IQ Merger Arbitrage ETF

Post on: 16 Март, 2015 No Comment

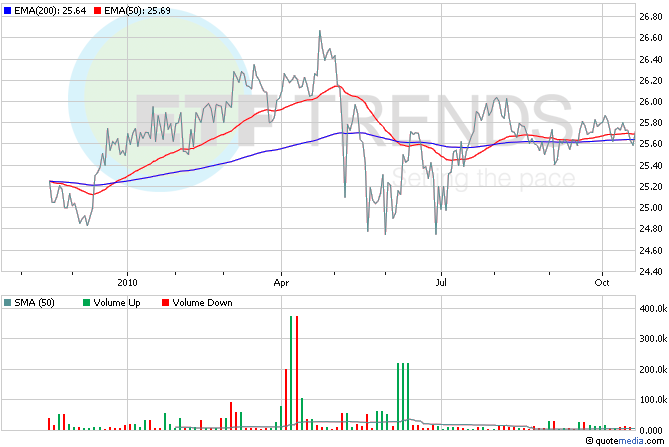

IQ Merger Arbitrage ETF (Price)

The performance data quoted above represents past performance. Past performance is not a guarantee of future results. Investment returns and value of the Fund shares will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. Fund returns reflect dividends and capital gains distributions. Index performance is for illustrative purposes only and does not represent actual Fund performance. One cannot invest directly in an index. Performance data for the Index assumes reinvestment of dividends and is net of the management fees for the Index’s components, as applicable, but it does not reflect management fees, transaction costs or other expenses that you would pay if you invested in the Fund directly.

IndexIQ shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Total Returns are calculated using the daily 4:00 pm ET net asset value (NAV). Market price returns reflect the share price as of the close of trading on the exchange where Fund shares are listed. Market price returns do not represent the returns you would receive if you traded shares at other times.

Risk Discussion: Certain of the proposed takeover transactions in which the Fund invests may be renegotiated, terminated or involve a longer time frame than originally contemplated, which may negatively impact the Fund’s returns. The Fund’s investment strategy may result in high portfolio turnover, which, in turn, may result in increased transaction costs to the Fund and lower total returns. The Fund may invest its assets in a relatively small number of issuers, thus making an investment in the Fund potentially more risky than an investment in a diversified fund which is otherwise similar to the Fund. The Fund is susceptible to foreign securities risk –since the Fund invests in foreign markets, it will be subject to risk of loss not typically associated with domestic markets. The Fund is non-diversified and is susceptible to greater losses if a single portfolio investment declines than would a diversified fund.

Returns less than 1 year are cumulative; all other returns are annualized.

* Fund Inception Date: November 17, 2009. The Index and Fund performance since inception in the table above is based on the Fund inception date. The Index inception date is October 31, 2007.

1 As stated in the Fund’s prospectus, the management fee is 0.75% and the Total Annual Fund Operating Expenses is 0.76%, which includes (i) other Fund expenses and (ii) the Fund’s pro rata share of fees and expenses incurred indirectly as a result of investing in other funds, including ETFs and money market funds. This amount will vary over time due to changes in the underlying ETF fees and expenses and the constitution of the Index.

2 IOPV, or Indicative Optimized Portfolio Value, is a calculation disseminated by the stock exchange that approximates the Fund’s NAV every 15 seconds throughout the trading day.

Investors in MNA do not receive K-1s for tax reporting purposes. IndexIQ distributes a single Form 1099 to its shareholders.

IQ MERGER ARBITRAGE INDEX

Returns for the IQ Merger Arbitrage Index do not reflect the deduction of management fees, taxes and other expenses.The MSCI World Index is a free-float adjusted market capitalization weighted index that is designed to measure the equity market performance of developed market (performance data assumes reinvestment of dividends, but it does not reflect management fees, transaction costs or other expenses).

The IQ Merger Arbitrage Index is the exclusive property of IndexIQ which has contracted with Structured Solutions to maintain and calculate the Index.