Is it just a pullback coming correction or beginning of bear market

Post on: 24 Июль, 2015 No Comment

Is recent sell-off on Wall Street a sign the bear is coming out of hibernation? A bear sculpture symbolizing falling markets stands in front of the stock exchange in Frankfurt, Germany, on Sept. 12, 2011. (Photo: Daniel Roland, AFP/Getty Images)

U.S. stocks, which are coming off their worst week in more than two years, have run into trouble. And that raises the question: Is the selling just getting started?

Ever since the 2008-09 financial crisis, which scared stock investors and slashed the value of the U.S. stock market by nearly 60%, a market drop of any size starts the worry cycle anew for still-jittery investors that fear another market rout.

The big question now is whether the recent sell-off, which has knocked the benchmark Standard & Poors 500-stock index down more than 3% from its July 24 record close of 1,987.98, is just another pullback? Or the start of an official correction, or drop of 10% or more? Or the beginning stages of a full-fledged bear market, defined as a decline of 20% or more?

In search of answers, USA TODAY reached out to a dozen Wall Street money managers and strategists. The general consensus is the current market turbulence will be short-lived and the losses will likely be capped at less than 10%. (The last official correction occurred in 2011.) The reason: many of the risks associated with a bigger decline, such as a recession and sky-high valuations, are not present at least right now.

Last weeks scares, they add, such as a debt default by Argentina, fears of an earlier-than-expected rate hike from the Federal Reserve and ongoing geopolitical risk in Ukraine and the Middle East, isnt enough to kill the bull.

However, at least two Wall Street pros warned that the latest sell-off is the start of what will morph into a bear market. The last bear market, which resulted in a 56.7% drop for the S&P 500, ended on March 9, 2009.

First, the good news.

THE CASE FOR A PULLBACK

Here are a few reasons why most pros think the current pullback wont turn into a lasting and painful double-digit decline.

* U.S. economy remains strong. The headlines abroad make people nervous, and most are unsure about the economy and Fed, says Nick Sargen, chief investment officer at Fort Washington Investment Advisors. The latest news have been encouraging. The economy improved in the second quarter and is off to a solid start in the current quarter. Inflation has edged higher but wages are moderate, which should keep the Fed on hold. Also, valuations aren’t cheap, but aren’t unusually high. (As it relates to geopolitics), I would get nervous if oil prices were surging, but they’re not.

Adds Sargen: We’re (more than) two years since the last correction, so that could happen any time. But the news out last week shouldn’t cause it.

* Correction triggers absent. We havent had a 10% correction in three years, so the conventional wisdom would suggest were due for a correction. However, tell me one piece of concrete evidence suggesting a sell-off is imminent. Its just not there! says Todd Schoenberger, president of J. Streicher Asset Management. (Corporate) earnings have been solid, the economy is clearly expanding, and the United States hasnt had to include itself in any of the hostile conflicts weve seen elsewhere in the world. This market is poised to move higher and should continue rising through at least the rest of the summer.

* Its normal market adjustment. My best guess is less than a 10% drop, says Bob Doll, chief equity strategist at Nuveen Asset Management. Significant declines usually are caused by downturns in earnings, something that has very low probability. So if I am wrong, and we have more than a 10% decline, I believe the market will come back quickly.

Whats going on? adds Doll. Along with the accumulating list of geopolitical issues, the Fed is getting its wish: more jobs, more GDP growth, and a little more inflation. The market is coming to the realization that the wonderful period of 20%-plus annual gains powered by rising earnings and rising P-Es is over. From here, its earnings. But earnings growth will be OK, high-single digit. So, the market is adjusting. The transition is often a sloppy, corrective period.

* Geopolitical risks wont derail global recovery. I don’t see anything more damaging than a 4%-8% pullback over the next few months, says Joe Quinlan chief market strategist at U.S. Trust, citing strong foreign investor demand for U.S. assets and a global economy thats still expanding at 3%+ rate.

The risks from abroad Russia-Ukraine/Argentina/Europe banking stress/Middle East are significant events unto themselves but not enough— either alone or collectively— to torpedo the global recovery, adds Quinlan. More importantly, the world is awash in capital; this, juxtaposed against rising foreign risks means more capital inflows into the U.S. now considered a safe and sturdy harbor for other people’s money.

