Jobs You Can Get with an Economics Degree

Post on: 12 Апрель, 2015 No Comment

If you are interested in a career in economics, then youll probably want to know the types of jobs you can get with an economics degree. As an economics major, youll have opportunities to work within various types of businesses. You may also choose to go on to law school, or pursue work with the government, non-profit organizations, or international companies. With a masters degree, youll also have the option to teach at a college or university.

Education

Most jobs in economics begin by having the right education requirements. Most employers require a degree in business or a degree in economics. In most cases, a bachelors is sufficient, but may top economist go on to get their masters degree.

Economics Salaries

According to the BLS, the 2010 median salary for economists was $89,450 per year, which equates to $43.00 per hour. Economist jobs didnt rank in Forbes list of top-paying majors for new college graduates. because you cant really get a high paying job in economics as a new graduate. Most of the jobs in economics take time to work into.

Some of the most popular employers and salaries of economists include:

- Scientific research and development services $109,720

- Federal executive branch 106,840

- Management, scientific, and technical consulting services 93,250

- Local government 69,950

- State government 61,620

Top Economics Jobs

Economists are some of the highest paying tech jobs in areas like Austin and San Fransisco. The highest paying economics jobs include those who work in scientific research and development services.

Economists Jobs

There are a variety of economist jobs working for banks, medical associations, petroleum companies, consumer credit companies, and universities. Companies you may work for include:

- Bank of America

- Wells Fargo

- Chase

- European Central Bank

- Shell

- Chevron

- ExxonMobil

- Equifax

- The United Nations

- American Veterinary Medical Association

Chief Economist

As a chief economist, youll likely need a PhD in economics with 10 or more years of work experience, preferably related to economic research. This position requires a lot of policy analysis, as well as public speaking for news casts and professional conferences. Chief economists bring economic considerations to bear on company policy, and assist in key decision making process by forecasting economic impact.

Deputy Chief Economist

The Deputy Chief Economist supports the role of Chief Economist by performing forecasts, trend analysis, and economic research. This job usually only requires a bachelors degree in economics. However, a masters or PhD is preferable.

Senior Economist

A senior economist, you will work closely with Managing Director in formulating short- and long-range strategic goals for the Economic Analysis (EA) Division and help define these goals for the Department and Agency as a whole.

Economic Affairs Officer

As an economic affairs officer, youll likely work as part of a government agency. An economic affairs officer is responsible for conducting research and analysis on trends and their potential impact on governments or business sectors.

Other Economics Jobs

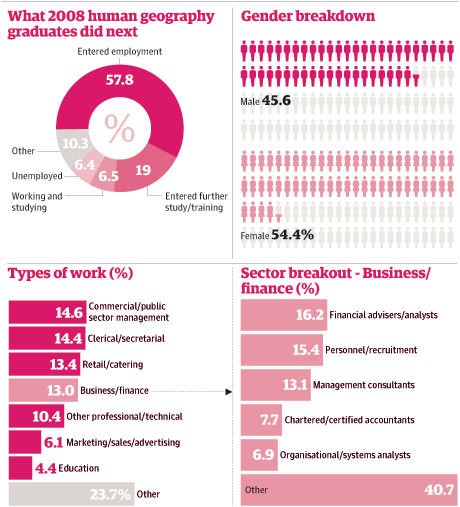

There are other jobs beyond economist. These include financial advisor, business analyst, and actuary.

Financial Advisors

If youre interested in becoming a financial advisor. youll want a degree in business, economics, or finance. If you want to become a manager, youll also want an MBA. As a financial advisor, youll be responsible for putting together comprehensive financial plans for individuals and families. This might include areas like insurance, investments, taxes, retirement, and estate planning.

Financial Analysts

It may be difficult to understand the difference between a financial analyst and a financial advisor. The jobs are very similar. However, a financial analyst researches current market trends, and uses various models to predict the opportune moment for investing, or selling investments, in order to maximize profits and minimize risk for an individual or company. If youre interested in becoming a financial analyst. youll need a major like computer science, math, business, economics or accounting.

Accountants

The distinction between a financial analyst vs accountant can also be a difficult one. When you become an accountant. youll be responsible for keeping accounting and financial records for individuals or business. There are lots of careers in accounting. which include:

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

- Accounts Payable Clerk

- Accounts Receivable Clerk

- Auditing Clerk

- Certified Internal Auditor

- Forensic Accountant

- Chief Financial Officer (CFO)

- Controller

Investment Advisors

Many people wonder what the difference between an investment advisor and a financial advisor. The distinction is not a small one. Investment advisors have fiduciary relationship with their clients, meaning that they must keep their best interests in mind when offering financial or investment advice.

Stock Brokers

Stock brokers fall into the area of Securities, Commodities, and Financial Services Sales Agents. The 2010 median salary for these careers was $70,190 per year. As a stock broker, youll offer advice on the purchase or sale of securities including stocks, bonds, and commodities.

Insurance Agents

Insurance agents dont really require a degree. However, having on in an area like economics, accounting, or finance is certainly helpful. As an insurance agent, youll offer various insurance policies and help clients choose the plans that best suit their needs. The 2010 median salary for insurance sales agents was $46,770 per year.

Personal Bankers

If youre interested in becoming a personal banker. then the knowledge that an economics degree offers will serve you well. As a personal banker, youll offer products and services to banking customers, meeting both personal and branch set goals. A huge part of being a personal banker is attracting and maintaining both new and current customer relations. According to the Bureau of Labor Statistics, personal bankers earning range anywhere from $12.76 to $25.72 in 2008.

Actuaries

Actuaries analyze risks and create policies to reduce the cost associated with risks. Many actuaries work for insurance companies, but many other businesses utilize them as well. The 2010 median salary for actuaries was $87,650 per year according to the BLS.