Investors really need a wakeup call advisors say

Post on: 24 Май, 2015 No Comment

Fully five years into one of the strongest bull market rallies that Wall Street has ever produced, financial advisors say a large percentage of their clients are still too scarred by the wounds inflicted during the 2008 financial collapse to put their money back to work.

MicroWorks | iStock | Getty Images Plus

Whatever their method of playing it safe, however, their inability to invest for growth—and block out market noise—is putting a serious hurt on the size of their future nest egg.

There are some people who have been in the market these last five years and enjoyed an amazing run, but we know that in aggregate, investors were actually exiting the market between 2009 and 2012, which amounts to hundreds of billions of dollars of forgone wealth, said Seth Masters, chief investment officer for AllianceBernstein’s Bernstein Global Wealth Management. This is one of the great bull markets of our lifetimes, and many people missed it.

Indeed, the S&P 500 has produced a nearly 72 percent total trailing return since Oct. 12, 2009.

Getting gun-shy investors off the sidelines requires a different message than it did before the Great Recession, when clients’ only concern was boosting returns, said Scott Farber, senior vice president and wealth strategist for U.S. Trust in Miami.

Farber said that as he conducts year-end portfolio reviews through Dec. 31, he’ll help clients set short- and long-term financial goals, while giving them tools to minimize risk.

Clients are still very nervous about investing in the market, said Farber, who spends two-thirds of his time educating clients on the cost of being too conservative and the loss of purchasing power due to inflation.

If you’re managing assets for the long term, you have to be conscious of both, he said.

The annual inflation rate, as measured by the Consumer Price Index, currently stands at 1.7 percent. Thus, it is not an immediate threat, but Farber said the natural business cycle suggests it will edge higher over time, which erodes the value of money.

Dividend stocks, commodities and Treasury inflation-protected securities (TIPS) have historically helped protect against the corrosive effects of inflation, while fixed-income assets, primarily bonds, have helped to offset equity market risk.

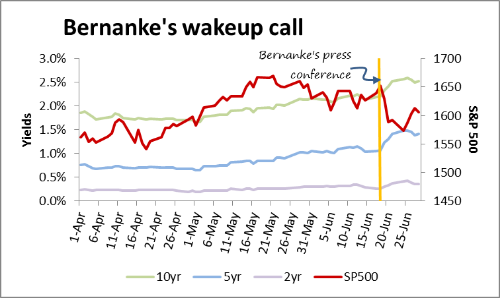

Government-backed bond yields, however, continue to flirt with record lows, with the benchmark 10-year Treasury returning a paltry 2.3 percent, which has forced investors to seek out riskier income-producing alternatives.

Among them, high-yield corporate bonds, master limited partnerships, real estate investment trusts and business development companies, which invest in or lend to small- and mid-sized companies.

Investors who are unfamiliar with the ever-expanding roster of new and increasingly complex financial products are most likely to sit on their hands, Farber said.

The No. 1 reason people don’t implement our advice is because it’s too complicated and they don’t understand it, he said. If you take a child by the hand, open a door to a dark room and tell them to go in and play, they won’t, because they don’t know what’s in there.