Investments Mutual funds

Post on: 26 Май, 2015 No Comment

Investing in Mutual funds

What are mutual funds?

Mutual funds 1 are a type of pooled investment vehicle. Shareholders of a mutual fund invest their money by purchasing shares of the fund. The money that they pay for the shares is pooled together and invested in a portfolio of securities, such as stocks, bonds, or money market instruments. Mutual funds are professionally managed and operated by money managers, who maintain the portfolio in accordance with the fund’s investments objectives as stated in the prospectus.

Popular investment disciplines which can involve mutual funds include:

- Asset allocation 2. a disciplined approach to long-term investing, designed to seek consistent exposure to markets. This approach does not guarantee a profit or protect against a loss. It also cannot eliminate the risk of fluctuating prices and uncertain returns. However, it may be used in an effort to manage risk and enhance returns.

- Dollar cost averaging 3. a strategy in which securities, typically mutual funds, are purchased in fixed dollar amounts at regular intervals, regardless of what direction the market is moving. While this method doesn’t guarantee against losses, over time, this can help to reduce the average cost of acquired shares.

- Target date (life cycle) investing 4. investors choose a fund with a specified target date near a personal need or goal (such as retirement) for which they will need to access their invested funds. Though target date investing does not protect against loss of principal, the fund’s risk exposure is gradually reduced as a target date draws nearer to prepare for the approaching liquidity needs.

Our World Selection Funds 5 offer asset allocation solutionsdesigned to help minimize the roller-coaster ride that volatile market conditions can generate. The five different fund strategies are aligned to a the full spectrum of risk profiles: Income Strategy Fund. Conservative Strategy Fund. Moderate Strategy Fund. Balanced Strategy Fund and Aggressive Strategy Fund.

In addition, the suite of HSBC Funds 6 includes domestic money market funds and domestic and international equity and debt funds 7. The HSBC Emerging Markets Debt Fund. HSBC Emerging Markets Local Debt Fund. HSBC Frontier Markets Fund. HSBC Total Return Fund and the HSBC RMB Fixed Income Fund all provide access to some of the world’s fastest growing markets through the lens of HSBC’s deep global knowledge and experience.

Mutual funds from the world’s leading managers

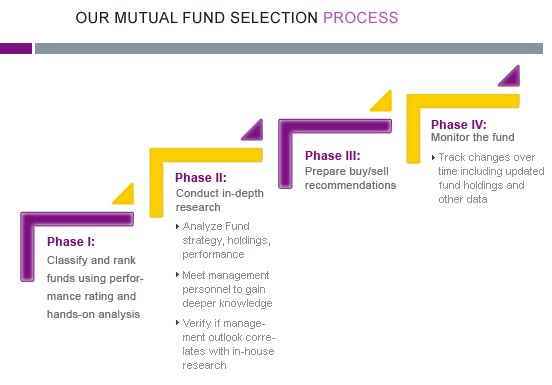

A financial professional 8 from HSBC Securities can not only provide access to the competitive funds managed by HSBC, but also help you choose from a broad selection of third-party mutual funds. Each of these funds is thoroughly screened and regularly reviewed by HSBC Wealth Portfolio Management Americas team 9 a global team of research analysts dedicated to identifying third party money managers with competitive advantages in their asset class, to enhance our clients’ portfolios.

Investment and certain insurance products, including annuities, are offered by HSBC Securities (USA) Inc. (HSI), member NYSE /FINRA /SIPC. In California, HSI conducts insurance business as HSBC Securities Insurance Services. License #: OE67746. HSI is an affiliate of HSBC Bank USA, N.A. Third party whole life, universal life and term life insurance products are offered through Insurance Agents of HSBC Insurance Agency (USA) Inc. which is a wholly-owned subsidiary of HSBC Bank USA, N.A. Products and services may vary by state and are not available in all states. California license #: OD36843 .