Is Now The Time For High Income Funds

Post on: 16 Март, 2015 No Comment

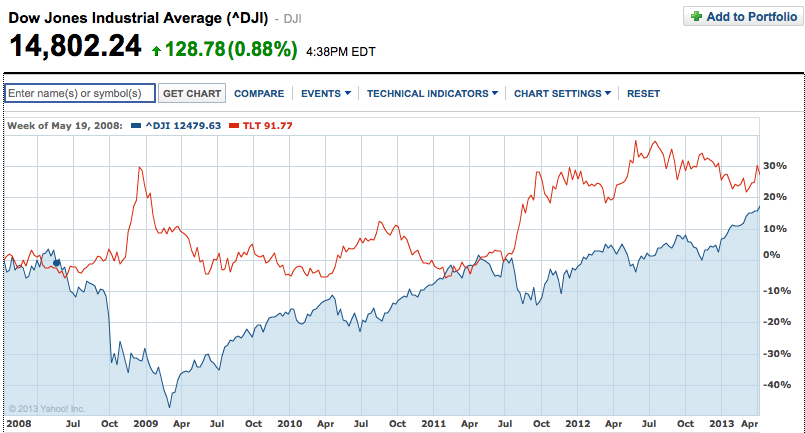

Recently the stock market has soared, and bond prices have also risen. The Dow Jones is closing in on 15,000 after hitting 12,101 in June 2012, for a 2,700 point gain in 10 months. Many investors expect a pullback as the summer approaches, as popular companies are at 52-week highs.

Currently there are slim pickings on the secondary bond market. Take a look at the dramatic rise in bond prices that occurred on April 5th:

The price of this particular ETF. which holds U.S. Treasury bonds. shows a gradual decrease; this reflects the sudden surge and pull back in the price of bonds recently.

A Profit Taking Strategy

Investors who are profit taking may be wondering what to do with the profit. One possibility is to conservatively allocate to high income funds. I have a few favorites, though I like to allocate small amounts to several different funds, and keep the levels in each fund equal to the amount a given portfolio can generate within 6 to 12 months. Obviously different investors invest differently. Certainly some investors dislike income funds and CEFs. they may not seem exciting, and if you choose the wrong one it may not be profitable. This could be caused by management that leverages different classes of shares. or the dilution of shares ; or because rates can go up. and the price of a funds holdings could go down. Additionally the funds yield may be subject to change. these are all important points to weigh.

When you pull up the price chart on an income fund you will notice most of them dropped significantly during the 08 and 09 collapse. Investors who reinvested into their income funds are now generating more income, since more shares were accumulated at lower prices. The same of course is true for strong dividend yielding stocks and now we are once again faced with high prices on stocks; however this time bonds are not yielding nearly what they were before the market fell in late Sept. and early October of 2008:

You can see the price of treasuries, as represented by this particular ETF, now lives in the range it shot up to in late 2008.

Treasuries May Be Treacherous

You have to realize that bond prices are now high, however U.S. treasuries are no longer AAA since S&P cut the U.S rating. Additionally the San Francisco Fed recently announced the bond buying program may be ending soon. While the president of the Federal Reserve bank of Atlanta recently stated it may be too soon to end the program.

The current 10-year yield is 1.86% this amounts to $18.60 a year from a $1,000 10-year U.S. treasury bond. While I believe there certainly is a place for treasuries in a portfolio, this rate is very unattractive; therefore I have developed the strategy I described, whereby I have redirected some profit to multiple high income funds. I am watching the treasuries for a better entry point in the future. Though currently they seem to be treacherous; junk bonds are no less treacherous, this is why allocation is important, in addition to a strategy.

The simple fact is, unless the U.S. defaults investments in treasuries should retain value; however they most likely will not keep pace with inflation. High income funds may keep pace with inflation; though if a company defaults the fund could take a hit and could under perform. With this risk in mind I believe allocation to multiple income funds, that hold various junk bonds; in increments that a portfolio can absorb in the event a fund under performs or rates jump up, is worth consideration.

In order to balance the risk junk bonds carry it is also important to consider the proportion of high yield to higher quality corporate bonds ; for every high yield income fund I like to also find a fund that holds investment grade bonds. Overall I like more exposure to investment grade bonds. Here is an example: