in the United States, United Kingdom and Australia. It used as its premise a gift of $20 million given to a foundation or a $1 million windfall to an individual and tried to show the pros and cons of investing those funds immediately or using dollar-cost averaging, which would invest those dollars in equal increments over time. During the time frame in which this report was written, stocks and bonds exceeded that of cash in all three markets.

The report concluded that if an investor expects such trends to continue and is satisfied with their target asset allocations and the risk/return characteristics of their strategy they should invest the lump sum immediately to gain exposure to the markets as soon as possible. If the investor is primarily concerned with minimizing downside risk and potential feelings of regret because they invested a lump sum just before a market downturn, then lump-sum investing is not the method for them.

The Vanguard report pointed out that when financial people discuss dollar-cost averaging, they are usually referring to the money employees transfer into retirement accounts on a monthly basis, making dollar-cost averaging a prudent way to invest. This report focused on strategies for investing an immediately available large sum of money.

Vanguard calculated the average magnitude of lump-sum investment outperformance by calculating the average ending values for a 60 percent/40 percent portfolio following rolling 10-year investment periods. In the United States, 12-month dollar-cost averaging led to an average ending portfolio value of $2,395,824, while lump-sum investing led to an average ending value of $2,450,264, or 2.3 percent more, the report found. The results in the UK and Australia were similar, with U.K. investors ending with 2.2 percent more and Australians ending with 1.3 percent more on average.

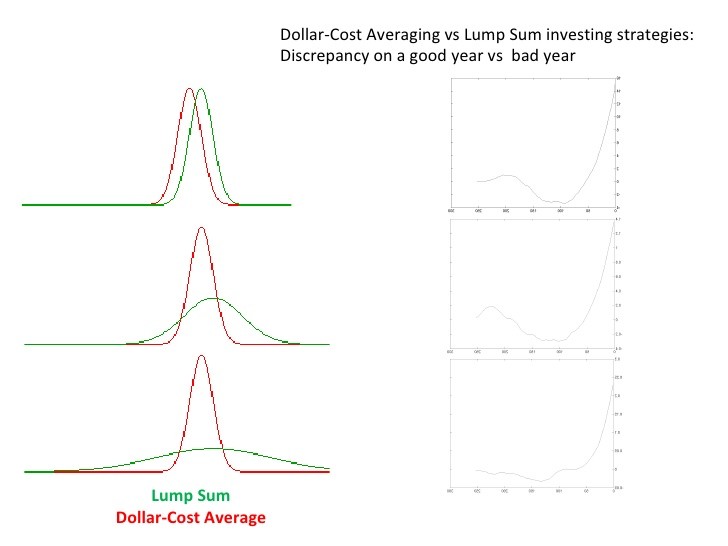

Even though LSIs average outperformance and risk-adjusted returns have been greater than those of DCA, risk-averse investors may be less concerned about averages than they are about worst-case scenarios, as well as the potential feelings of regret that would occur if a lump-sum investment were made immediately prior to a market decline, the report said.

These concerns are not unreasonable. Dollar-cost averaging performed better in market downturns so it could be the logical alternative for investors who prefer some short-term downside protection.

Out of 1,021 rolling 12-month investment periods in the U.S. analyzed for the Vanguard report, lump-sum investors would have seen their portfolios decline during 229 periods or 22.4 percent, while dollar-cost averaging investors would have seen such declines during only 180 periods or 17.6 percent. The average lost during those 229 lump-sum investing periods was $84,000 vs. only $56,947 in the 180 dollar-cost averaging periods, the report found.