Investment trust discounts and premiums

Post on: 4 Май, 2015 No Comment

M any investors are unnerved by investment trust discounts and premiums. But the concepts are quite simple and – assuming youre not a pure passive investor 1 – they shouldnt put you off these interesting shares.

That said, not understanding the difference between discounts and premiums can cost you money. Its all too easy to be confused, as some recent comments on Monevator revealed.

My previous articles on investment trusts should give anyone who needs it a primer on the basics.

Today Ill focus on discounts and premiums.

What does your investment trust own?

We all (now! ) know that an investment trus t is a company that purchases assets to hold or trade.

Such assets could include equities, property, bonds, or even exotic fare like farmland or art, depending on the trusts objectives.

When we buy shares in a particular investment trust, we become part-owners in the trust and so effectively have part-ownership of those underlying assets.

Our slice of the pie is in proportion to the percentage of the shares outstanding that we own. Most of us will only ever own a few thousand shares in an investment trust. But its the same principle, whether you hold 0.001% or 10% of the trusts outstanding shares.

As a shareholder in such a trust, youll typically be paid your proportion of the dividend income generated by those blue chip equities, minus costs and any income retained for the trusts reserves.

Equity income trusts appeal to investors who want a diversified income. But as a shareholder, youll also benefit (or suffer!) from the rise and fall in the value of the portfolio of shares your trust owns.

Alternatively, you might buy an investment trust that owns property or miners or bonds, or pretty much anything else you can think of.

You might even buy an investment trust because you believe (rightly or wrongly) that the manager is an especially skilled one.

He or she may be buying the same sort of shares you could buy yourself – or that you could buy via a tracker fund – but you may believe the trusts manager is more skillful at picking winners, and so you hope they will beat the market.

Net assets

In any case, the trust will own a lot of stuff, which are called its assets .

The trust may also have debt (also known as gearing), which would need to be repaid out of assets if the trust were ever to be wound up, before its owners could divide up whatever was left.

Therefore:

Net asset value (NAV) = Total assets minus debt

How to calculate the net asset value per share

While they amount to the same thing, its easier to think about what portion of the trusts net assets each individual share is theoretically entitled to, rather to work off the whole trusts market value.

Lets consider an example.

Imagine the worlds simplest investment trust, Monevator Investments PLC .

This recklessly mismanaged operation owns shares in just two companies, Diageo and Glaxosmithkline. (Hey, its good to hedge your bets !)

Lets say shares in Diageo are trading at £10 and Glaxosmithkline £12, and that the trust owns 100,000 shares of Diageo, and 50,000 shares of Glaxo.

The Diageo holding is worth £10 x 100,000 = £1 million

The Glaxo holding is worth £12 x 50,000 = £600,000

The Monevator trust has zero debts .

Therefore, the net assets of Monevator Investments is £1.6 million.

Now, lets say this trust has 1 million shares in issue.

Net assets per share = £1.6 million / 1 million = 160p per share.

Each share is effectively a claim on 160p worth of assets owned by Monevator Investments.

So far so simple!

Investment trust share price versus NAV

Any share is worth whatever someone will pay for it. Theres no right or wrong value for any particular share that you can calculate with a formula.

This is why share prices are so volatile – the market is constantly trying to work out whats the correct value of every company.

With a big drug maker like Glaxo, calculating its right value is likely impossible. There are so many brands, new ventures, potential disasters and expired patients patents that can impact its profits from quarter-to-quarter. Changing sentiment about the company also continually alters the multiple (the P/E ratio) that investors are prepared to pay for a claim on those profits.

However with an investment trust like Monevator Investments. it should be easy to work out its value. You just look at its assets and debts, calculate the NAV like weve done above, and hey presto – youve got its value.

And thats true 2. Indeed you dont even have to calculate the NAV per share if you dont want to. Websites like the Association of Investment Companies collates those stats for you.

However, price is what you pay, value is what you get – and the two arent always in sync.

