INVESTOR RISK

Post on: 16 Март, 2015 No Comment

Specialist Banking & Management Associates is The Strategic Think Tank and Executive Advisory Services Company on Economic & Financial Management, Scientific Research & Development, Investment Banking, Global Asset & Wealth Management, and serving High Net Worth Individuals & Private Investors, Executives & Managers, Institutional Investors, Company & Project Owners, and Foundation & Funding Groups who are utilizing our global banking expertise for Investment & Loan Funding, Project Finance and individual Investments in direct cooperation with European prime banks prime banks in Europe, Asia and Northern America.

We are Facilitators of Investment, Finance and Trading Programs in direct Cooperation with AAA — rated European Prime Banks, Placement Program Managers and Providers within the international banking system, preferably in Swiss, Germany and Great Britain. Banking Contracts are provided to High Net Worth Clients, whose investments are under their own account name, guaranteed, insured and safely guarded and always under their control during the period contracted.

We are providing World Capital Market & Financial Management Research, Capital Market Services as part of Political & Economic Risk Management, Financial Markets Research on Instruments and Institutions, International Capital Movement and Monetary Cooperation, evaluating Economic Performance & Investment Potential towards competitive and yielding Placements on World Capital Markets.

Our services incorporate Investment Banking, Private Banking, Personal Banking & Wealth Management, Asset & Financial Management, Investment Funding, Project Finance & Loan Funding through the Facilitation of Specialist Banking Contracts for entering the bank secured Investment Programs conducted by European Prime Banks or Money Center Banks preferably in Swiss, Germany and Great Britain in close Cooperation with Placement Program Managers and Providers

- To provide guidance and assistance to principals as private clients and high-net-worth individuals, corporations & institutional investors, banks & funding groups, trusts & foundations, executives & managers, and entrepreneurs through professional excellence according to international banking standards.

- To explore innovative financial solutions and facilitate global investment potential for wealth creation and life quality enhancement by providing global reach and connectivity between capital markets and knowledge driven Investors profiteering from yielding investments.

For entering Investment Programs, please start your request, and in order to meet the requirements, anticipate our Terms & Conditions, which you find as link below or via Index.

INVESTOR RISK

When investors hear about the opportunity to earn high profits, the first reaction is almost inevitably to assume that the risks must be commensurably high. Otherwise, one assumes that every investor would place funds in such programs. In fact, the risk to the investor’s capital in a properly structured Bank Credit Instrument trading program is almost nil. The means employed to eliminate risk vary with the type of program and include:

1. Investor’s funds are deposited in investor’s own name and own account in the trade bank and cannot be removed without investor’s instruction or encumbered in any way. The investor is the sole signatory on the account. Investor does not place his/her funds with the Program Manager or Introducing Broker. The bank holds the funds throughout the investment.

2. Investor gives the bank or the Program Manager a very limited power of attorney, which authorizes the purchase and resale of specific types of bank instruments from a specific category of banks, (e.g. A-AAA rated, top 100 World or top 25 European). The Program Manager can have no further influence over the funds.

3. The bank will typically offer a CD, U.S. Treasuries or a Bank Guarantee, which, it holds in custodial safekeeping. These instruments pay a modest money market rate of interest to the investor at maturity (usually one year and one day from deposit) in addition to any profits derived from the trading program. The investor holds the safekeeping receipt.

In instances where the investor actually purchases and owns the credit instrument, i.e. “direct programs”, ownership is typically limited to a matter of hours, or at most a few days, before the instrument is resold. The price of these credit instruments is not known to fluctuate significantly even with sizable changes in interest rates or bond prices.

Given these very secure procedures, why then isn’t everyone investing in these programs? There are several reasons:

Most programs operate with $100 million or more and are meant for large investors. Relatively few programs have been structured to accept small investments of $1 million or less. The banks bind Program Managers and Investors to very strict confidentiality agreements and it is very difficult to find the Program Managers or Investors willing to disclose their activities. Most programs are operated in the top European banks or domestic branches of top European banks and are therefore harder for U.S. citizens to access, research and invest in with confidence.

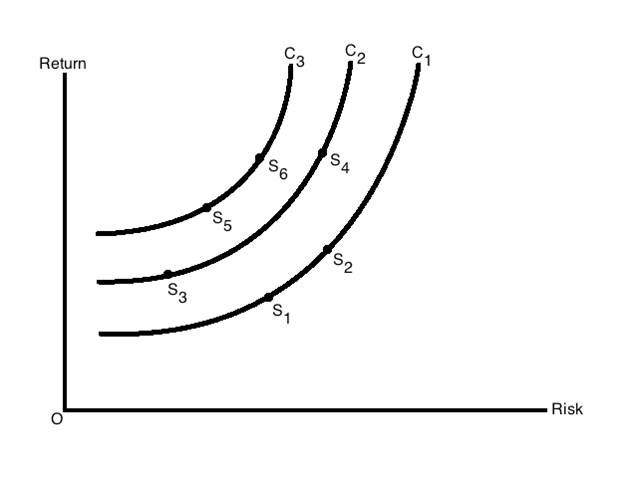

Investor behavior depends on “perceived” risk rather than actual risk. While the actual risk may be very low, the “perceived” risk of a little known and somewhat obscure sounding business does dissuade many investors from getting involved. This is especially true because only specialized back room departments of the bank are involved with these transactions. Most bank officials have no knowledge of them, particularly in the United States. Knowledgeable banking officials are sworn to secrecy and would never divulge the existence of this market for fear of disturbing large depositors who would clamor for higher deposit yields.

There have also been several highly publicized instances of fraud, which has prompted the SEC and Federal Reserve to issue warnings. Although to our knowledge no fraudulent programs have been discovered that utilize the secure investment procedures that we have outlined in this technical report. The fraudulent activities usually arise when investors give up control of their funds to phony trade managers who use Ponzi scheme type payouts.

While the risk to principal can be completely eliminated, there may be no guarantee that the profits will actually be fully earned, i.e. best efforts trading. In some programs this presents a potential interest or dividend earnings loss from the time when funds are placed in the program until the date of first payout. Typically this period is only two to three weeks. In programs for small investors, it can be as long as eight weeks. For large investors, this potential earnings loss presents a real risk. Often, a minimum return secured by a bank guarantee is used to offset this risk factor.

Good trading programs are difficult to find, costly and time consuming to verify, quickly oversubscribed and frequently closed before interested investors can arrange the necessary funds. Literally dozens, perhaps hundreds of programs are offered annually. Many are non-existent repackaging of the same programs by different people or first time efforts that never get off the ground. The fundamental question, which should be asked by a potential investor when reviewing program procedures is “How does this program protect my principal from loss?” If complete protection of principal is provided for in the procedures, the potential investor has established a sound basis for moving forward.