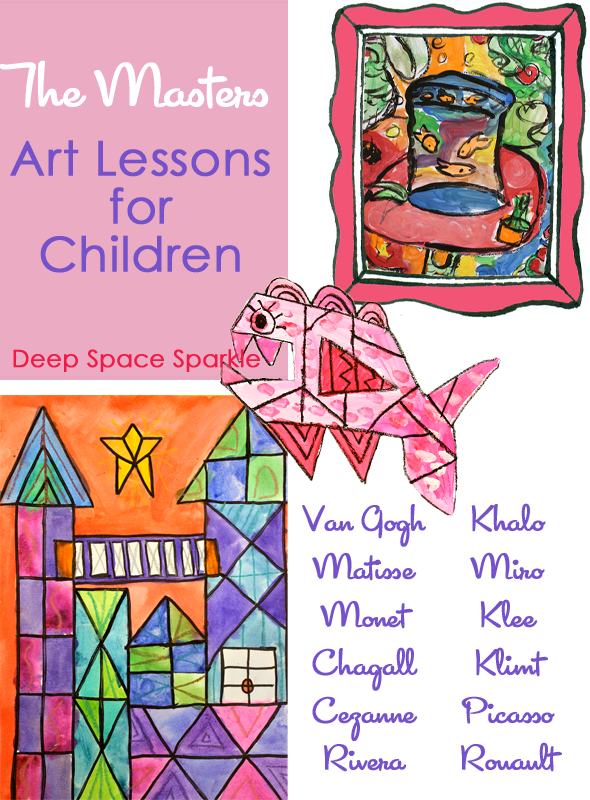

Lessons from Masters

Post on: 13 Июль, 2015 No Comment

Graham Formulas Modification for Indian Markets

I have certain thoughts on a couple of Graham formulas that are widely used by value investing folks, especially for the Indian markets. Please feel free to post your comments to correct my understanding.

a) Graham’s Formula

I have seen multiple investors use this formula quite blindly and call a stock undervalued/overvalued depending on whether the Graham price derived from this formula is greater than or lesser than the current market price. Graham published this formula in 1974 and took only US data. The formula per se states

Price = (EPS* (8.5+2*g)*4.4)/AAA rate

where,

EPS = TTM EPS for the past 12 months

8.5 = P/E multiple for a no-growth company

g = the company’s long term earnings growth estimate (5 years)

AAA rate = current prevailing AAA bond rate

4.4 = The average yield of high-grade corporate bonds in 1962.

For Indian markets, I guess we can use the formula as-is, but for the number 4.4. Why do you want to use 4.4 when the average yield of high grade corporate bonds in India is around 10-14% currently? I have no idea why people use 4.4 here. If you do, please let me know.

I will tell you my approach here when I use Graham’s number.

EPS = Average (median) EPS over the past 5 years (10 years, if data is available)

7 = P/E multiple for a no-growth company

g = 25% of the past 5 year CAGR (I am pessimistic that way, and I can’t predict future growth)

AAA rate = currently use 10%

12.5 = Avg. yield of high-grade corporate bonds currently

So, the modified formula would work out to

Price = (Avg. EPS * (7+1.5*(25% of 5 yr CAGR)) * 12.5)/10

What do you think of this approach? I have used the logic of Graham, but not the 4.4 multiple that Graham used. Does it lead to over-stating the Graham price?

This formula is also widely used, although in my experience in Indian markets, the resultant values are a bit on the higher side.

Price = Sqrt (22.5 * Book value * EPS)

Let’s not use this formula blindly. Let’s think about How did this formula come about. How did he arrive at the number of 22.5? etc.

Graham thought that nobody should be paying more than P/B = 1.5 and P/E = 15 for a stock. How did he arrive at the number ‘15’ for P/E? Well, he thought that nobody should be willing to pay more than the AAA bond yield at that time. AAA bond yield at that time was 7.5%. Therefore, AAA P/E will be 1/7.5

13.3, rounded up to 15.

So, Price/Book * Price/Earnings = 1.5*15

Price (squared) = 22.5 * Book value * Earnings

Price = Sqrt (22.5 * Book value * Earnings)

Now that we know how the formula was derived, let’s modify it to Indian standards.

Let’s not have P/B more than 1.25. Current AAA bond yield is 10%. Therefore, AAA P/E will be 1/10% = 10. That is we should not be willing to pay more than P/E = 10 for any stock. That modifies our formula to,

Price (squared) = 1.25*10*Book value * Earnings

Price = Sqrt (12.5* Book value * Earnings)

Again, for conservative calculations, I use average of the past 5 years (or 10 years) of data for Book value and Earnings.

The one grouse that I do have with this formula is that for commodity stocks, the Indian stock markets rarely value companies at more than 8-10 P/E. So, using this formula indiscriminately will lead to poor investments. Do look into company details, capital structure etc. before investing.

Some other investors screen their companies based on an interview by Graham in 1976 titled “The Simplest Way to Select Bargain Stocks” where he stated that

i) P/E should be not be more than 7x-10x

ii) Equity/Assets ratio > 0.5 (in other words, D/E < 1)

Again, P/E screener should be changed for the Indian scenario. Graham stated that the yield on stocks should be atleast 2 times the AAA bond yield (to compensate for the risk). Back then, the rates were 7%. So, the yield on stocks need to be 14%, which in turn means P/E not more than 7. If rates dip to 5%, then P/E not more than 10.

In the Indian scenario, AAA bond yield is 10%. Stock yield should be 2*10% = 20%; and therefore stock P/E should not be more than 1/20% = 5. So, for the Indian scenario, the rules change to

i) P/E should not be more than 5x-7x

ii) Equity/Assets ratio > 0.5

P.S: Of course, one of the biggest rule of Graham was diversification. He used these quantitative formulas on a portfolio of 30 stocks and invested in them. Some turned out to be multi-baggers and some duds, but as a portfolio beat the market. So, if you are trying to use these formulas for investing in one or two stocks, kindly do due diligence and use these formulas with discretion.