Is CCC Credit Worth the Risk

Post on: 26 Апрель, 2015 No Comment

Typically, one would expect higher-risk assets to generate higher returns. But when it comes to high-yield corporate bonds, indiscriminate exposure to the CCC-and-below category may not produce the expected results.

Bonds rated CCC and below can be fertile ground for active managers. They have a wide distribution of returns, so there can be rich rewards for identifying winners and avoiding losers. And pricing anomalies are relatively common. For example, at times of high anxiety, markets sometimes price in excessively pessimistic assumptions about bankruptcy rates. With strong research and security selection, nimble investors should be able to find attractive buying opportunities in all but the worst market scenarios.

But the lowest-rated bonds are not for everyone. Growing numbers of investors want yield, but they are nervous about volatility and want to reduce the risk of extreme outcomes. So, what would be the impact of entirely excluding lower-rated credit from the opportunity set?

In terms of diversification, the impact is modest. Only about 12% of the global high-yield corporate market is rated CCC and below, so such a strategy doesn’t meaningfully restrict the choice.

What about missing out on the upside? CCC bonds are often among the star performers in a credit rally. Today, we don’t think this is an immediate concern. For a major rally to occur, credit spreads first have to build up to a peak. The most recent peak was November 2008, at the height of the financial crisis, with the Barclays Capital Global High Yield Index reaching spreads of about 17%. Currently we are near long-term average spreads—they were around 6% at the end of July. So we think it’s more likely that we’ll continue on in a volatile market with mini peaks and mini rallies.

In our view, higher-quality bonds are very well suited to this environment—particularly for investors who want to limit their exposure. Should a large sell-off take place, we’d expect higher-rated assets to be more resilient than more aggressive high-yield holdings.

Last year we did a study on the US credit market from January 1993 through June 2011, comparing the performance of the different categories of high-yield credit. We found that the highest-rated segment (BB) captured 88% of the upside in rising markets, compared with only 68% of the downside when markets were falling. This pattern of capturing more upside than downside resulted in overall returns that were both higher than the overall market and less volatile.

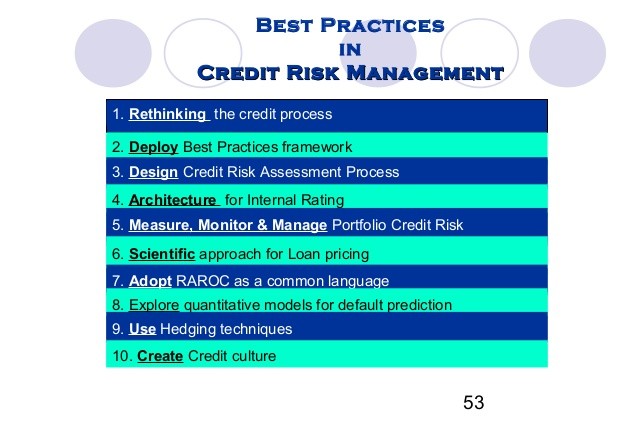

CCC-rated bonds actually performed worst, returning an average of about 6% per year—almost 3% less than BB-rated bonds. In other words, on average, the least risky bonds performed best. To get an idea of why lower-risk assets tended to outperform, we divided the data into four market-cycle phases, shown in the display below.

CCC bonds as a group did extremely well in rally phases, averaging double the returns of BB and B bonds. In a rally, risk-taking strategies benefit, so, when bond spreads are falling back from extremely wide levels (as they did in 2009) the more risk an investor takes, the better the return.

We call the next stage the “carry” phase (which is the state the market is in roughly 75% of the time.) Risk-taking is still compensated, but spreads are more compressed, so there’s less scope for outsize capital gains, and bond returns are roughly the same as their yields. Here, despite the fact that CCC bonds have higher yields, they slightly underperformed BB and B bonds. The higher yields were outweighed by the credit losses and defaults that CCCs experienced even in “normal” markets.

Investors typically buy CCCs during carry periods because they are stretching for yield. And, on a case-by-case basis, skillful security selection should be able to uncover value. But for CCCs as a group, investors have been overpaying for yield during these periods—the yield advantage would have had to be even higher to fully offset the greater risk of these bonds.

In a market crisis phase, the more risk one takes, the worse the return. So, unsurprisingly, on average the CCC category suffered in these environments.

Finally, in a recovery phase, investors generally don’t want to buy a lot of risk, but the intense selling pressure has eased. The result is a bounce-back that lifts all risk assets. History suggests that returns can be compelling, but one doesn’t need to own the riskiest CCC bonds to generate this return.

This implies that it’s possible to generate attractive returns in all but the strongest bull markets by simply sticking to higher credit-quality bonds.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio- management teams.

Ivan Rudolph-Shabinsky is a Senior Portfolio Manager at AllianceBernstein.