Kroll Builds Bond Rating Firm With Lace Financial Acquisition Bloomberg Business

Post on: 7 Май, 2015 No Comment

Aug. 31 (Bloomberg) —Kroll Bond Ratings Inc. purchased Lace Financial, as the firm founded by former corporate investigator Jules Kroll ramps up its credit rating business.

The acquisition enables Kroll to issue rankings through Lace, which has Nationally Recognized Statistical Rating Organization status, a designation given by the Securities and Exchange Commission, according to Jerome Fons, executive vice president for strategy for the company.

Frederick, Maryland-based Lace Financial, which gained so-called NRSRO status 2008, has about a dozen employees that grade banks and other financial institutions, Fons said. A company needs to have issued bonds rankings for three years before applying for the status, Fons said.

Kroll, based in New York, plans to release its methodology for assessing residential mortgage-backed securities by the end of October, Fons said.

“This is where we’ve been building up capabilities. Plain vanilla, honest, solid securitization of RMBS should be coming back,” Fons said. “I think the market could come back if we were able to help establish trust in the origination and securitization process.”

The acquisition of Lace was reported earlier in the Wall Street Journal.

Regulatory Scrutiny

Jules Kroll, the chairman and chief executive officer of the newly-created rating company, founded Kroll Inc. a firm that provides investigative, intelligence and security services.

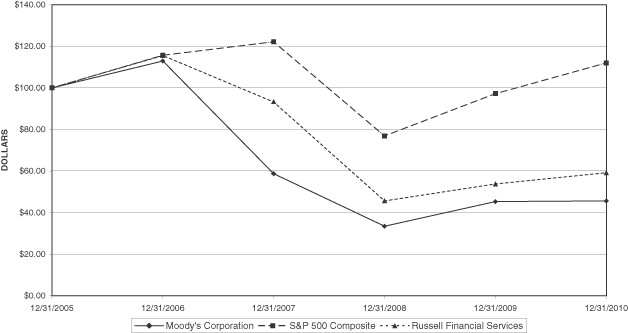

He’s seeking to compete against Moody’s Investors Service, Standard & Poor’s and Fitch Ratings after the three rating companies faced congressional and state-regulatory scrutiny for assigning top marks to U.S. subprime-mortgage bonds just before that market collapsed in 2007.

“There was a view that the top tranche had to be AAA rated,” Fons said. “It was a complete disaster for the industry.”

One alternative would be for mortgage-backed debt to be assigned a lower credit rating at the time it’s issued, and, if the deal performs well over time, the rating could move toward AAA, Fons said.

Fons was formerly a Moody’s executive who criticized credit graders to U.S. lawmakers.

To contact the reporters on this story: Christine Richard in New York at crichard5@bloomberg.net Matthew Leising in New York at mleising@bloomberg.net.

To contact the editor responsible for this story: Alan Goldstein at agoldstein5@bloomberg.net