Leveraged loans return % in November; YTD return is 8 8%

Post on: 18 Июнь, 2015 No Comment

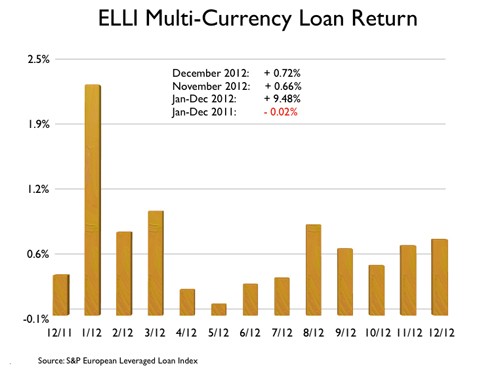

In November, secondary prices inched lower as accounts turned their gaze to the bulging new-issue calendar and as concerns arose regarding the fiscal cliff. As a result, the S&P/LSTA Index was limited to a 0.31% gain – comprised of 0.42% of accrued interest less 0.11% of diminished market value – little changed from October’s 0.32% figure. For the large names that comprise the S&P/LSTA Loan 100, market value fell more steeply, at 0.31%. The Loan 100, therefore, managed to eke out a modest 0.07% return during the month, up from 0.03% in October.

For the first 11 months of 2012, the S&P/LSTA Index is up 8.8% versus just 1.01% during same period in 2011 when the debt ceiling standoff and S&P’s downgrade of America’s credit rating briefly sent risk asset prices reeling. Despite lagging recently, the Loan 100 continues to outperform in the year-to-November at 9.32%, versus a loss of 0.08% during the comparable period last year.

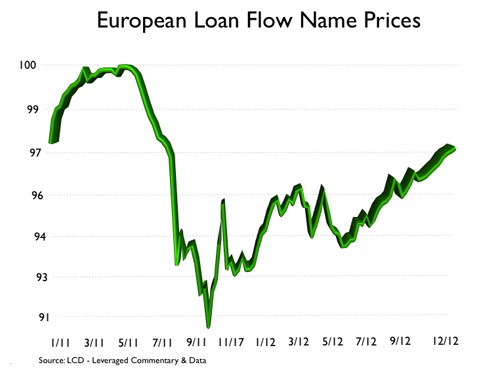

Getting back to November’s performance, prices moved within a narrow range. After starting fairly steady, loan prices weakened during the second week of November in sympathy with the stock market, which sold off after the election. During the second half of November, however, prices caught a bid. The reason was twofold. Certainly, recovering share prices – and improved investor sentiment that drove the increase – helped the cause.

Moreover, still robust technical conditions kept a floor under loan prices. As this chart suggests, the loan market’s supply/demand equation has reached a fragile equilibrium over the past two months as supply caught up to strong inflows.

On the demand side of the scales, CLOs again drove the bus. In November, 16 managers printed $8.3 billion of new vehicles, passing October’s short-lived mark of $6.9 billion as the biggest monthly total since 2007. Fun facts: (1) in 2006 when CLO issuance reached its zenith, issuance averaged $8 billion a month; and (2) by all accounts, volume will finish at a five-year high of $50 billion, give or take.

On the retail front, investors put $1.8 billion of net new money to work in loan funds in November – including the $320 million IPO of Ares Dynamic Credit Allocation Fund (ARDC) on Nov. 29 – according to EPFR, Lipper and Yahoo !Finance. That is the largest monthly haul since May 2011 and is up from $1.6 billion in October.

All of this new cash into market – along with what managers say is roughly $1.5-2.0 billion of institutional allocations into separate accounts – offset $26 billion of new institutional loans that broke to market in November, which, though down from October’s recent high of $42 billion, is nonetheless atop the year-to-date monthly average of $21 billion.

With tone still a bit “squishy” in the words on many participants, BB loans outperformed single B credit for the second straight month. Distressed and defaulted paper, however, continued to knock the cover off the ball as credit opportunity investors sought out wide-margin opportunity.

The pattern was also clear in the new-issue market where single B clearing yields gapped out 13 bps versus those of BB loans, which remain in high demand not just from institutional loan accounts but banks and cross-over investors.

Looking ahead, the picture is hazy. So much hinges on the outcome of the fiscal negotiations in Washington as well as any number of macro-factors (Europe’s debt situation and economic woes, tension in the Middle East, China ’s economic growth) that forecasting is even more difficult than usual.

If, indeed, the fiscal cliff issue eases, it doesn’t take Kreskin to divine a bullish case for 2013 where both supply and capital inflows are plentiful. If, however, there’s another fiscal showdown – or the dreaded plunge off the fiscal cliff – all bets are off.

Loans versus other asset classes

In November, amid mild volatility for risk assets and declining rates – with the 10-year Treasury yield easing 16 bps to 1.61% — loans underperformed 10-year Treasuries, HY and equities while leading investment-grade corporate bonds, which sagged a bit as arrangers unleashed $120 billion of new issue on the market, the largest total in recent memory.