Key benefits of municipal bond investments for your portfolio Market Realist

Post on: 21 Июль, 2015 No Comment

Why investors should consider municipal bonds despite Puerto Rico (Part 6 of 8)

Key benefits of municipal bond investments for your portfolio

Municipal bonds

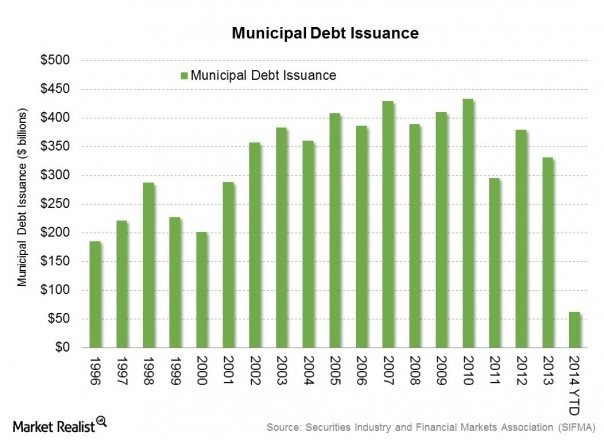

Municipal bonds (or munis) are issued by state and local governments and their agencies to fund capital expenditure on public projects (like highways, bridges, schools, or hospitals). In the last few articles of this series, we discussed some important variants of municipal bonds (RVNU ) and how investors can benefit from them. In this article, we’ll discuss some important investor benefits from municipal bonds (VRD ).

Advantages of exemption from federal tax

The chief advantage of investing in municipal bonds (VRD ) is that the interest income on most of them is exempt from federal income taxes and often state and local taxes as well. So the yield on munis (PVI ) trades at a discount to debt of similar credit quality and tenor. However, the investor’s tax bracket is crucial to deciding whether the muni represents a good investment, as this advantage becomes particularly relevant as the tax bracket of the investor increases.

What is the tax equivalent yield (or TEY)?

The TEY represents the minimum yield on other bond investments (LQD ) that must be earned in order for them to compare favorably with the tax-exempt yield offered on the muni bond. The TEY is computed as the muni bond divided by (1 – the investor’s tax rate). So the higher the investor’s tax rate, the higher the required TEY on other comparable bonds. For example, a muni bond yielding 4% will have a TEY of 5.7% for an investor in the 30% tax bracket and a TEY of 6.7% for an investor in the 40% tax bracket. This would imply that an equivalent bond investment would have to earn a minimum of 5.7% and 6.7% for investors in the 30% and 40% tax brackets, respectively, to be attractive compared to the muni bond (MUB ).

Lower default rates

Default rates on municipal bonds (RVNU ) have historically been lower than similar rated corporate bonds. In 2013, the default rate on the S&P High Yield Municipal Bond Index was 0.807 compared to 2.1% for U.S. Speculative Grade Corporate Bonds. However, readers should note that default rates can be higher for smaller, unrated muni issues and retail investors would do well to shy away from these. Municipal bonds (RVNU ) also often have other features such as bond insurance that protect investors from default risk.

In the next article of this series, we’ll discuss some of the major risks that can arise from investments in municipal bonds. Please read on to Part 7.