LowVolatility ETFs

Post on: 3 Июль, 2015 No Comment

Asset Class ETFs News:

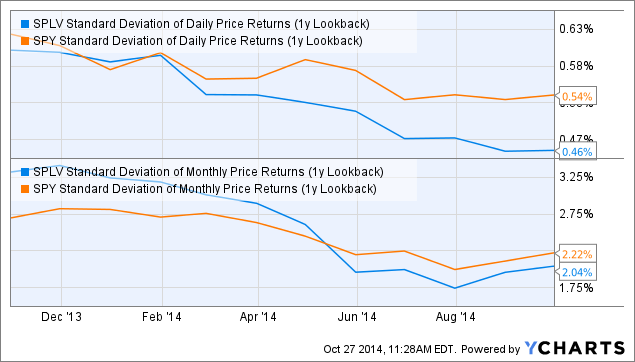

Low-volatility stocks and exchange traded funds appear to be the new safe havens for those investors who are risk-averse but still want some exposure to equities. Stocks that tout prices which have fluctuated the least in the past are attracting nervous investors during this time of uncertainty over the U.S. fiscal cliff and Europes debt logjam.

Why have low-volatility stocks posted such great risk-adjusted returns? The best explanation is leverage aversion. Investors who target above-market returns may be unwilling or unable to use leverage to reach their expected-return targets. By resorting to volatile stocks (more accurately high-beta stocks), which theoretically should outperform less-volatile stocks, they hope to earn above-average profits, ETF analyst Samuel Lee wrote for Morningstar. [Low-Volatility and Dividend ETFs for Yield ]

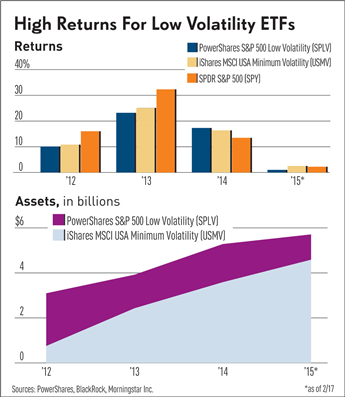

Low volatility strategies tend to underperform during a bull market, however, during times of market uncertainty, they can provide decent risk-adjusted returns. Low-volatility ETFs have garnered about $3.5 billion in 2012 through October, four times the amount they drew in in 2011, according to Morningstar data. The majority of assets invested in this style are concentrated in just a handful of funds. The biggest ETF in the group, the PowerShares S&P 500 Low Volatility ETF (NYSEArca:SPLV ). has $2.7 billion in assets since its May 2011 launch and accounts for almost 60% of the $4.8 billion invested in the entire category, reports Jonnelle Marte for MarketWatch. [Low-Volatility ETFs Help Limit Downside Risk ]

Low-volatility stocks have also become the next safe harbor as investors move out of bonds. As the bond market has provided little to no yield, investors are beginning to realize that boring stocks with above-average dividends may be the answer.

However, low-volatility strategies are not a guarantee that losses will not occur. Furthermore, low-volatility stocks are usually ignored by big institutional investors due to their lag in a bull market. Recent research shows that over the long run, a portfolio of less-volatile stocks can actually beat a portfolio of riskier stocks — a contradiction of the theory that high returns require high risk. [Low-Volatility ETFs Vs. Dividend ETFs ]

Other low-volatility ETFs:

- iShares MSCI USA Minimum Volatility Index Fund (NYSEArca:USMV )

- iShares MSCI All Country World Minimum Volatility Index Fund (NYSEArca:ACWV )

- iShares MSCI EAFE Minimum Volatility Index Fund (NYSEArca:EFAV )

PowerShares S&P 500 Low Volatility ETF

Tisha Guerrero contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.