JPMorgan Launches the Corporate Emerging Markets Bond Index CEMBI

Post on: 9 Апрель, 2015 No Comment

The Global Corporate Benchmark is the Latest Addition To JPMorgan s Family of Fixed Income Indices

November 08, 2007 01:50 PM Eastern Standard Time

NEW YORK—( BUSINESS WIRE )—JPMorgan today announced the introduction of its Corporate Emerging Markets Bond Index (CEMBI), a global, liquid corporate emerging markets benchmark that tracks U.S.-denominated corporate bonds issued by emerging markets entities. The CEMBI is the first in a series of corporate emerging markets indices JPMorgan plans to introduce.

Today s launch also includes the first hybrid index in the JPMorgan emerging markets fixed income family the CEMBI HYBRID, which integrates corporates and sovereigns. The CEMBI HYBRID will incorporate the newly created CEMBI and the widely used EMBI Global.

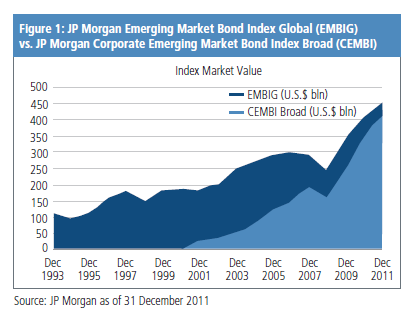

The corporate CEMBI is a liquid basket of emerging markets corporate issues which include approximately 80 bonds, representing 60 issuers and 16 countries (as of Oct 31, 2007). The CEMBI has strict liquidity criteria for inclusion in order to provide replicability, tradability, robust pricing and data integrity. The CEMBI BROAD, which JPMorgan plans to launch in coming months, will be more comprehensive and will include smaller issues to cover a wider array of corporate bonds. The minimum amount outstanding required will likely be $350mm for the CEMBI BROAD compared to $500 million for the replicable and tradable CEMBI. There will also be a diversified version for both series to provide a well-distributed, more balanced weightings for countries included in the index.

We created the CEMBI in response to the rapid increase of corporate issuance and the need for a diligently managed global corporate index . said Gloria M. Kim, head of JPMorgan s Global Bond Index Group. It continues a legacy of premier index products developed by JPMorgan and underscores the firm s dedication to developing emerging markets.

One key feature of the CEMBI is the liquidity of the underlying basket. The CEMBI will allow JPMorgan to provide a full range of tradeable products, starting with total return swaps and funded certificates. JPMorgan s market-making on the CEMBI will be a tool for investors to take directional views or implement relative value strategies in the emerging markets corporate space.

Annual external debt issuance from emerging market corporates has risen from $21 billion in 2002 to $115 billion in 2006 and has already exceeded $140 billion this year. This market is growing rapidly and generating significant interest from investors, both from traditional emerging market funds and from dedicated corporate credit investors that may be entering emerging markets for the first time, said Victoria Miles co-head of Emerging Markets Corporate Credit Research at JPMorgan.

This index will play a key role in the further development of the asset class, providing investors with an important tool for benchmarking and assessing relative value across global credit markets, concluded Warren Mar, co-head of Emerging Markets Corporate Credit Research at JPMorgan.

Daily historical index levels and statistics are available from December 31, 2001. Clients and investors can access index levels and statistics for the CEMBI on JPMorgan s client-only research website, www.morganmarkets.com and on Bloomberg page, < JPMX >.