Little Common About Preferred Stock

Post on: 2 Июль, 2015 No Comment

Part Stock, Part Bond

There’s something about the word preferred that puts a smile on your face. It conjures images of better treatment, faster service and lower rates. It’s the antithesis of the ordinary, everyday, common experience.

But is that the case if you’re an investor? Should preferred stock get preferential treatment in your equities portfolio?

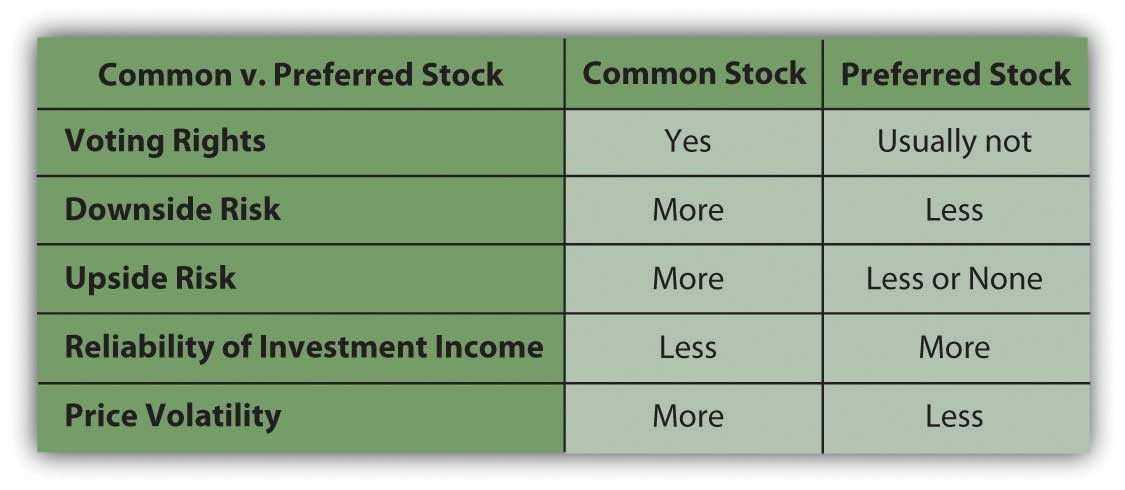

In some ways, preferred stock is similar to common stock. For example, both types give you an ownership stake in the issuing corporation and the right to share in its profits. And you can sell both preferred and common stock in the secondary market whenever you want to. But the differences between the two vehicles are more striking than their similarities.

Not in Common

Most preferred stock provides regular income in the form of a dividend, which must be paid before any dividends are paid on the corporation’s common stock. The dividend isn’t linked to the company’s profitability in the same way common stock dividends are, so the amount is usually fixed at issue and doesn’t increase or decrease later.

But in some cases, the corporation may issue participating preferred shares. In this case preferred shareholders receive an additional payment if the dividend on its common shares is more than the preferred dividend.

Equally important, if the corporation can’t pay preferred dividends on schedule, they usually accrue until the company is once again able to pay them. This isn’t the case with common stock dividends, which may be cut or eliminated if the issuing company is having financial problems or decides to use its profits in other ways.

When it comes to tax treatment, however, common stock has the advantage. That’s because common stock dividends are usually taxed at your long-term capital gains rate — a maximum of 15 percent. In contrast, most preferred stock dividends are taxed at your regular rate.

Unlike investors who own common stock, holders of preferred stock usually don’t have voting rights. In fact, one reason privately held corporations sometimes choose to raise capital with preferred rather than common stock is to avoid giving shareholders any say on matters of corporate governance.

A Hybrid Investment

Preferred shares are often described as hybrid investments, part equity and part debt security. Like a bond, the price of preferred stock in the secondary market is affected primarily by changing interest rates — dropping below the issue price if rates increase and rising if rates fall. In neither case is there much potential for long-term growth in value. But preferred stock prices can be more volatile than bond prices, which means they’re more vulnerable to short-term losses.

Like bonds, preferred stocks may be callable, which means the issuer can redeem them at any time after the date specified at the time of issue. Calls usually occur when interest rates drop, so if your preferred stock is called, your reinvestment alternatives may offer less income than you had been receiving. Also like bonds, some preferred stock is convertible, which means you can exchange your preferred shares for shares of the corporation’s common stock. The price at which the conversion can occur is also set at the time of issue.

Another bondlike characteristic of preferred stock that may be particularly attractive to certain investors is that in the case of bankruptcy, preferred stockholders have a greater claim on the corporation’s remaining assets than holders of common stock. This claim may not be worth very much in reality, though. When it comes to repayment, preferred stockholders must get in line behind owners of even the most junior bond the company has issued.

If you own a balanced mutual fund or certain equity income funds, you may own some preferred stock indirectly. Fund managers typically hold preferred stock because the average rate of return on this asset class is higher than the return on bonds — though it’s less than on common stock. But whether these stocks are appropriate for most individual investors’ portfolios is the subject of sometimes-heated debate.

As with any investment decision you make, the bottom line is whether the potential return on a specific security justifies the risks you take in owning it.