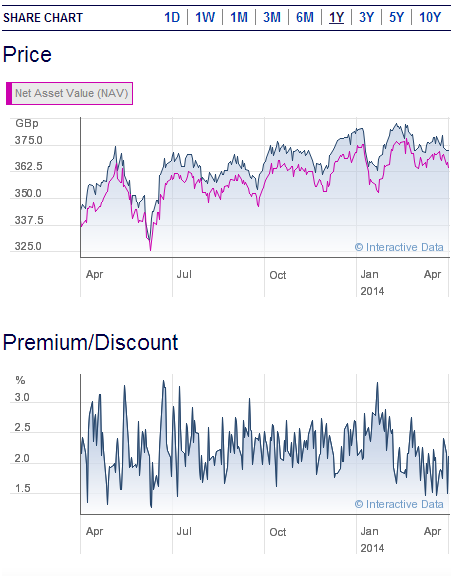

Discounts, premiums, and NAVs

In fact, it is often the case that the share price of an investment trust is less than its NAV per share.

For instance, Monevator Investments may be trading for £1.20 a share, despite anyone with a calculator (or the link above) being able to see that the NAV per share is £1.60.

So in this case, a buyer is getting £1.60 of underlying assets for just £1.20.

Bargain! The share is trading at a discount to NAV:

The discount is (£1.60-£1.20)/£1.60 = 25%

Less often youll find a trust with a share price greater than its NAV. (This is the case as I type with Terry Smiths new Emerging Market Trust ).

Lets say Monevator Investments is trading at £1.80, but its net assets are still £1.60 per share.

Then the premium is (£1.80-£1.60)/£1.60 = 12.5%

In this case youre paying 12.5% above what the shares would be worth if everything was sold off tomorrow.

Probably not such a good deal!

Discounts can be great for income investors. since the money you spend on your shares buys you more of the trusts underlying income generating assets. For example, suppose a trust trading at £1 per share – the same as its NAV of 100p – owns a portfolio of blue chips that generates a 3% yield. If the share price falls to 90p to create a 10% discount to an unchanged NAV, then new buyers will enjoy a higher 3.33% yield from the trust. (i.e. 100/90*3). The opposite is true with premiums – they reduce the yield.

A few final tips on discounts and premiums

Heres a few things you may be wondering about – or that maybe you should be wondering about if youre not:

- Fund factsheets and data suppliers usually give the discount or premium as a percentage figure.

- Typically a negative number – e.g. -5% or (5%) – indicates the level of discount to NAV.

- In contrast a positive percentage indicates a premium to NAV.

- As listed companies, investment trusts release regular RNS press releases to the stock market, which you can find on various websites. I always check these for the latest NAV per share, and I do the discount/premium calculations for myself, just to double check the online data sources and factsheets.

- Another reason to check is that different data suppliers often treat debt and accrued income differently in their calculations. And sometimes theyre just wrong!

- Why do investment trusts trade at discounts? And why on Earth would anyone pay more for a trust than its assets are worth? Great questions, which Ive previously attempted to answer .

Opportunity knocks

The whole discounts and premiums malarkey was often pinned by old-school Independent Financial Advisers as a reason they put their customers money into unit trusts rather than investment trusts.

Clients were too easily confused, they said. (Honest guv, nothing to do with the commission that unit trusts kicked back, but investment trusts could not… )

Yet confusion, panic, and mispricing can be your friend if youre involved in the quixotic and ill-advised game of active investing .

To that end, I think investment trusts and their mercurial discounts offer a dedicated active investor an interesting halfway house between open-ended funds and ETFs, and the outright stockpicking of single company shares.

Thanks for reading! Monevator is a simply spiffing blog about making, saving, and investing money. Please do check out some of the best articles or follow our posts via Facebook, Twitter, email or RSS.

- Investment trusts are companies that invest in other companies, so in effect they are actively managed funds. Passive investors prefer the warm comfort of very low fees to the potential (but in practice all too rare) upside from active management, and therefore would choose trackers and ETFs over investment trusts. [↩ ] Ignoring for now more complicated trusts that invest in unquoted assets [↩ ]