Japan’s bond market Quantitative freezing

Post on: 16 Март, 2015 No Comment

AS PART of its quest to end Japan’s 15-year-old deflationary torpor, the Bank of Japan is buying around 70% of all newly issued Japanese government bonds (JGBs). Whether this will boost inflation to the central bank’s target of 2% by the spring of next year remains uncertain: it is barely halfway there. But the vast scale of the purchases has certainly warped the world’s second-biggest sovereign-debt market in ways the Bank of Japan did not foresee.

The BoJ is buying ¥7 trillion ($67 billion) of JGBs a month. It now owns a fifth of the government’s outstanding debt. Trading volumes have fallen dramatically, as has volatility in prices. One day in April there was no trading at all in the most recent issue of the benchmark ten-year bond.

In this section

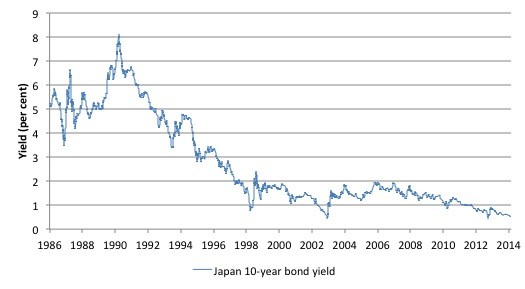

That has left the private sector little room to influence the price of JGBs, says Naka Matsuzawa of Nomura, an investment bank. Bond prices remain high and yields low despite low unemployment and slowly rising inflation, which would normally presage higher yields. The current yield on the ten-year bond, 0.5%, looks tiny even by Japanese standards.

Part of the reason that bond prices remain high is that financial institutions have not sold as many JGBs as the BoJ had hoped. It had assumed that falling yields would prompt banks to shift their holdings into riskier assets, stimulating the economy. Although Japan’s biggest banks sold JGBs in the months immediately following the BoJ’s first purchases in 2013, they have now largely stopped. Regional banks, the most notorious JGB-addicts, hung on to their bonds, and are now purchasing more.

Trading in JGBs was already a bit thin before the BoJ embarked on its asset purchases (quantitative easing, or QE, in the jargon). Most participants are long-term buyers, all moving in the same direction. The moribund state of the market will make it harder to end QE without prompting a spike in yields.

Yet a little market malfunction would be a small price to pay for lifting Japan out of deflation. In fact, argue some, the situation is of concern only to bond traders. They are making rather less money than before, says Peter Tasker of Arcus Investment, a fund-management firm. Trading desks could be pared down if volumes fail to rebound, says Ki Cho of PIMCO, a big bond-fund manager. Some European banks have already drastically shrunk their JGB departments.

If taken to extremes, the wilting of the market could become a problem, making it harder for the government to issue debt and the BoJ to trade it. A more imminent concern is whether its listless state will deter the BoJ from expanding QE later this year. The 2% inflation target remains distant, but bigger debt purchases would make it look even more like the central bank was funding the budget deficit, and set up an even more difficult adjustment when QE ends. Mr Matsuzawa argues that the BoJ should give the market more room to breathe next year by reducing its bond purchases instead—although for the moment, that looks like wishful thinking.