List of Stock Brokers in India A Comparison of Brokerage Charges

Post on: 18 Август, 2015 No Comment

Brief Introduction of Online Stock Market Trading

Stock Exchange

Stocks (Shares, equity) are traded in stock exchange. India has two big stock exchanges (Bombay Stock Exchange — BSE and National Stock Exchange — NSE) and few small exchanges like Jaipur Stock Exchange etc. Click here to see the list of Stock Exchanges in India

Investor can trade stocks in any of the stock exchange in India.

Stock Broker

Investor requires a Stock Broker to buy and sell shares in stock exchanges (BSE, NSE etc.). Stock Broker are registered member of stock exchange.

Only stock brokers can directly buy and sell shares in Stock Market. An investor must contact a stock broker to trade stocks on behalf of him. Broker charge commissions (brokerages) for their service. Brokerage is usually a percent of total amount of trade and varies from broker to broker. In recent days the idea of flat fee share broker is picking up. In flat fee stock trading, a fixed amount is charged (i.e. Rs 20 per trade) irrespective to the size of the order.

Online Stock Trading

Traditionally stock trading is done through stock brokers, personally or through telephones. As number of people trading in stock market increase enormously in last few years, some issues like location constrains, busy phone lines, miss communication etc start growing in stock broker offices. Information technology (Stock Market Software) helps stock brokers in solving these problems with Online Stock Trading.

Online Stock Market Trading is an internet based stock trading facility. Investor can trade shares through a website without any manual intervention from Stock Broker.

In this case these Online Stock Trading companies are stock broker for the investor. They are registered with one or more Stock Exchanges. Mostly Online Trading Websites in India trades in BSE and NSE.

There are two different type of trading platforms available for online equity trading.

- Installable software based Stock Trading Terminals

These trading environment requires software to be installed on investors computer. These software are provided by the stock broker. These softwares require high speed internet connection. This kind of trading terminals are used by high volume intra day equity traders.

Advantages:

- Orders directly send to stock exchanges rather then stock broker. This makes order execution very fast.

- It provides almost each and every information which is required to a trader on a single screen including stock market charts, live data, alerts, stock market news etc.

Disadvantages:

- Location constrain — You cannot trade if you are not on the computer where you have installed trading terminal software.

- It requires high speed internet connection.

- These trading terminals are not easily available for low volumn share traders.

These kind of trading environment doesn’t require any additional software installation. They are like other internet websites which investor can access from around the world through normal internet connection.

Below are few advantages and disadvantages of Online Stock Market Trading :-

Advantages of Online Stock Trading (Website based):

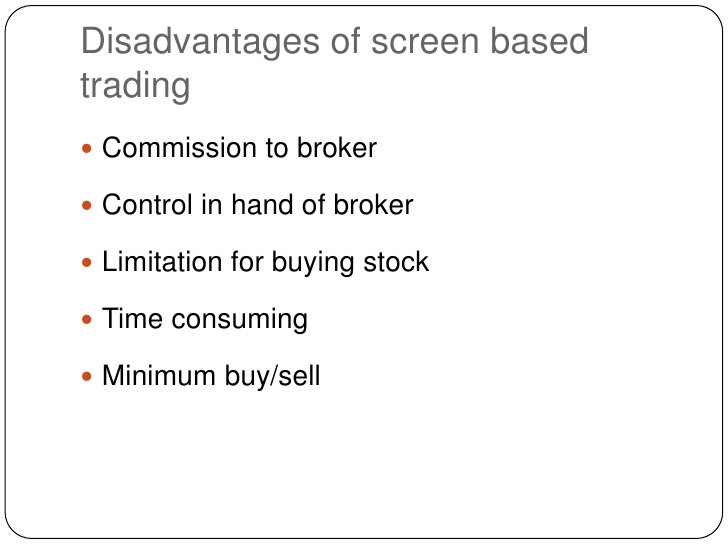

Disadvantages of Online Stock Trading (Website based):

- Website performance — sometime the website is too slow or not enough user friendly.

- Little long learning curve especially for people who doesn’t know much about computer and internet.

- Brokerages are little high.

Type of Brokers (by services they provide)

Brokers in India can be categories by the type of services they provide. There are two popular types of broker; full-service broker and discount broker. Both of them have their own pros and cons.

Full-service broker (Full Service Brokerage)

Full-service (Full-price) brokers are the traditional broker’s who offers almost kind of investment options and advisory to its customers.

This includes trading in stock (equity), Future & Options, commodities and currency derivatives, Investment in Mutual Funds, IPO’s, Fixed Deposits and Bonds, Life Insurance and General Insurance. They also provide Wealth Management and Investment Planning services to individual as well as corporate customers.

Full Service Brokers have their own research teams which helps the customer in their financial planning. They regularly publish newsletters like market watch where they provide research reports, stock tips and recommendations to their customers.

The service they offer comes at a cost. There services charges, fees and brokerages are higher from discount brokers. They charges brokerage based on a certain % of the trade value.

Most of the stock brokers in India are full-service brokers. Some popular names are ICICI Securities Pvt Ltd, HDFC Securities Ltd, Kotak Securities Ltd, HSBC Invest Direct Ltd and SBICAP Securities Ltd.

Discount Broker (Discount Brokerage)

An increasing popular discount broker’s provides less number of services but at a much cheaper price. They offer no-frill services and specialized into few investment options. Discount brokers are good for ‘do-it-yourself’ kind of investors.

While the services offered by them varies from broker to broker, many of the discount stock brokers do not provide services like stock research, investment in IPO’s, Mutual Funds, FD’s, Bonds and NCD’s. They generally do not have their own research teams and thus do not provide wealth management related services.

Discount Brokerage is a new concept in India and its picking up very quickly. There are two sub categories of discount brokers in India by the way they charge the brokerage:

Brokers charging Fixed Price per Trade

These are the brokers who charges ‘fixed price brokerage per trade’ irrespective to the size of trade. i.e. Zerodha. India’s first discount broker, charges Rs 20 per trade.

Brokers charging Fixed Monthly Fees for unlimited Trades

These are the brokers who charge ‘fixed monthly fees’ and offers unlimited trading in selected segments and exchanges. R K Global Shares & Securities Ltd and RKSV Securities Ltd are two popular brokers who provide unlimited brokerage services based fixed monthly rates.