Junk Bonds What Now

Post on: 15 Июнь, 2015 No Comment

The dramatic half-point interest rate cut by the Federal Reserve on Sept. 18 gave investors a boost, but the turmoil in the global credit markets is not over. How long will it last and how bad will it get? Martin Fridson, a junk-bond veteran and stock market historian who has had a courtside seat through several credit booms and busts over the past quarter-century, says this crunch has a long way to go. Fridson set up his own shop, FridsonVision, in 2002 after a long stint at Merrill Lynch (MER) as director of global high-yield strategy. Contributing economics editor Christopher Farrell asked him what he thinks is in store for junk bonds.

Is the credit crunch almost over, at least for junk bonds?

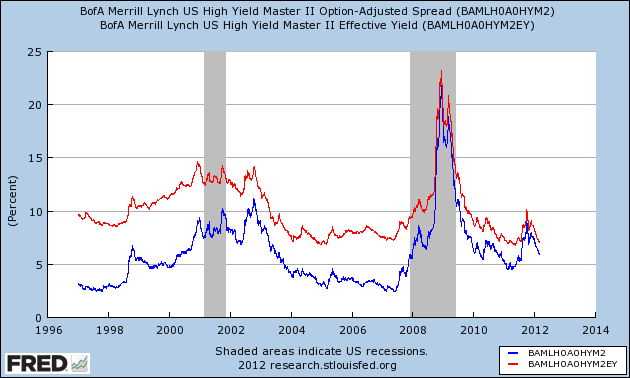

No way. There are real risks here, and an oversupply of debt from private equity deals will keep pressure on the market. We measure this market by comparing the interest rates on high-yield bonds to those on U.S. Treasury bonds with the same maturities. In June that difference was about 2.7 percentage points, and it rose all summer because buyers demanded higher yields as they became more concerned about risk. In early September the difference was 4.7 percentage points. That’s not an uncommonly high level. It will go higher.

Are more issuers defaulting on their bonds?

Right now only about 1.5% of high-yield bonds are in default, a low point for this credit cycle. But we see signs that will rise when we look at the number of issues that yield more than 10 percentage points above Treasuries, a sign the market fears those bonds will default. In the past two months that number has jumped from 23 to 80 issues. In the last credit cycle, defaults peaked at 11%, in the cycle before that, at around 13%.

Then why is there so much optimistic talk in the high-yield market?

People are entertaining new theories about why the world has changed and that valuations based on historic standards have to be thrown out. For instance, some say many companies have the option of meeting their payments with new debt rather than cash, in so-called covenant lite deals. Hedge funds with billions of dollars will bail out companies in trouble, too. The flaw in the logic will be apparent as more of these companies default.

Is this an opportune time for individual investors to be in junk bonds?

There may be a short-term trading opportunity here. For most investors, the opportunity will be better later on. At some point the payoff will be fabulous.

For those with longer time horizons, how can they find a junk-bond fund?

The key is finding a fund that has been constant. It’s easy to take big risks and become the best fund in any one year. What you want is a fund that won’t just be at the top during the great years but will do well over time. You can find funds consistently near the top at Morningstar (MORN).com or BusinessWeek.com.

Market historians note parallels to a 1907 credit crunch. Back then, financier J.P. Morgan calmed the waters just as the Fed is doing now. In 1908 the stock market soared. A hint of what’s to come?

In most cases booms started from a low point in stock valuations after credit was restored by the Federal Reserve, or earlier, by J.P. Morgan. We’re not there yet. But at some point the Fed will inject substantial liquidity into the system, and that could lead to a surge in stock prices.