Lazy portfolios make asset allocation easy

Post on: 18 Май, 2015 No Comment

T he lazy portfolios are the blazing beacons of passive investing. Once you’ve absorbed all the advice and theory you can stand about risk, cost and diversification, you’re still left with one crucial question:

“What does a simple, low cost, diversified portfolio look like?”

And that’s where the lazy portfolios shine a light. They’re rough-and-ready model portfolios designed by some of the champions of passive investing . Think of the lazies as a show home – a useful source of ideas for building your own portfolio.

A lazy portfolio’s standout features are:

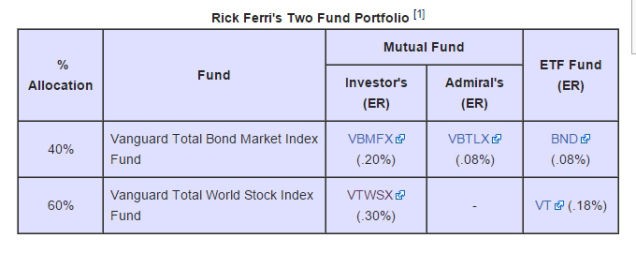

You only need a few funds to diversify across the key asset classes. This cuts costs and keeps the portfolio manageable.

You rebalance your funds occasionally, but otherwise leave them to make like an oak tree and grow. Novice investors can start with a very simple portfolio and add new funds from time to time, to further diversify.

Passive investors use cut-price index funds and Exchange Traded Funds (ETFs) to prevent high fund charges gobbling up their returns.

Every lazy portfolio sticks a hefty chunk into government bonds. The designers are drawing attention to the power of bonds to cushion your portfolio from equity market crashes. Your eventual allocation to bonds will depend on how much risk you can handle.

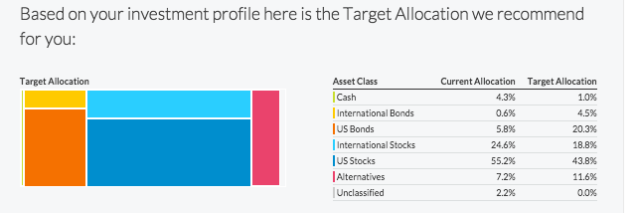

The lazy portfolios show there’s more than one way to cut the cake. Different portfolios suit different needs, mindsets and goals. But the truth is they will all put you in roughly the same ballpark. There’s no need to agonise over every percentage point split between asset classes .

You don’t need to pay for black box analytics to spit out some fully personalized mean variance optimised, risk-calibrated portfolio. You can just keep things simple and do it yourself.

Dirty Harry Vs Juliet Bravo

The lazy portfolios youll read about on the Internet and in books are mostly US orientated. But Monevator has converted them for UK readers using index funds and ETFs chosen from our market.

Cost rules our decision making. Every fund is selected on the basis that:

- It fits the original investment category.

- It’s generally the cheapest choice available by Ongoing Charge Figure (OCF) and any other upfront fund fees that apply. 1

Translator’s notes

Stars and Stripes flavoured lazy portfolios are skewed towards domestic equities. Historically, American investors have been heavily biased towards the home team, and that makes a certain sense given the size, dynamism, and diversity of their domestic market.

UK investors may want to allocate a greater percentage of their equity allocation internationally. given that UK plc only accounts for about 8% of global market cap and that the FTSE All-Share and FTSE 100 are more concentrated than US equivalents.

When it comes to bond funds, weve chosen to make our UK picks less diverse. The US portfolios tend to use a Total Bond Market fund, split about 70% into US Government bonds and 30% into Corporate bonds.

In the UK, Total Bond Market funds are as common as apologetic bankers, so I’ve chosen to use UK Government bond trackers instead.

Why? Well firstly, we’re dealing in lazy portfolios. Secondly, bonds are meant to provide you with some protection against equities being hammered when markets are stressed. Government bonds are less correlated with equities than corporate bonds, and so more likely to do the job.

US lazies often tilt towards value and small-value equity funds. Historical evidence suggests that investing in downtrodden companies of this kind can juice your returns – in exchange for an extra dose of risk, of course.

Yet again the UK market responds with a shrug of the shoulders. There are no corresponding value and small-value trackers over here. The closest proxies are high-yielding dividend funds. Value equities by their very nature tend to pay out a good yield, so many of them are scooped into dividend funds. It’s an ill-fitting suit at best, but it’s what weve got.

Finally, for some authentically British home-cooking weve rustled up a version of Tim Hale’s Home Bias Global Style Tilts 4 portfolio .

Tim Hale is the only British commentator I know of who stands comparison to the black belts of US passive investing. I’d recommend his book to any UK investor.

Okay, lets go!