* Interest rate melt-up unlikely. Right now we are not looking for a bear-market, at least not for the major indices like the S&P 500, says Russ Koesterich, chief investment strategist at BlackRock. Our expectation is that the economy continues to stabilize and, while rates are likely to move higher, they do not ‘melt-up’. This suggests that stocks are looking at something closer to a pullback or a correction. That said, I think there are segments of the market where high valuations suggest more severe losses. Small-cap stocks look vulnerable, and are already down roughly 8% from their recent highs.

* Return to normal markets. The S&P 500 is setting up for a pullback: a drop of less than 10%, says Doug Cote, chief market strategist at Voya Investment Management.

The market is simply adjusting to a return to a more normal interest rate policy from the Fed, he says.

We feel that the Fed’s jawboning of (market) excesses is a form of forward guidance and is the Feds start to reining in their zero-rate policy effect well before action is taken, says Cote. July’s end-of-month volatility should not be construed as an error. Instead, it is more likely a shot across the bow before the real move to independence from the Fed takes place. This is not 2011 when markets were ultimately pummeled by a U.S. credit downgrade and euro crisis policy mistakes. Instead, it is a natural progression back to normal markets that are free and independent of the Fed. But this means a pullback is likely, and this should be viewed as good news.

* Ample liquidity favors stocks. The market is vulnerable to a correction at any time, says David Kelly, chief global strategist at J.P. Morgan Funds. However, we do not believe that it is any more prone to a correction today than at other times during this long market rally.

Our current outlook is for stronger U.S. economic growth, rising earnings and the redeployment of corporate and household cash in ways that help equity markets either directly through households moving from cash to stocks and corporate stock buybacks, or indirectly through increased dividends that get reinvested or M&A activity, Kelly adds.

Now, the not-so good news. A correction could be coming.

THE CASE FOR A CORRECTION

Says Uri Landesman, president of Platinum Partners: The market is extended and expensive. It is not discounting bad news. The technicals suggests that you will have a move into the correction category.

Finally, we bring you the bad news. A bear market is on the horizon.

THE CASE FOR A BEAR MARKET

* Fear and volatility is back. My vote is for a bear market, says Axel Merk, chief investment officer at Merk Investments. Why? Fear has to come back to the market. One of the Feds key achievements is that risky assets dont appear so risky anymore. We see that in junk bonds not yielding much or the S&P 500 rising on rather low volatility and low investor fear.

But fear will return as the Fed moves closer to hiking interest rates.

Volatility (fear) will rise again, and the (rate) normalization process will put downward pressure on asset prices, says Merk. Asset prices can then only be sustained based on other reasons, such as stronger earnings. In my assessment, there is little chance earnings can expand at fast enough a pace to justify valuations once fear comes back to the market.

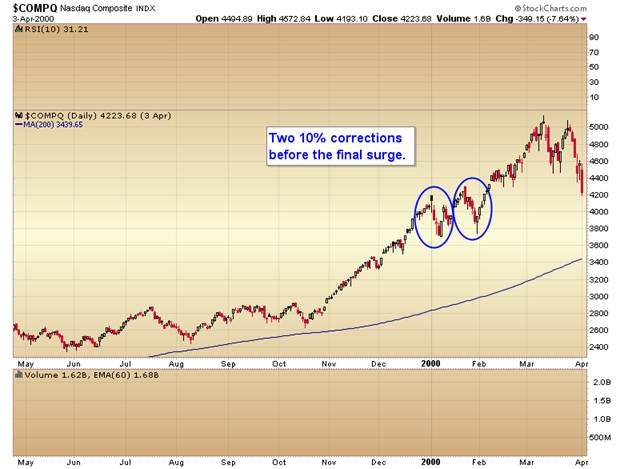

* Overvaluation and irrational exuberance. Walter Zimmerman, senior technical analyst at United-ICAP, says a bear market is coming, and he ticked off eight reasons to back up his claim. Among the things worrying him now is risk blindness on the part of overly exuberant investors, which shows up in historically low yields on junk bonds and overvaluation in pockets of the stock market, such as small-cap stocks. The heady pace of corporate buybacks and merger-and-acquisition activity are also signs of froth, Zimmerman warns.

The market will also react horribly when the Fed starts to raise rates, he adds. And the recent decline of market leaders like the Dow and German-based stocks is also a warning sign of more losses to come, Zimmerman adds.