Junk bonds in your portfolio Career

Post on: 15 Июнь, 2015 No Comment

The term junk bond may evoke thoughts in many investors, of toxic bonds or worst, investment scams in a portfolio. But don’t let the term fool you; these worthless-sounding investments can create high returns if considered on a calculated risk basis.

Not to discount the high risk associated with these securities, the truth is high risk usually delivers high returns. The masses of advisors say avoid junk bonds like the plague, and while there is some substance to that notion, here’s what you need to know about junk bonds.

Allow me to refresh your knowledge of bonds; it is a debt investment in which an investor lends money to an entity (corporate or governmental) that borrows the funds (principal) for a defined period of time (maturity) and repays at a fixed interest rate (coupons).

The rating of bonds is very important as it radiates the associated risk status of owning a specific bond, while evaluating the credit quality. The credit quality referred to focuses mainly on the ability of the bond issuers to repay. Think of a bond rating as the report card for a government or company’s credit rating.

There are two main bond categories based on credit quality: Investment Grade — issued by low to mediumrisk lenders and usually ranges from AAA to BBB (depending on Rating Agency) and unlikely to offer huge returns, therefore the risk of the borrowers defaulting on interest payments is much smaller. It is important to note that these rating agencies monitor and report the credit worthiness of bond issuers and of course assign a risk-rating profile.

On the other hand, junk bonds’ credit ratings are less than pristine, thus making it difficult for them to acquire capital at an inexpensive cost. They tend to bear a rating of ‘BB’ or lower by Standard & Poor’s, a leading Ratings Agency. Also, these bonds tend to pay a high yield to bondholders to firstly attract, and then compensate for the risk being undertaken.

So, technically, a junk bond is similar in form to a regular investment grade bond in that it is characterised as an instrument of indebtedness or simply an IOU I owe you from the issuer. The difference lies in their issuers’ credit quality, which is the bonds issuers’ ability to repay the debt. The truth is junk bonds pay high yields but carry a higher than average risk of default on the bond.

Junk bonds can further be broken down into two other categories.

The first is Fallen Angels — as the name suggests, this was once an investment grade bond that has since been reduced to junk-bond status because of the issuer’s deteriorating poor credit quality. An example would be Petrobras, which has been downgraded twice in 15 months by the major ratings agencies and is now one notch away from junk territory.

The second is Rising Stars — this is a bond with a rating that has been increased because of the issuer’s improving credit quality. A rising star may still be a junk bond that is on its way to being investment grade.

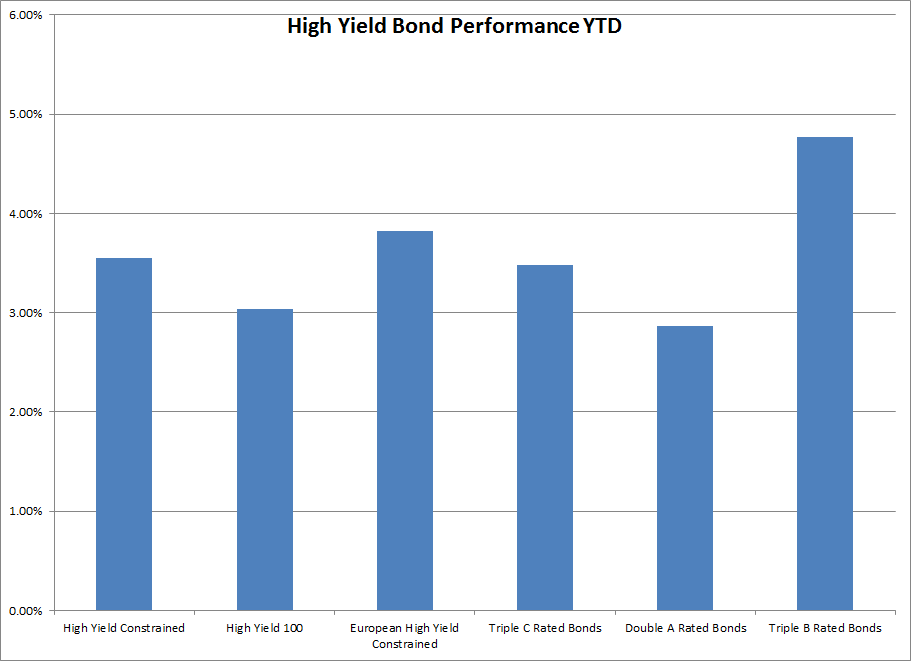

In these yield-challenged times, there’s no sin in seeking for an extra point or two in returns. It is easy to see why investors are tempted by the prospect of an increased rate of return on funds invested. Junk bonds tend to yield an average of more than five per cent, compared with just above three per cent for investment-grade corporate bonds.

If junk bonds are already in for your portfolio you need to know a few things. The obvious caveat is that junk bonds are high risk and if entire loss of the funds doesn’t keep you up at night then it would prove beneficial to hold and continue receiving coupons to offset losses in the value of the bond.

Secondly, if junk bonds aren’t in your portfolio, investing in them requires a high degree of analytical skills, particularly knowledge of specialised credit. It is imperative that the junk bond be reviewed by your financial advisor in any scenario.

This isn’t to say that junk-bond investing is strictly for the wealthy. For many individual investors, using a high yielding bond fund (such as a mutual fund) may provide a lane of entry for them in your portfolio. Not only do these funds allow you to take advantage of professionals who spend their entire day researching junk bonds, but these funds also lower your risk by diversifying your investments across different asset types.

It should be noted that junk bonds are not much different than equities in that they follow boom and bust cycles. Despite its name, junk bonds can be valuable investments for informed investors, but their potential high returns come with the potential for high risk.

Recently, Russia’s credit rating was downgraded to junk status for the first time in a decade due to the collapse in oil price, the tumbling value of its currency, the rouble, and sanctions imposed because of its intervention in Ukraine. Ratings agency Standard & Poor’s said the downgrade was caused by the country’s reduced flexibility to cut interest rates and a weakening of the financial system and that Russia faces increasingly difficult monetary policy decisions while also trying to support sustainable GDP growth. It added: These challenges result from the inflationary effects of exchange rate depreciation and sanctions from the West as well as counter-sanctions imposed by Russia.

In light of this, Russian Sovereign and Corporate Bonds have been drastically reduced in price; and thus present the million-dollar question: Does this present a buying or holding opportunity? Again, keep in mind this high-risk investment is not for the faint of heart and your Financial Advisor must dissect the financials objectively, quantitatively and present risk versus rewards. Junk bonds are not for the casual investor. A smart purchase requires careful planning and familiarity with market fluctuations. Even then junk bonds pose a high risk and full understanding that unless you have substantial quantitative reasons to believe your purchase promises a safety of principal, you are ultimately speculating, not investing.

Moscow, Russia People walk past a money exchange office with a sign showing currency exchange rates in Moscow, Tuesday, January 20, 2015. The Russian currency has lost half of its value in one year under a combined blow of slumping oil prices and Western sanctions over Ukraine. (PHOTO: AP)