London Interbank Offered Rate (LIBOR) Definition

Post on: 16 Март, 2015 No Comment

DEFINITION of ‘LIBOR’

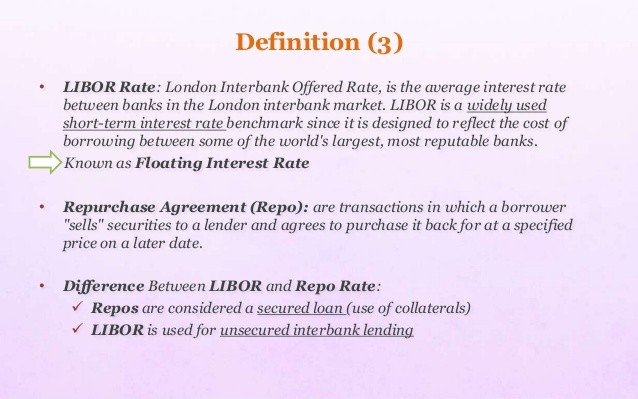

LIBOR or ICE LIBOR (previously BBA LIBOR) is a benchmark rate that some of the world’s leading banks charge each other for short-term loans. It stands for IntercontinentalExchange London Interbank Offered Rate and serves as the first step to calculating interest rates on various loans throughout the world. LIBOR is administered by the ICE Benchmark Administration (IBA), and is based on five currencies: U.S. dollar (USD), Euro (EUR), pound sterling (GBP), Japanese yen (JPY) and Swiss franc (CHF), and serves seven different maturities: overnight, one week, and 1, 2, 3, 6 and 12 months. There are a total of 35 different LIBOR rates each business day. The most commonly quoted rate is the three-month U.S. dollar rate.

INVESTOPEDIA EXPLAINS ‘LIBOR’

LIBOR (or ICE LIBOR) is the world’s most widely-used benchmark for short-term interest rates. It serves as the primary indicator for the average rate at which banks that contribute to the determination of LIBOR may obtain short-term loans in the London interbank market. Currently there are 11 to 18 contributor banks for five major currencies (US$, EUR, GBP. JPY. CHF ), giving rates for seven different maturities. A total of 35 rates are posted every business day (number of currencies x number of different maturities) with the 3-month U.S. dollar rate being the most common one (usually referred to as the “current LIBOR rate”).

LIBOR or ICE LIBOR’s primary function is to serve as the benchmark reference rate for debt instruments, including government and corporate bonds, mortgages, student loans, credit cards; as well as derivatives such as currency and interest swaps, among many other financial products.

For example, take a Swiss franc-denominated Floating-Rate Note (or floater) that pays coupons based on LIBOR plus a margin of 35 basis points (0.35%) annually. In this case, the LIBOR rate used is the one-year LIBOR plus a 35 basis point spread. Every year, the coupon rate is reset in order to match the current Swiss franc one-year LIBOR, plus the predetermined spread.

If, for instance, the one-year LIBOR is 4% at the beginning of the year, the bond will pay 4.35% of its par value at the end of the year. The spread usually increases or decreases depending on the credit worthiness of the institution issuing debt.

Another prominent trait of LIBOR or ICE LIBOR is that it helps to evaluate the current state of the world’s banking system as well as to set expectations for future central bank interest rates.

ICE LIBOR was previously known as BBA LIBOR until February 1. 2014, the date on which the ICE Benchmark Administration (IBA) took over the Administration of LIBOR.

To learn more about the basics of constructing LIBOR rates, go to the official ICE site .