Junk Bond Bubble Myth v

Post on: 18 Август, 2015 No Comment

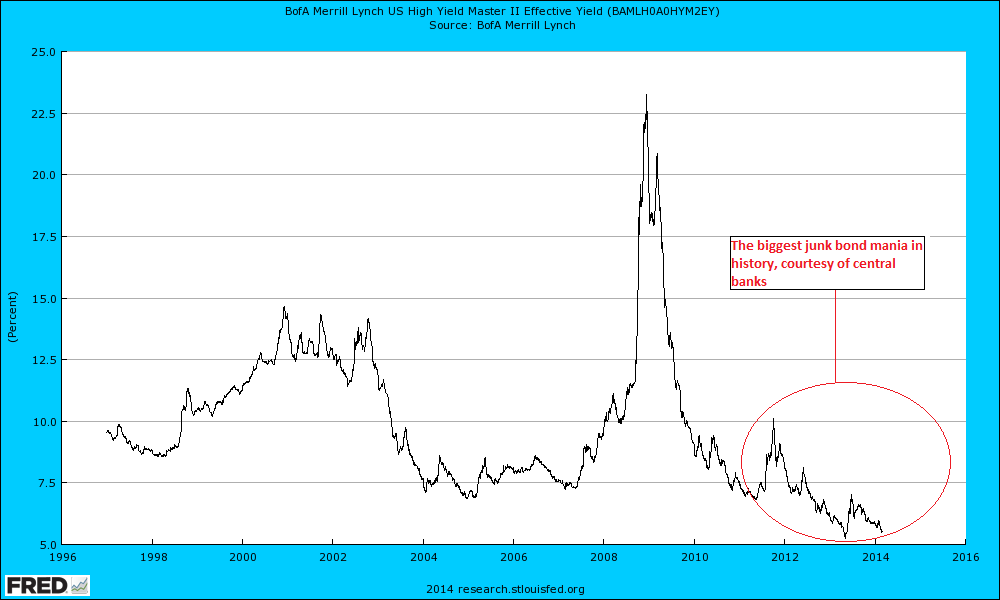

I am sure the numbers being reported regarding individual investors rushing into high yield bond funds are true. However, I am not sure the correct facts are being circulated. The main narrative that has been reported everywhere from Barrons to the Financial Times is that net inflows into junk bond mutual funds are at record highs. At the same time the reports say that the supply of new high yield bond issues in dollar terms has never been higher, and yields on junk bonds have never been lower. This leads to the conclusion that retail bond investors are causing a junk bond market bubble.

I think both narratives are incorrect, and I have not seen any stories that include what I believe are the most important facts.

Almost all the media coverage has the following chart, or similar stats regarding the inflows into high yield bond funds. The following chart is taken from the article “Junk bonds, bubbles and Goldilocks” written by one my favorite market commentators, Mick Weinstein (hey every now and then even the great one’s get it wrong).

The conclusion from this chart is inescapable. In 2012, investors have been pouring money into high-yield funds. OK, I accept that there has been a change in behavior. However, is the $63 Billion dollar number meaningful?

Are these investors holding a large portion of the of outstanding high yield debt or a small portion? Is the amount that they are buying enough to move prices dramatically? I have not seen these figures mentioned in any articles.

Here are the numbers that I was able to find:

Corporate Bonds Outstanding $8.1 Trillion (Second quarter 2012 SIFMA)

Estimated Split between Investment Grade and High Yield Data 80 /20 based on SIFMA New Issuance Data

Estimated Outstanding High Yield Corporate Bonds $1.6 Trillion

Should Less Than $0.1 Trillion in new demand for high yields bonds make a major difference in $1.6 Trillion dollar market?

Some would argue that its not the size of the overall market, but the balance between supply and demand. This is particularly true if existing high yield bondholders are reluctant sellers because they fear that they will not be able to get access to new issues in the future at a comparable price. In this case, we know that retail demand in 2012 is estimated to be around 63 billion, however, new high yield bond issues this year should be around about $250 Billion or about 20% higher than the previous year. While there is more new demand than new supply, the numbers don’t seem terribly out of balance.

My conclusion. “Mom and Pop” investors are not playing a lead role in driving high yield bond prices higher. Instead, I think they are actually taking advantage of high yield bonds being very attractive relative to investment grade bonds. This topic is covered in the article, “Junk Bonds Are A Screaming Buy .”