Is Now the Right Time for the Preferred Stock ETF

Post on: 1 Июль, 2015 No Comment

Is Now the Right Time for the Preferred Stock ETF?

Barclays Global Investors has been nothing short of masterful at generating market share in the exchange-traded fund environment. One of the reasons for the success of the iShares creators is the ability to find attractive niches.

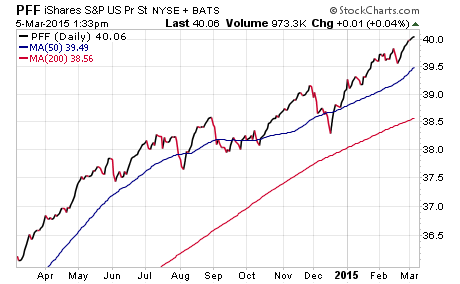

Take, for example, preferred stocks. Until April of 2007, the entire asset class had been ignored by ETF providers. However, Barclays jumped quickly, serving up the iShares S&P U.S. Preferred Stock Index Fund (PFF ).

Originally, I didnt believe that the new product would be well-received. It had an expense ratio of .48%, which significantly detracted from the 5.5% income stream. It was 75% rooted in financials, which significantly exposed investors to sub-prime concerns that were beginning to mount. Moreover, the guaranteed dividend payment was coming at the cost of muted appreciation.

I guess you could say, I was a little skeptical of the iShares S&P U.S. Preferred Stock Index Fund (PFF). Yet, where theres less appreciation and less volatility in an asset class, like bonds, there would be less depreciation to worry about. And for those who wanted that dividend, I thought that PFF might be one way to go.

Then came the global credit crisis of July/August 2007. Could any segment of the economy have been less desirable than financials?

The iShares S&P U.S. Preferred Stock Index Fund (PFF ) fell 10% from high to low in the summer crunch. That was as bad as broader U.S. indexes like the S&P 500 and almost as bad as the peak-to-trough drop for the S&P Select Financials SPDR (XLF ).

Perhaps the S&P U.S. Preferred Stock Index was not the safest port in the storm. Or, more accurately, when the worlds financial system is on the brink of collapse, an index with heavy exposure to financial companies might not be the best choice.

On the other hand, what about right now? The iShares S&P U.S. Preferred Stock Index Fund (PFF ) and the S&P Select Financials SPDR (XLF ) have recovered to the spot they occupied on July 20 the day the global credit crisis hit. And PFF is only down 5% for the year.

Although I still feel better about recommending banks outright, using the KRW Bank Index (KBE ), some people might like the slow-n-steady approach of the preferred index; that is, it is very likely to reclaim and hold its initial price of 50, while still delivering a 5.5% annual yield. And at a current price of 48, you may be able to get some appreciation to go with that dividend payment.

Although I am not recommending the alternative index for preferred ETF investing, its important to mention its existence. The Powershares Financial Preferred Portfolio ( PGF ) is based on a Wachovia index of financial preferreds.

Disclosure Statement: As a Registered Investment Advisor, Pacific Park Financial, Inc. may hold positions in the ETFs, mutual funds and/or index funds mentioned above. Investors who are interested in money management services may visit the Pacific Park Financial, Inc. web site.

Share this post: