Irish Debt Clock

Post on: 5 Апрель, 2015 No Comment

Loading.

The key to a country’s economic recovery and the restoration of financial normalcy is the stabilisation of the National Debt. The national debt rises if the Government spends more than it takes in, mostly in the form of taxes. If the Government balances its books, like most households, the national debt stops rising.

This situation is ultimately desirable in all countries, because it means that the Government is in harmony with the households of the country it governs. If not, the households in that country will ultimately lack economic confidence in that Government, because everyone intuitively knows that the Government will ultimately have to tax the earnings/wealth of those households to make its ends meet. When such fears prevail beyond the short term, countries’ economies begin to implode because households and companies domiciled in the jurisdiction begin to lose confidence in the economic system of that country, and leave it, or at least export their wealth from it, with negative impacts on the economy’s growth and ultimate economic prospects.

Countries which, on the other hand, have surpluses on their Government accounts, as Ireland did from the mid 1990s to the mid 2000s, enjoy the confidence of its resident households and enterprises and enjoy superior growth, superior tax revenues, and falling debt — in short, a virtuous economic and debt cycle.

As long as a country’s debt as percentage of its GNP and GDP remains on a rising trajectory, its economic prospects are worsening. However the Finance Dublin Debt Clock is rising at a slower rate than in 2010-2013, and this is bolstered by improvements in GNP growth and Government finances, with debt as a percentage of national income rising at a diminishing rate.

The return to growth of Ireland in 2013 (+3.4% GNP growth), followed by an expected year on year growth rate of over 5 per cent in 2014 indicates that Ireland is experiencing an earlier than anticipated return to financial stability, due entirely to the growth effect in bolstering national income (thus reducing the debt as a percentage of GNP).

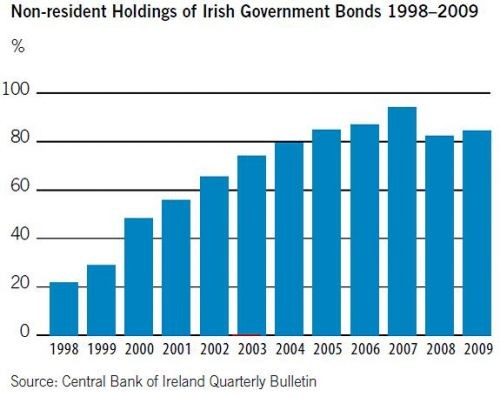

This was accompanied by a return to bond markets by the Irish sovereign in 2013, enabling refinancing (proposed replacement) of IMF loans at rates as low as zero per cent (in mid September 2014, and 0.8 p.c. in January 2015). What underpinned the improved confidence in Irish Government bonds in 2013-2014 was the expectation that the debt to GDP ratio curve will peak out in a year or two, and, perhaps begin a downwards trajectory after that, as it did through the course of the 1990s — early 2000s, which was the true foundation of the ‘Celtic Tiger’ period.

Nevertheless, Ireland’s national debt (2014) still lay on an upwards trajectory, primarily because of the low relative productivity of Ireland’s high levels of public expenditure, alongside a market-competitive private and FDI sector as evidenced by the Irish private sector’s high rankings in many world competitiveness indexes, such as those of the World Bank, and others.

The FINANCE DUBLIN Irish Government Debt Clock was set at midnight on June 30th 2009, when it was 65.278 billion. It updates the latest figures for the National Debt of the Republic of Ireland. The clock is re-set periodically, to reflect changes in debt and deficit estimates from the Dept of Finance, the National Treasury Management Agency (NTMA), and other bodies .

* Debt ratio definitions:

(a) The GDP and GNP values used are the following money estimates (forecast) for the current year published by the Central Bank of Ireland in its Q3 Bulletin (October 2014), (GNP: 155.6bn; GDP: 183.6 bn). This latter forecast incorporated the national income estimates by the Irish CSO (March 21st 2014) for 2013, which calculated GNP growth for 2013 at 3.4% in volume terms;

(b) The debt total is the latest official ‘National Debt’, as defined by the Irish National Treasury Management Agency (NTMA). It differs from ‘Gross Government Debt’, (GGD) a concept generally used by Eurostat, and the EU for expressing debt figures in the EU. The official National Debt at 31/12/14 stood at 182.3 bn. The Gross total was 197.06 bn but this was offset by cash balances etc of 14.76bn. Of the total national debt, 116.34 was in the form of Government Bonds liabilities. The outstanding liability value of EU/IMF Programme Funding was 58.79 bn at December 31st 2014. It is this IMF/EU funding that the Irish Finance Ministry and NTMA are concentrating on replacing. Theoretically, if it were all replaced at Government bond yields prevailing in January 2015 (in light of the successful experience of re-funding 4 bn at 0.8 p.c. in the first week of the year) a potential once off boost to Ireland’s GNP of 10% to 15% could be imparted in the medium term (2 to 3 years).

The fact that this potential now exists for the Irish state is strong evidence that cavalier attitudes to sovereign debt liabilities by debtor nations (urged on the Irish Government by a variety of commentators within and outside the country during the years 2010-12) were not going to pay off in the long term, leaving aside any moral considerations of attitudes to debt obligations.

The above debt figure, as an expression of the public debt burden of the Irish economy (i.e. its leverage) is a more accurate measure of its indebtedness, expressed as a ratio of GDP/GNP. This is because the ‘GGD’ figure does not take into account Exchequer financial assets (including cash balances, sovereign wealth fund assets, and its revenue earning stakes in the domestic Irish banking sector such as equity and bank guarantee income) (These were estimated by the CSO at 41 billion at end 2013 in a release on 14th April 2014).

If these further assets were included as assets, the Irish net debt figure would be approximately 9 per cent of GDP lower (end 2014) than the level shown on this page (approx 90 p.c.).

Other, higher, (gross) figures, which include private debt, (nevertheless relatively high in the Republic of Ireland’s case) usually do not include external assets, while expressions of total private debt, including the financial services sector, are particularly inappropriate as a measure of the Republic of Ireland’s indebtedness, as they account only for foreign liabilities, but not assets, of Ireland’s International Financial Services Centre (IFSC).

Note: Impact of Promissory Note replacement with sovereign debt, announcement February 7th 2013. The event is a rescheduling of debt, that, while it impacts the time value of debt obligations in a positive way for the Irish Exchequer (estimated future interest savings by economic forecasters of between 500 million and 1 billion per annum, including the NTMA, the agency charged with managing the Irish sovereign debt ) does not affect the nominal, monetary value of debt expressed in the debt clock figures above. The rescheduled debt proportion of the national debt above currently represents approximately 20 per cent of the total debt, and will fall to c.18 per cent within a year, at the current rate of deficit-fuelled debt accumulation that continues.

When leverage approaches 100 per cent of income, economies enter enhanced risk territory because their stability, and ultimate creditworthiness diminishes, because a relatively rapidly rising debt ratio places particularly severe limitations on an economy’s ability to recover fiscal balance, as the experience of Ireland since this debt clock was established (in 2009), has shown — with debt rising from 67 billion (July 2009) to the level shown above.

February 1 st 2015: The Irish Exchequer recorded a surplus of 780.6 bn in January 2015, compared with a deficit of 1.142 bn in January 2014. While this turnaround does not definitely signify that Ireland’s Government may undershoot its deficit target of c.3 p.c. for 2015 as a whole, the figures prompted the Finance Minister Michael Noonan to say in a statement that the debt ‘is now on a downwards trajectory’. This combined with early paymwent of over half of the IMP program loans in recent months, and the issuance of a first ever 30 year bond by the Irish State in January at record low interest rates indicates that the Irish debt trajectory is at its zenith, and may shortly begin to fall as a percentage of GDP. Already, as the Finance Dublin Debt Clock figures on this page show, the debt has effectively stabilised, ending an era of austerity and debt reduction in the Irish economy, which began with the global financial collapse of 2007-2008.

January 13th 2015: Continuing in the successful vein of Irish prime rated fund raising this year, the Bank of Ireland Group today raised 750 million of 5 year covered bonds at a yield of 0.5%

March 2014: Ireland’s strong GNP growth recovery — Ireland records one of the developed world’s highest GNP growth rates — 3.4 p.c. — in 2013

8th February 2013: Impact of Promissory Note replacement with sovereign debt

8th January: NTMA raises approximately a quarter of 2013 target funding in Syndicated Tap of 2017 bond, at 3.3 p.c. effectively marking the end of Ireland’s lockout from bond markets

5th December: Reaction to the 2013 Irish Budget from analysts

14 November: Fitch is the first credit rating agency since the IMF bailout to adjust the credit rating outlook for Ireland from negative to stable

13 November: Bank of Ireland raises 1bn in covered bond market, in first public bond issue by an Irish institution in 3 years

8 November: Nobel Economics prize winner Pissarides addresses Irish Senate on youth unemployment

16 October: Editorial, Finance Dublin October: The Financial Transactions Tax fails all the tests

16 October: Ireland opts out of new FTT zone, along with leading nations globally

28 September: Deputy Governor of Irish Central Bank points to research that shows that spending cuts are most effective means of resolving Irish debt problems as Ireland prepares for its 2013 Budget.

26 July: Ireland returns to long term bond market for first time since IMF bailout, raising 5.23 bn in 5 year and 8 year maturities