Kansas To Issue Pension Bonds To Meet Obligations

Post on: 16 Март, 2015 No Comment

Kansas is mooting a plan whereby the state government would take on debt and invest it in order to meet its pension obligations. The so-called pension bonds will be invested in order to produce an annual return that can be pumped into the pension pool for state workers.

Gov. Sam Brownback is advocating the idea, claiming that it would lower the states contribution to the Kansas Public Employees Retirement System. There are reasons to question that logic, and grounds for investors in the states bonds to be very worried about its financial future on the back of the plans.

Kansas bets on black

The plan is essentially the same as an individual investor loaning money to put in stocks. If you cant beat the interest rate you lose money directly. Yields on bonds maturing in ten years are currently trading at a yield of around 2.9%, meaning that the state would have to earn that and more in order to see this as a positive. Municipal bond yields are helped in part by their tax-free status, meaning investors are comfortable with lower yields.

Kansas predicts, according to its own math, that the bonds will pay a coupon of less than 5% over 30 years while the fund will reap a nominal return of 8% per year. The plan is to feed that additional cashflow into the pension system and reap the benefits on state expenditure.

The question is, if Kansas believes itself to be such a good investor why doesnt it put everything in its fund in order to become the richest state in the union? With a thirty year maturity on the debt and an expected average return of 8% over that period, its certain to find almost infinite investors, assuming the plan is credible. It could even charge them for the privilege.

Kansas credit rating has been downgraded in the last twelve months because of its pension obligations. The issuing of extra bonds to cover those obligations wont do the state any favors on the bond market, particularly when dealing with a significant budget shortfall. Kansas isnt the only state to issue bonds with this express purpose, Illinois did so multiple times in recent decades.

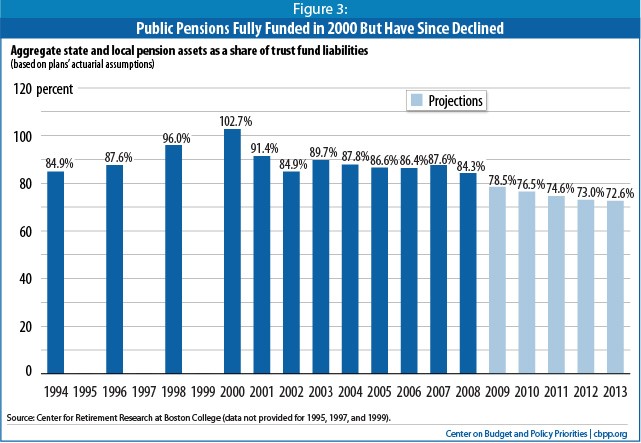

State governments fall in face of pension debt

Widescale federal intervention into state pension problems appears a long way off, particularly considering what happened in Detroit. Until some sort of realization program comes into place, states are going to try to find their own solutions, and leveraging low borrowing costs in order to invest is going to be a popular one.

The current trajectory is clear and worrying. States will eventually go bankrupt from their pension obligations, and theres nothing but substantial economic change or exceptional governance that will stop that from happening. Kansas is setting itself up as a hedge fund operating entirely on leverage in order to beat the system.

$105 billion pension-specific bonds have been issued since the mid 1980s. According to information gathered by the Wall Street Journal, they have returned approximately 1.5% as a group. Why Kansas thinks it can beat the street is difficult to glean from political polemics, but its clear that the government is willing to take massive risk in order to secure measly return.