Journal Entry for Temporary Investment Equity and Debt Securities

Post on: 1 Июнь, 2015 No Comment

It is very common for companies to invest their idle cash in a variety of investments. These temporary investments may be in a form of marketable equity or debt securities. This post will solely discuss journal entries for temporary investments. As always, I conclude some sets of case examples to make sure you can follow this easily .

Advertisement

Temporary Investments: Marketable Equity Securities

Temporary investments consist of marketable equity securities [preferred and common stock] and marketable debt securities [government and corporate bonds]. In order for an investment to be classified as temporary, it must meet both of the following conditions :

- Be readily marketable; and

- Be intended for conversion into cash within 1 year or the operating cycle [whichever is longer].

“Ready marketable ” means that the item can easily be sold. If the stock is not publicly held, there may exist only a limited market for its purchase, thus making it difficult to sell. If this is the case, condition 1 has not been met and the stock would not be classified as a temporary marketable security.

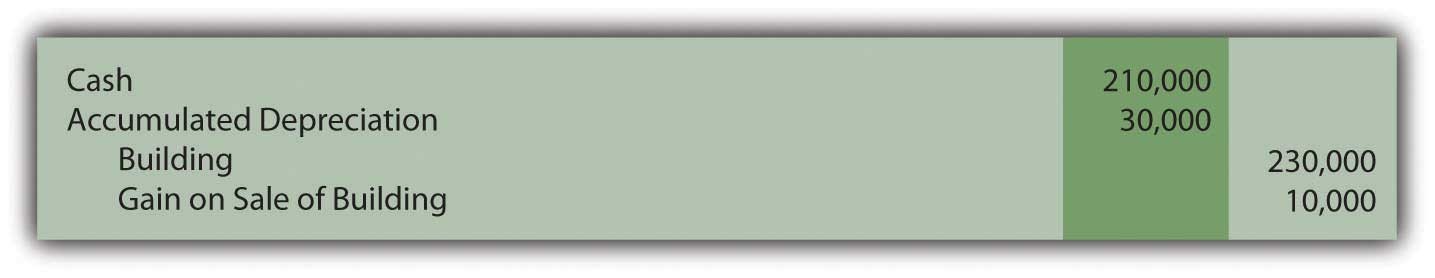

When marketable equity securities are purchased, an asset account should be debited for the purchase price plus any broker’s fee or taxes incurred in this transaction. Brokers’ fees and taxes are not expenses; they are an addition to the cost of the stock. When the stock is later sold, such fees are considered to be a reduction of the selling price. If the selling price is higher than the purchase price, the difference is a gain and it is credited to a gain account; if it is lower it is a loss and it is debited to a loss account.

A corporation buys 100 shares of IBM stock for a total price of $1,000 and pays a broker’s fee of $100. It later sells these shares for $2,000 and pays a broker’s fee of $200. Assume the shares meet both of the above-mentioned conditions.

The journal entries are :

[Debit]. Investment in Short-term Equity Securities = $1,100

[Credit ]. Cash = $1,100

and

[Debit]. Cash = $1,800*

[Credit]. Investment in Short-term Equity Securities = $1,100

[Credit]. Gain on Sale of Securities = $700

(Note: *$2,000. 200 = $ 1,800)

If in the previous example the selling price was $900 and the broker’s fee was $90, there would be a loss of $290 [($900. $90). $1, 100]. If dividends are received on short-term shares of stock, an entry is made debiting Cash and crediting Dividend Revenue .

Temporary Investments: Marketable Debt Securities

Marketable debt securities are investments in bonds and other debt instruments that meet the two conditions mentioned earlier, namely :

- They are readily marketable, and

- The intention is to sell them within 1 year or the operating cycle [whichever is longer]

If these securities are purchased above or below par, a discount or premium situation arises. The discount of premium should not be amortized since the intention is to hold the securities for only a short time period. Accordingly, the investment account is debited at the net amount paid, and no use is made of a discount or premium account.

A $100,000 bond is purchased as a short-term investment at 98 on January 1, 20A. The journal entry is :

[Debit]. Investment in Short-term Debt Securities = $98,000

[Credit]. Cash = $98,000

Notice that the investment account is debited at the net price of $98,000 and no discount account is used. The $2,000 reduction from par would not be amortized. Since debt securities pay interest, an entry must be made crediting Interest Revenue:

- If the interest has been received, then Cash is debited.

- If not, it must be accrued on December 31 by debiting Interest Receivable.

If in the previous example the bond paid interest of 10% annually and the payment date is December 31, 20A. the following journal entry would be made on that date :

[Debit]. Cash = $10,000

[Credit]. Interest Revenue = $10,000

If the interest payment date is not until the next day (January 1, 20B) then on December 31, 20A, an adjusting entry for the accrual would be made, as follows :

[Debit]. Interest Receivable = $10,000

[Credit]. Interest Revenue = $10,000

If a bond is purchased between interest dates, its price will be increased by the amount of accrued interest thus far. This increase should be debited to Interest Revenue since its effect is to reduce the amount of interest earned .

A short-term bond dated January 1, 20A, is purchased on April 1, 20A, at its par of $100,000. The interest rate is 10% and is payable on December 31. The accrued interest this far is $2,500 = $100,000 x 10% x 14. The selling price will therefore be $102,500.

At the time of purchase the journal entries are :

[Debit]. Investment in Short-term Debt Securities = $100,000

[Debit]. Interest Revenue = $2,500

[Credit]. Cash = $102,500

On December 31, the journal entry for the interest is :

[Debit]. Cash = $10,000

[Credit]. Interest Revenue = $10,000*