Leveraged Buyout (LBO) Definition Example

Post on: 9 Июнь, 2015 No Comment

What it is:

A leveraged buyout (LBO) is a method of acquiring a company with money that is nearly all borrowed.

How it works/Example:

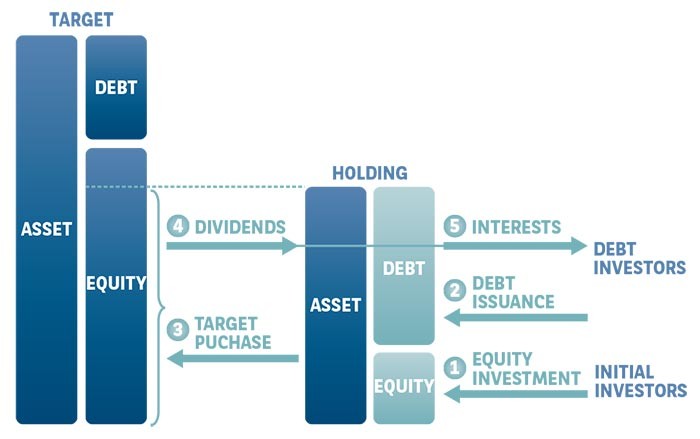

The basic idea behind an LBO is that the acquirer purchases the target with a loan collateralized by the target’s own assets. In hostile takeover situations, the use of the target’s assets to secure credit for the acquirer is one reason the LBO has a predatory reputation.

#-ad_banner-#Private equity firms often raise money specifically to conduct LBOs. These LBO funds are often hundreds of millions of dollars strong, which goes a long way considering that these acquirers will borrow most of the money they’ll need to purchase their targets. Many LBO funds are divisions of major banks like J.P. Morgan or divisions of private equity firms such as Carlyle Partners or Blackstone Capital Partners.

To conduct an LBO, the acquirer ensures that the target’s assets are adequate as collateral for the loan needed to purchase the target. The acquirer must also create and study financial forecasts of the combined entities to make sure that they generate enough cash to cover the principal and interest payments. In some cases, maintaining optimal cash flow could be a challenge if the target’s management team leaves after the acquisition .

Once the buyer has determined that the LBO is financially feasible, it works on acquiring enough cash for the acquisition by incurring debt. In some cases, the ensuing liability comes directly from one or more banks. In other cases, the acquirer issues bonds in the open market. Because the combined entity often has a high debt/equity ratio (near 90% debt, 10% equity ), the bonds are usually not investment grade (that is, they are junk bonds).

Doing an LBO is expensive and the process can be complex. When a particular deal is especially large, there is often more than one acquirer which allows for sharing of the risks, costs, and rewards of the deal. Often the acquirer must hire an intermediary to negotiate the emotional matters of severance, union contracts, reorganization plans, and other major post-acquisition issues with management, shareholders, and directors. In addition, the use of an investment bank. a law firm, and third-party consultants is often necessary to correctly structure the transaction.

Generally, acquirers sell or take their LBO targets public five or ten years after their purchase and make what are hopefully large profits, often 15% to 25% compounded annually. A sale doesn’t always mean the debt is paid off, however. The act of offering new shares to the public is frequently an attempt to obtain cash to pay down the debt to a feasible level (this is called a reverse LBO).

LBO activity usually increases when interest rates are low (which reduces the cost of borrowing) and/or when the economy or a particular industry is underperforming (and thus undervaluing the target firm ‘s equity). However, increased LBO activity also means more competition for deals, which tends to bid up the premiums paid for targets. Expensive acquisitions increase the debt needed to acquire targets and increase the risk that a newly combined entity won’t be able to support its larger debt obligations.